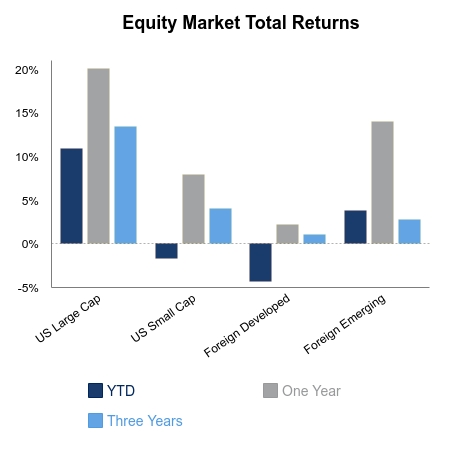

Markets have traded off in the last few days after strong performance toward the end of last week. The turn comes as uncertainty increases around the timing of stimulus relief and a global increase in COVID-19 cases. The last two days have seen S&P 500 losses of over 60 basis points after four consecutively strong days. The week ending yesterday was still very strong with performance of 2.07%.

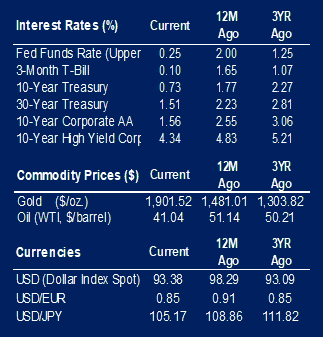

Earnings reports for financial companies have been rolling in this week. Reports for the major banks are better than expected, but still not great. Companies in the major banks category who have reported show an earnings per share decline of 12.4% from a year ago. The low interest rate environment is expected to negatively impact the margins of these institutions.

Growth in consumer prices decreased to 0.2% in September after August’s growth of 0.4%. The major positive contributor was a sharp increase in pricing for used cars and trucks. Prices in this category increased by 6.7%. This is the highest increase we have seen all year after another large increase in August of 5.4%. Fuel oil prices were a significant detractor from index growth with a decrease of 5.3%. Consumer Price Index (CPI) growth stayed at 0.2% excluding food and energy.

Over the one-year period, headline CPI is up 1.4%, led by food with an increase of 3.9%. Significant detractors have been energy with a decline of 7.7%. Core CPI is up 1.7% over the year. Price growth of used cars and trucks has seen the most significant increase over this period with an increase of 10.3%. Apparel and transportation services pricing have declined by 6% and 5.1% respectively.

Hourly earnings increased by 0.1% from August to September. Real growth in earnings decreased by 0.1% after accounting for the 0.2% increase in CPI. There was an artificial spike in the growth reading for annual hourly earnings due to the pandemic impacting lower wage jobs at a higher rate.

Markets are expected to remain volatile as we approach the U.S. general election. Another contributing factor to market volatility is news related to the development of vaccines for COVID-19.

Crude oil prices continue to stay in the $40 range with a barrel of WTI Crude closing yesterday at $41.11.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.