Equities rallied on the week, led by a surge in small caps. The S&P 500 gained a solid 2.2% on the week, but the laggard Russell 2000 rocketed more than 6%. There was a massive rotation within equities as momentum names were hit extremely hard and forgotten value names surged. The Bloomberg Pure Momentum Index underperformed the Bloomberg Value Index by almost 4% over a two-day stretch this week. It was the largest move in either direction since 2007. Several consensus-long secular software stocks were down 10-15%, whereas beaten down energy names were up 8-15%.

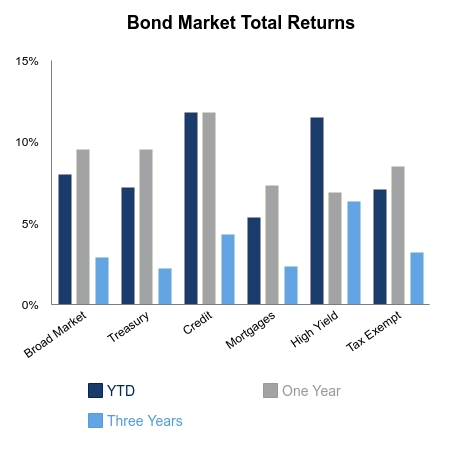

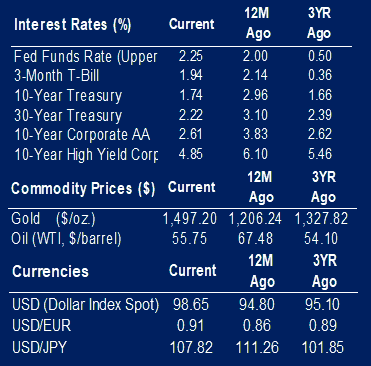

Bonds, having had a relentless surge, finally got a snapback as yields popped higher. The Bloomberg Barclays Aggregate Bond Index fell 1.3% on the week and the duration heavy 30-year Treasury lost almost 3% in value. Gold fell more than 3.5% as it is continuing to trade in lock step with real interest rates.

This week was a big week regarding labor market data, which has been the anchor supporting many upbeat forecasts. For the most part, there was plenty of weakness in the reports. Monthly job cuts via Challenger, Gray & Christmas logged their 13th consecutive increase over the prior year. This is more than double the near-recession of 2015 and only two away from the peak levels reached during the last two recessions. Job openings are now negative on a year-over-year basis for two consecutive months. The Bureau of Labor Statistics non-farm payrolls came in below consensus and this includes the start-up of temporary Census workers ahead of the 2020 count. Private payrolls came in at 96,000 net adds versus expectations of 150,000. Lastly, downward revisions to private payrolls have occurred in seven of the last 12 months, again the longest stretch since 2008.

Aside from trade war tweets, the anticipation of global central banks continues to be the primary force driving markets. The European Central Bank (ECB), having spent the last two weeks saying further stimulus was looking unlikely, unleashed more easing. The more vigorous the public denial, the more likely the outcome continues to hold true. This has often been the recipe regarding currency devaluations throughout history. The ECB lowered the deposit rate to be more negative and restarted quantitative easing (QE). This time the QE is open-ended, i.e. infinity. The ECB balance sheet as a percentage of GDP is 40%, whereas Japan is at 104%. It took five years for Japan to go from 40% to 100% and over this span GDP growth averaged 1.1%.

|

|

Contributed by | Justin Carley, CFA, Managing Director

Justin is a Managing Director, providing portfolio management and credit analysis for fixed income strategies. He also manages the firm’s multi-manager portfolio strategies and contributes to the asset allocation framework. Justin has more than 10 years of experience focusing on management, analysis and trading of fixed income portfolios. Previously, Justin was a fixed income portfolio manager at American Trust & Savings Bank. Justin has a bachelor’s degree from Truman State University, holds the Chartered Financial Analyst designation and holds a Fellowship in the Life Insurance Management Institute.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.