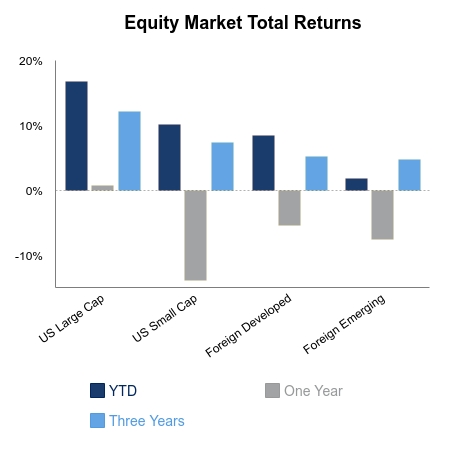

The S&P 500 fell 1.2% on the week aided by a 2.6% drop on Friday where both China and the United States increased retaliatory tariffs. Small cap equities continue to be weak and fell 2.5% on the week. Small cap equities have underperformed the S&P 500 by 10% over the last six months. Emerging market equities have completed a full retrace to the December lows, now down roughly 12% from their April highs. Safe haven assets such as gold and Treasury bonds continue to move higher in price.

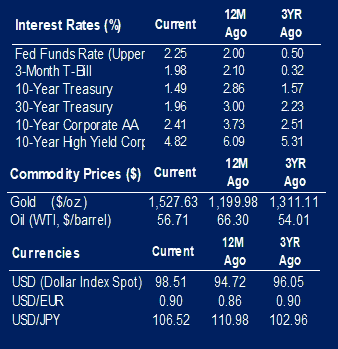

The big news of the week has been a storm of rhetoric on the policy front. Jackson Hole revealed a Federal Reserve (Fed) that does not have a strong consensus to lower interest rates. While it’s likely at least one more cut will unfold, it’s unlikely a consensus can be formed to cutting rates in an aggressive manner. This is a negative headwind at the margin for equities, which have been anticipating interest rate cuts. It’s also suggestive of continued Treasury curve flattening, which has taken place this week. The 2-year and 10-year Treasury inverted recently, and this week saw the 3-month and 30-year Treasury invert. This latest inversion has a 100% track record in predicting recessions.

On Friday China retaliated with some tariffs and then President Trump indicated more retaliation. The market sold off on the unknown as the decision wouldn’t be announced until after the market closed. The United States raised tariffs modestly, but since they are set to go into effect in September and December some hope remains there will be a last-minute resolution. Any indication of communication between the two sides only furthers these hopes and pushes equity prices up in anticipation.

Former Federal Open Market Committee Vice Chair, Bill Dudley, penned a piece of possibly the most controversial comments ever made by a current or former high-ranking central bank official. He concluded his opinion piece with these comments, “There’s even an argument that the election itself falls within the Fed’s purview. After all, Trump’s reelection arguably presents a threat to the U.S. and global economy, to the Fed’s independence and its ability to achieve its employment and inflation objectives. If the goal of monetary policy is to achieve the best long-term economic outcome, then Fed officials should consider how their decisions will affect the political outcome in 2020.”

And if that wasn’t enough, current head of the Bank of England made a pitch to put digital currencies at the center of the global monetary system.

|

|

Please Note: Interest Rates, Commodity Prices, Currencies as of 8/29/19

Contributed by | Justin Carley, CFA, Managing Director

Justin is a Managing Director, providing portfolio management and credit analysis for fixed income strategies. He also manages the firm’s multi-manager portfolio strategies and contributes to the asset allocation framework. Justin has more than 10 years of experience focusing on management, analysis and trading of fixed income portfolios. Previously, Justin was a fixed income portfolio manager at American Trust & Savings Bank. Justin has a bachelor’s degree from Truman State University, holds the Chartered Financial Analyst designation and holds a Fellowship in the Life Insurance Management Institute.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.