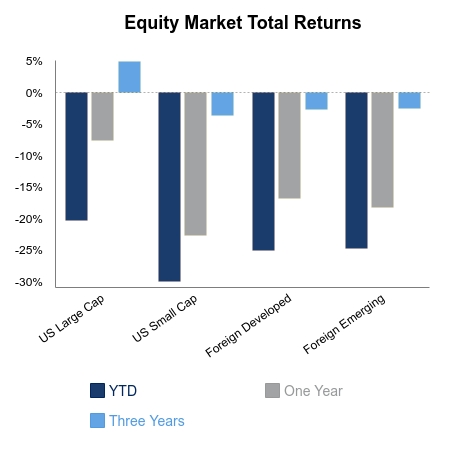

It’s been a week of positive returns in domestic equity markets, and that feels good to write. The S&P 500 return over the week was 3.27%. This comes on the heels of the potential passage of stimulatory fiscal and monetary actions. The Federal Reserve monetary actions have been going on for a couple of weeks. A question now is, will the Senate’s $2 trillion virus relief package pass the House. If it does pass the House, how effective will it be? Another contributing factor to the positive move in markets this week has been ongoing discussions on direct government investments in struggling companies. These conversations have focused on cash infusions to airline and aircraft manufacturing companies.

The energy sector led in returns this week trading up by 22.29%. The sector is down 51.21% year-to-date. The consumer discretionary and industrial sectors closed out the top three performing sectors with returns of 10.88% and 8.02%. This goes to show some investors are putting risk back on the table. Defensive sectors that have held up relatively well year-to-date, saw weaker relative performance this week. One-week performance numbers for consumer staples, utilities and health care were -7.60%, -6.21% and -2.54%. These sectors are among the better performing sectors year-to-date.

Economic numbers coming out do not fully reflect the economic impact of COVID-19. This week’s numbers show positive housing moves in February. The existing home sales number of 5.77 million was 250,000 homes better than expected. The prior month’s number was 5.42 million. New home sales were also better than expected at 765,000 compared to the expected 745,000. The number was a little lighter than January’s 800,000.

Durable goods orders were better than expected in February. The reading of 1.2% compares positively to the expected -0.95%. The growth was led by increases in transportation equipment orders and nondefense aircraft and parts orders. A March dip in durable goods orders is expected.

Initial manufacturing numbers for March shows some weakness. The Markit PMI Manufacturing number of 49.2 is below the 50 threshold which indicates economic weakness. The number is better than the expected 42.5 but lower than the previous month’s 50.7. The Philadelphia Fed Index, which tracks manufacturing activity in the Third Federal Reserve District was significantly lower than expected at -12.7. The expectation was for a reading of 10, down from last month’s 36.7.

|

|

Contributed by | Kuuku Saah, CFA, Managing Director

Kuuku is a Managing Director at BTC Capital Management with nine years of investment management experience. Kuuku’s primary responsibilities include portfolio management and analysis. Kuuku attended Drake University and double-majored in finance and economics. He is a holder of the right to use the Chartered Financial Analyst® designation.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.