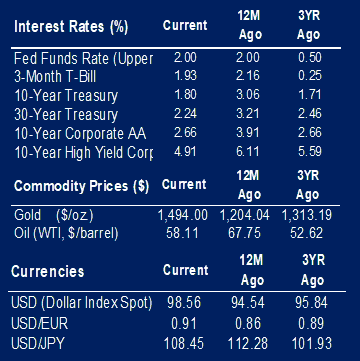

The big news this week was the drone attack on the Abqaiq oil facility in Saudi Arabia. The attack impacted 5% of the global oil supply. Crude oil prices were up 13% the first trading day after the attack, but prices have since moderated. The moderation is due to the Saudis announcing they expect most of the production at the facility to be up and running by the end of the week. Oil is up 5% from the trading day before the attack.

It is an eventful week when a Fed rate cut is not the top economic story. The relegation of this announcement to this second paragraph may have to do with the decrease being widely anticipated. The cut of 0.25% is the second such cut of the year. The announcement did show some dissension among Federal Open Market Committee members. Three of the members voted against the 25 bps cut.

Economic news for the week is more positive than not. Retail sales for August were revised upward to 0.4% from 0.2%. Strong sales of autos and an increase in online sales led the growth for the month. Auto sales grew by 1.8%. Nonstore or online sales grew by 1.6%. Gas stations and clothing retail stores held back the retail sales number the most with declines of 0.9% for both industries. There was no growth over July when you exclude the auto sales. The expectation was for retail sales excluding autos to see a growth of 0.2%.

Core CPI, an inflation measure excluding food and energy, was higher than expected month-over-month and year-over-year. Month-over-month growth for August was 0.30% and year-over-year growth was 2.4%. The expectation was for growth of 0.2% and 2.3% respectively. Including food and energy, the headline CPI number of 0.10 – month-over-month, was in line with expectations. The year-over-year growth of 1.7% was lower than the expected 1.8%. The increase in price levels was led again by autos. Pricing for used cars and trucks increased by 1.1% over the one-month period.

The build up of inventories increased in July. Business inventories grew by 0.4%. Inventories did not grow from May to June. This growth has been led by a build up in stock among merchant wholesalers and retailers. Merchant wholesalers, entities that buy products and resell to retailers and other wholesalers, increased their inventory by 7.1%. Retailers increased their inventory by 4.6%.

|

|

Contributed by | Kuuku Saah, CFA, Investment Analyst

Kuuku is an Investment Analyst at BTC Capital Management with nine years of prior experience in the Wealth Management division of Bankers Trust. Kuuku’s primary responsibilities include portfolio management and analysis. Kuuku attended Drake University and double-majored in finance and economics. He is a holder of the right to use the Chartered Financial Analyst® designation.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.