March and first quarter 2020 data continue to come in. The expectation has been for reported numbers to be relatively bad. In some cases, the numbers are worse than expected. One of these cases is retail sales. Retail sales were down 8.7% from February in March. The expectation was for sales to be down 7.0%. We saw weak numbers from businesses that have taken the brunt of stay-at-home orders and self-isolation. Food services and drinking establishments saw a decline in sales of 26.5%. Motor vehicle and parts dealers and furniture stores have also been significantly hit. These businesses saw declines of 25.6% and 26.8%. April’s retail sales numbers are expected to be worse than March’s numbers.

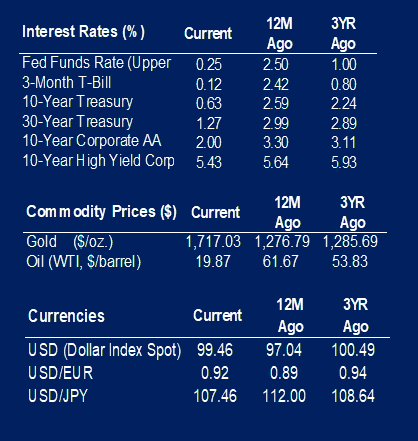

Outside of the demand slow down, Consumer Price Index (CPI) numbers were also heavily impacted by oil pricing pressure. Headline CPI was down 0.40%. Worse than the expected -0.30%. Excluding food and energy, core CPI was down 0.10%. There are some concerns we may be entering periods of disinflation. Year-over-year (YOY) CPI was 1.5%, this compares with the previous month’s YOY number of 2.3%. Core CPI YOY was at 2.1%.

Initial jobless claims stayed above six million. The reading as of the week that ended April 4 was 6.607 million. This compares to the prior week’s, 6.867 million. The expectation is for this number to increase as the U.S. economy goes through another round of layoffs.

Hourly earnings grew by 0.40% over the previous month in March. Earnings grew by 3.1% YOY. Month-over-month and YOY numbers are the same as February’s numbers.

Consumer optimism for the economy continued its decline. The Michigan Sentiment Indicator was at 71. This is down from the previous month’s 89. The expectation was for a reading of 78.

Weakness in manufacturing continues. The Empire State Index, a Federal Reserve survey of manufacturing in New York state, was down to -78.2. The expectation was for it to go down to -33.9.

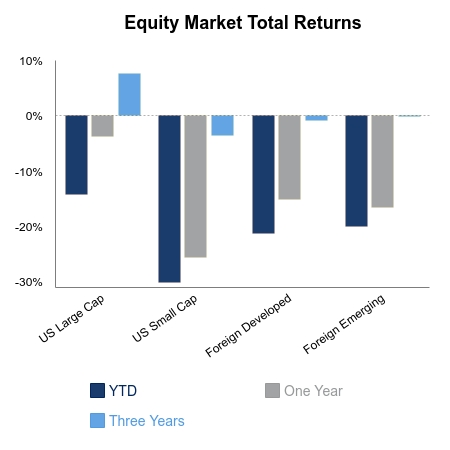

Energy went from being the best performing sector last week, up 23%, to the worst performing this week, down 6.49%. The sector is down 45.57% for the year. The best performing sector this week was Consumer Discretionary, despite weak retail sales. The performance was led by online and direct marketing retail. The S&P 500 index was up 1.25% for the week. Year-to-date, the equity index is down 13.34%.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.