Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- JOLTS Data – Quits Rate and Job Openings

- Concerns of Recession Climb

- Corporate Bond Update

- Earnings Revision Ratio

- Predictability of Corporate Profits

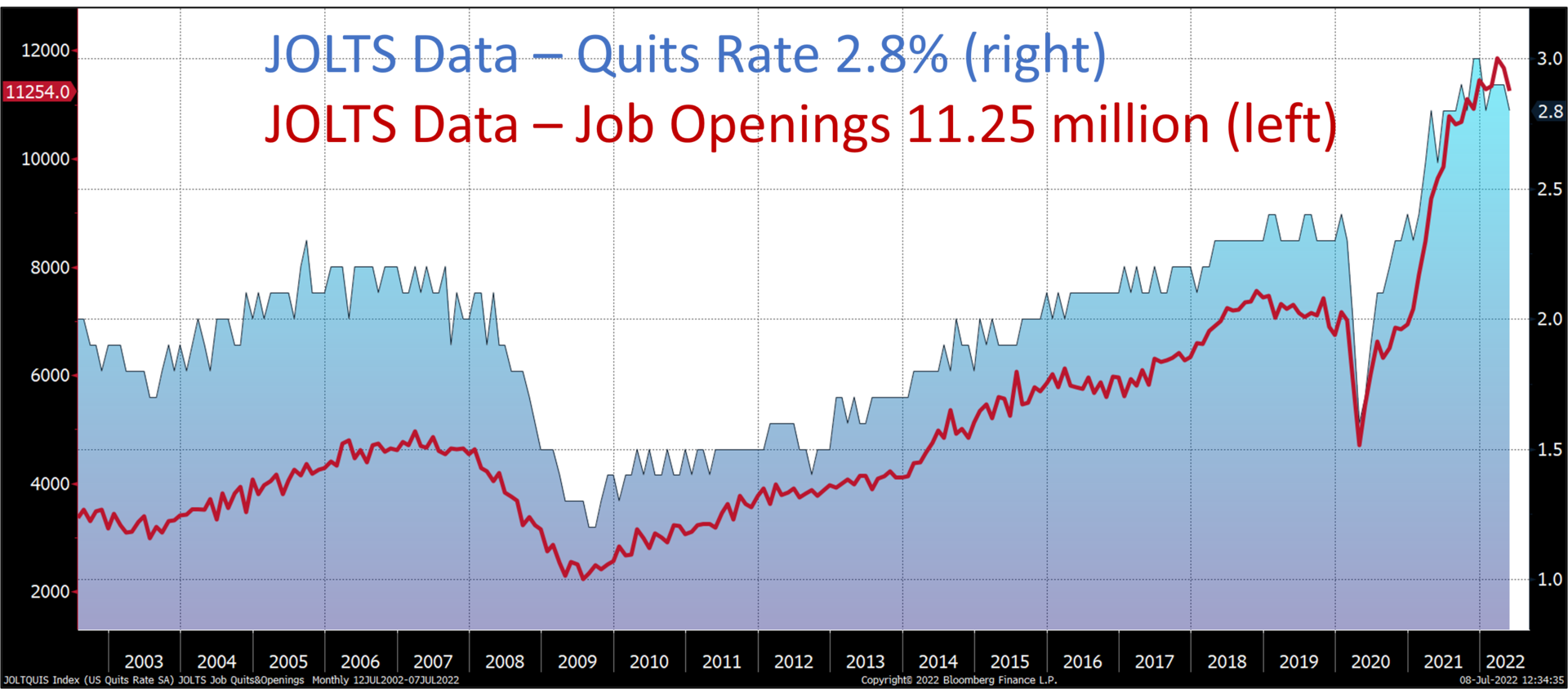

1. JOLTS Data – Quits Rata and Job Openings

- The Quits Rate is the number of workers voluntarily leaving jobs as a percentage of total employment. Typically, people either leave positions because they are moving to a new employment opportunity or because they are confident they will be able to find a new opportunity.

- Current reading of the Quits Rates continues to point to labor market strength as it remains at a high level relative to pre-pandemic periods.

- The Job Openings and Labor Turnover Survey (JOLTS) also provides a measure of job vacancies and currently indicates near record openings.

- Continued strength in these measures contributes to prospective strength in wage growth which feeds into the current environment of higher inflation.

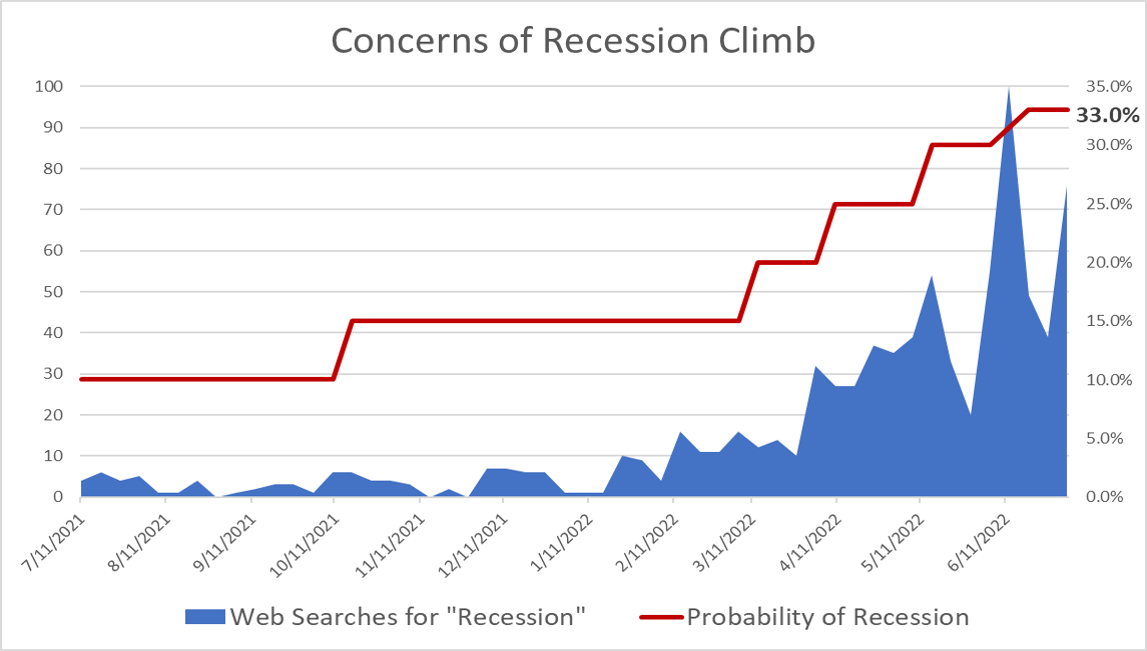

2. Concerns of Recession Climb

Sources: Bloomberg LLC, Google Analytics Sources: Bloomberg LLC, Google Analytics |

|

- The chart above shows that concerns of a recession have been rising during the first half of 2022.

- Concerns about a recession hit a high in June based upon volume of news stories including the word “recession”.

- The median forecasted probability of a recession to occur in the next year climbed to 33%. This is as signs of slowing economic growth continue along with concerns the Federal Reserve’s raising of interest rates will slow capital spending by businesses.

- While the probability of a recession grows, a consensus of economists surveyed by Bloomberg still presume positive economic growth in 2022-2023 (table on right).

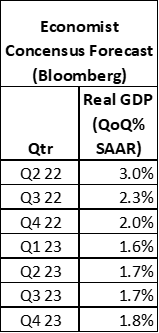

3. Corporate Bond Update

- Corporate bonds continue to weaken.

- Option adjusted spreads are now over 150 basis points (bps).

- Longer dated corporates are more sensitive to spread moves and have underperformed.

- The Federal Reserve has only hiked one time previously when spreads were above 150 bps.

- The market is pricing in either a 50 or 75 basis point hike at the July meeting.

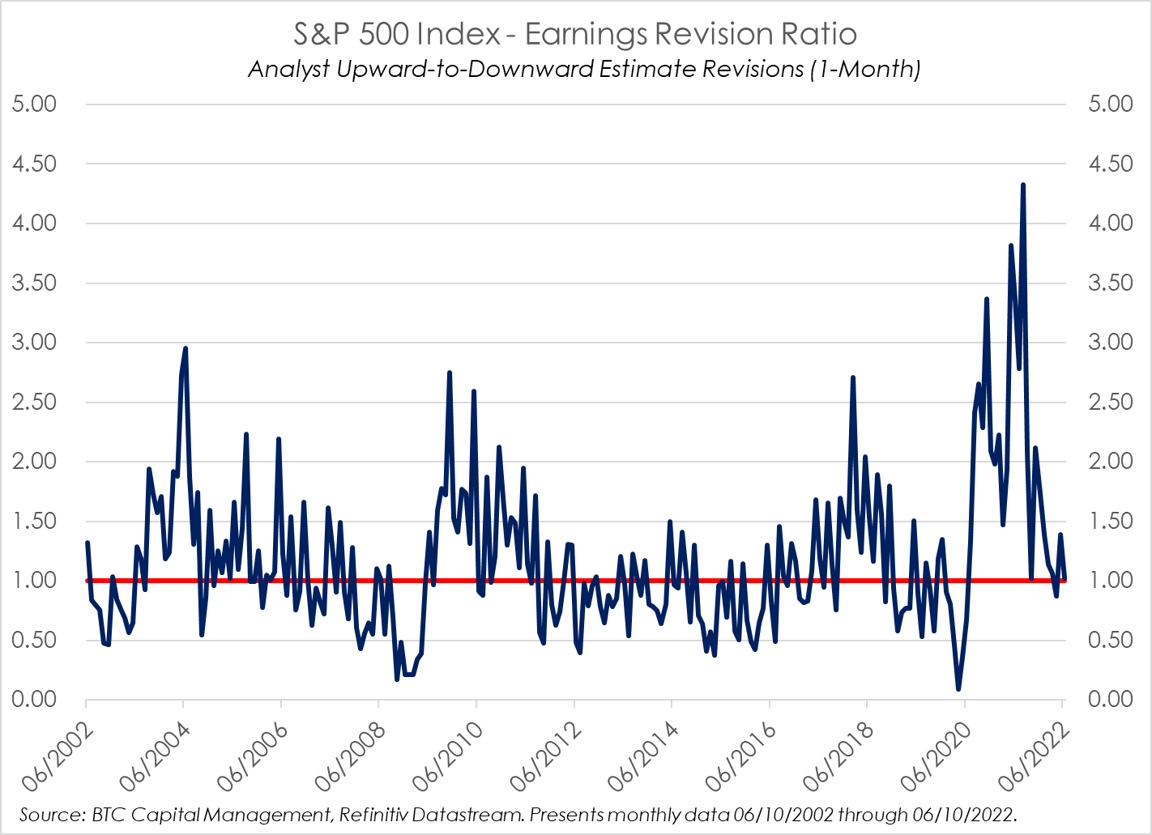

4. Earnings Revision Ratio

- Earnings usually drive equity valuations. Analysts, while optimistic looking forward to calendar years 2022 and 2023, have recently been somewhat pessimistic as to their near-term outlook.

- This chart exhibits the trend in analysts’ one-month earnings revisions, which has been fluctuating throughout the first half of 2022. Currently analyst downward revisions appear to exceed analyst upward revisions.

- Per Refinitiv, analysts are projecting earnings to grow year-over-year for 2022 and 2023 by 9.2% and 10.1%, respectively.

- Likewise, analysts are projecting year-over-year growth in revenues for each period of 10.9% and 4.7%, respectively.

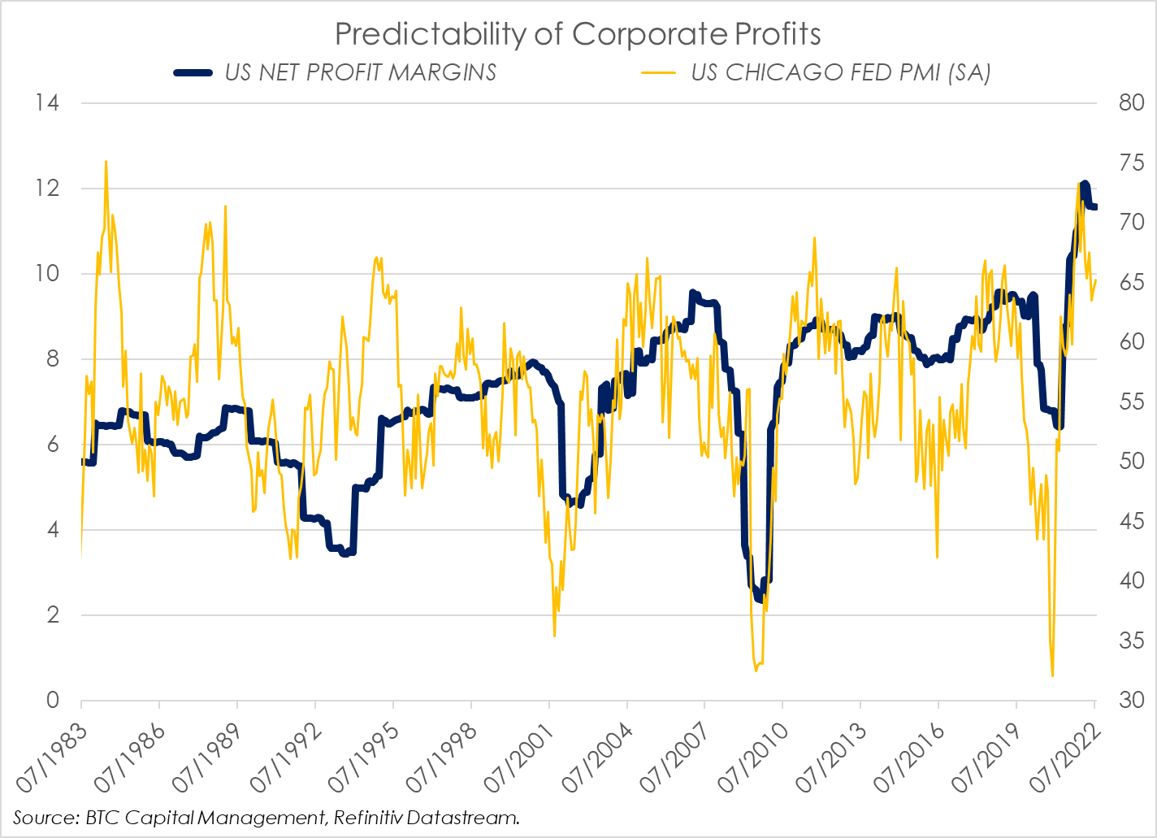

5. Predictability of Corporate Profits

- Corporate margins may be adversely affected by a reduction in consumer confidence, influenced by inflation and general economic trends.

- This chart considers the impact of the Chicago Federal Reserve Bank’s Purchasing Managers Index (PMI; seasonally adjusted) as a leading indicator of the trend in corporate profitability (as measured by corporate profit margins).

- The PMI is a leading indicator of the trend in corporate profitability, with usually a six-month lead versus corporate margins. Note the recent downturn in margins following the downturn in PMI.

- Concerns about recession, inflation, the trend in interest rates and the ability for consumers to navigate through this mire all came to be front-of-mind issues.

Source: BTC Capital Management, Bloomberg Finance L.P., Refinitiv Datastream, FactSet

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.