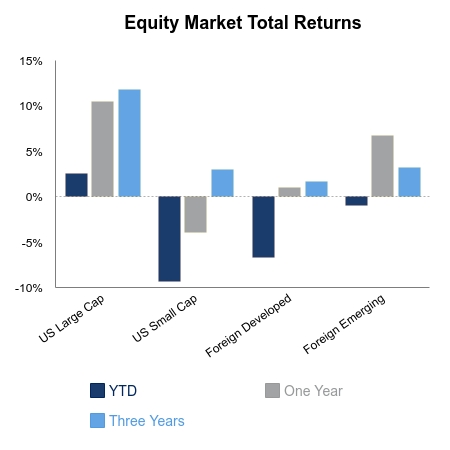

Equities were off slightly for the week as investors pulled back ahead of a newsy week highlighted by several earnings announcements, the Federal Open Market Committee (FOMC) meeting and uncertainty on fiscal stimulus extensions. The S&P 500 was down 0.5%, this time with the NASDAQ pulling the market lower. The NASDAQ was down 1.5%, whereas domestic small caps were up 0.7%.

Economic data was light on the week. Initial jobless claims remain elevated and show a sequential increase as permanent job losses continue to mount. The U.S. Citi Economic Surprise Index has peaked after reaching the highest level in the series history, which dates to 2003. The level was twice as high as any previous reaching, meaning the economic data has been far better than forecast. Despite the high reading, the index level is less important than direction. Thus, risk assets would face a headwind as this series’ mean reverts. Adding to the near-term risk has been an increasing number of down days for the market on higher volume, while upside days have been accompanied with very light volume. Two of the highest volume exchange traded funds; SPY (S&P 500 proxy) and QQQ (large cap growth proxy), were up more than 1% on Wednesday, which was an FOMC meeting date. However, the volume was only 40-60% compared to the previous two FOMC meeting days in June and April.

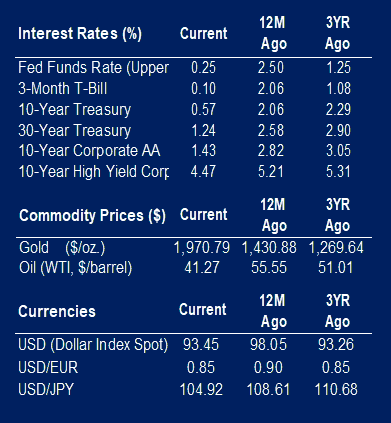

The Federal Reserve left rates unchanged as they will for a very long time. They did attempt to be proactive in their commentary by saying they will do whatever it takes. They continue to emphasize upside room to the balance sheet, which the market likes to hear. Offsetting this somewhat is a widening gap between lawmakers on how the next fiscal stimulus should look. It appears no deal will be done this week, thereby removing enhanced unemployment and other stimulus measures. Further delays next week could see equity markets pull back as uncertainly rises.

We are in the heart of earnings season with roughly half the S&P 500 having reported thus far. Upside earnings surprises have been pronounced and evident in most sectors. This has been a tailwind to those companies when accompanied by favorable commentary on the current quarter. Some companies exposed to secular growth trends in health care, the internet and cloud enterprise have reported exceptional growth numbers in sales and earnings.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.