The S&P 500 rallied 2.1% on this shortened week. Small caps advanced 2.9% while emerging market equities gained 1.7%. Bond yields continue to move lower with the 10-year Treasury hitting its lowest level since 2016. The G20 saw the resumption of trade talks between the United States and China and what appears to be a more friendly tone. However, details were limited and it turned out to be more of a “sell the news” event. Equities popped at the open on Monday, but faded throughout the day. However, they remain in a consolidation and could be on the verge of a big breakout.

The economic data for the week was quite soft. The big event for the week was the global PMI readings and they were very soft on an absolute basis, and relative to expectations. The U.S. PMI was better than most with a reading of 51.7. Still, this was the lowest reading since 2016 and the new orders component saw a noticeable drop from 52.7 to 50. Other leading indices for the United States showed some deterioration as well. This helped keep a bid for Treasuries and allowed yields to fall further.

International Monetary Fund Managing Director, Christine Lagarde, has been nominated to head the European Central Bank (ECB). She has been openly quoted saying negative interest rates benefit the economy. This news sent European sovereign yields lower with the closely watched Germany 10-year once again setting a new low of -0.4%. In regard to negative interest rates, it is worth remembering that both the European and Japanese bank indices are down more than 70% from their pre-global financial crisis highs.

U.S. yields also fell on the ECB announcement as they are unlikely to diverge too significantly. In some ways the Federal Reserve will be forced to adopt a policy similar to what foreign central banks do. This is because if the ECB continues to go down the negative interest rate rabbit hole and the United States doesn’t cut, it will drive the U.S. dollar up. This will import deflation resulting in low anchored inflation expectations along with a much higher systemic risk. In essence, it becomes a race to the bottom because of the interplay between interest rates, foreign exchange movement and inflation.

Second quarter earnings season will begin to pick up steam before too long. According to FactSet, earnings per share are expected to decline 2.6%, while 3Q and 4Q estimates continue to fall. As usual, forward guidance will play a pivotal role.

Contributed by | Justin Carley, CFA, Managing Director

Justin is a Managing Director, providing portfolio management and credit analysis for fixed income strategies. He also manages the firm’s multi-manager portfolio strategies and contributes to the asset allocation framework. Justin has more than 10 years of experience focusing on management, analysis and trading of fixed income portfolios. Previously, Justin was a fixed income portfolio manager at American Trust & Savings Bank. Justin has a bachelor’s degree from Truman State University, holds the Chartered Financial Analyst designation and holds a Fellowship in the Life Insurance Management Institute.

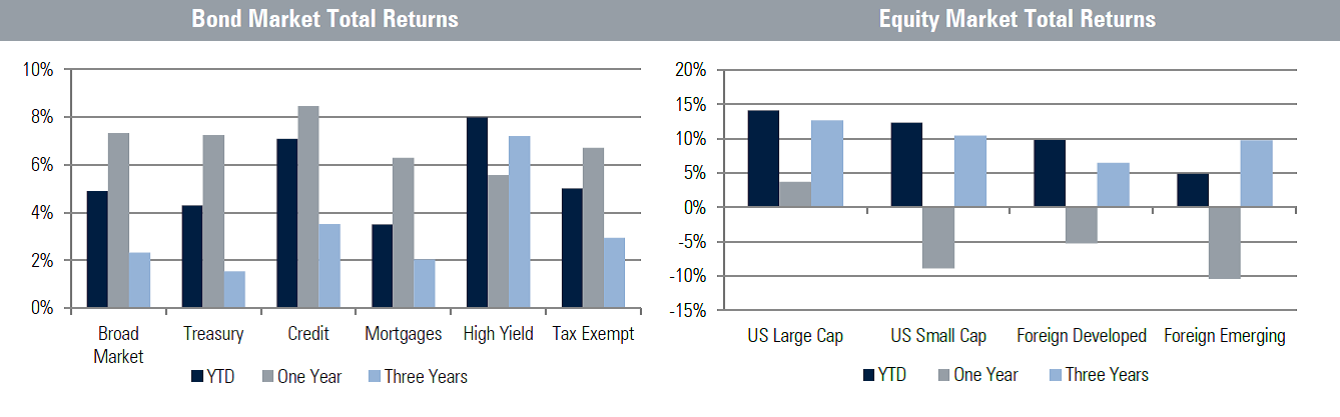

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.