Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Bank Borrowing from the Fed

- Yield Curves Fuel Rising Recession Odds

- Monthly Flows by Asset Type

- Deposits: All Commercial Banks

- Performance by Asset Class

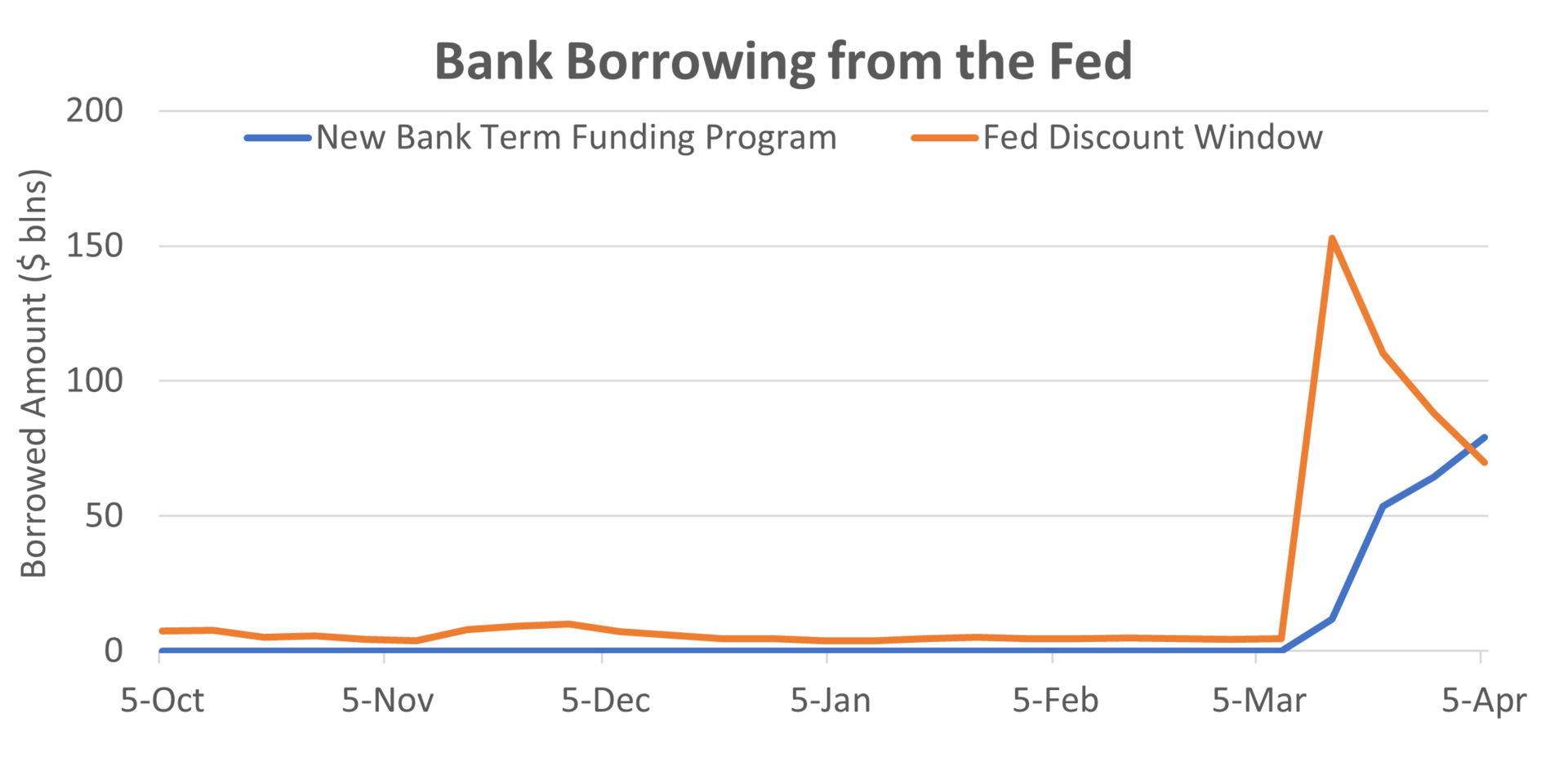

1. Bank Borrowing from the Fed

- Banks have historically borrowed from the Federal Reserve’s “discount window,” its main direct lending facility, to ensure they have adequate liquidity to manage risk and to support the smooth flow of credit to households and businesses.

- Borrowing from the discount window spiked last month to make sure adequate liquidity was in place as the industry responded to the collapse of Silicon Valley Bank and Signature Bank.

- The Bank Term Funding Program (BTFP) was created last month to provide loans to banks, savings associations, credit unions and other eligible institutions as an emergency measure to offer another option to institutions to ensure adequate liquidity is maintained in the financial system.

- Use of the BTFP has grown quickly and the loans issued under this program are for up to one year in length and have favorable collateral terms.

- With the introduction of the BTFP use of the discount window has declined dramatically and financial markets have largely quieted their concerns over the safety of the banking system.

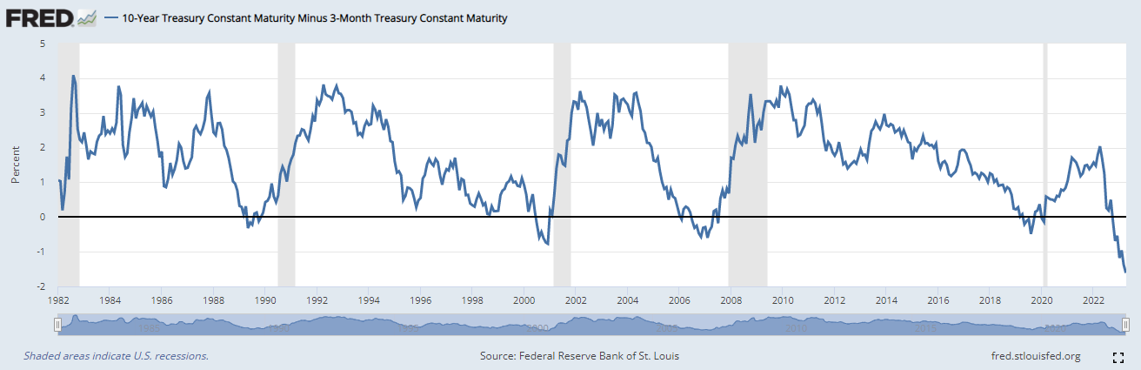

2. Yield Curves Fuel Rising Recession Odds

- The above chart depicts the 10-year Treasury minus the 3-month yield. Currently, this metric is seeing the deepest inversion in series’ history.

- The current 3-month yield is 4.9%, but the implied rate in 18 months is approximately 3.5%, the largest on record.

- Bloomberg’s 12-month forward Recession Probability model is at 100%.

- Bloomberg has moved up their probability of recession beginning in July to 97% from 76% previously.

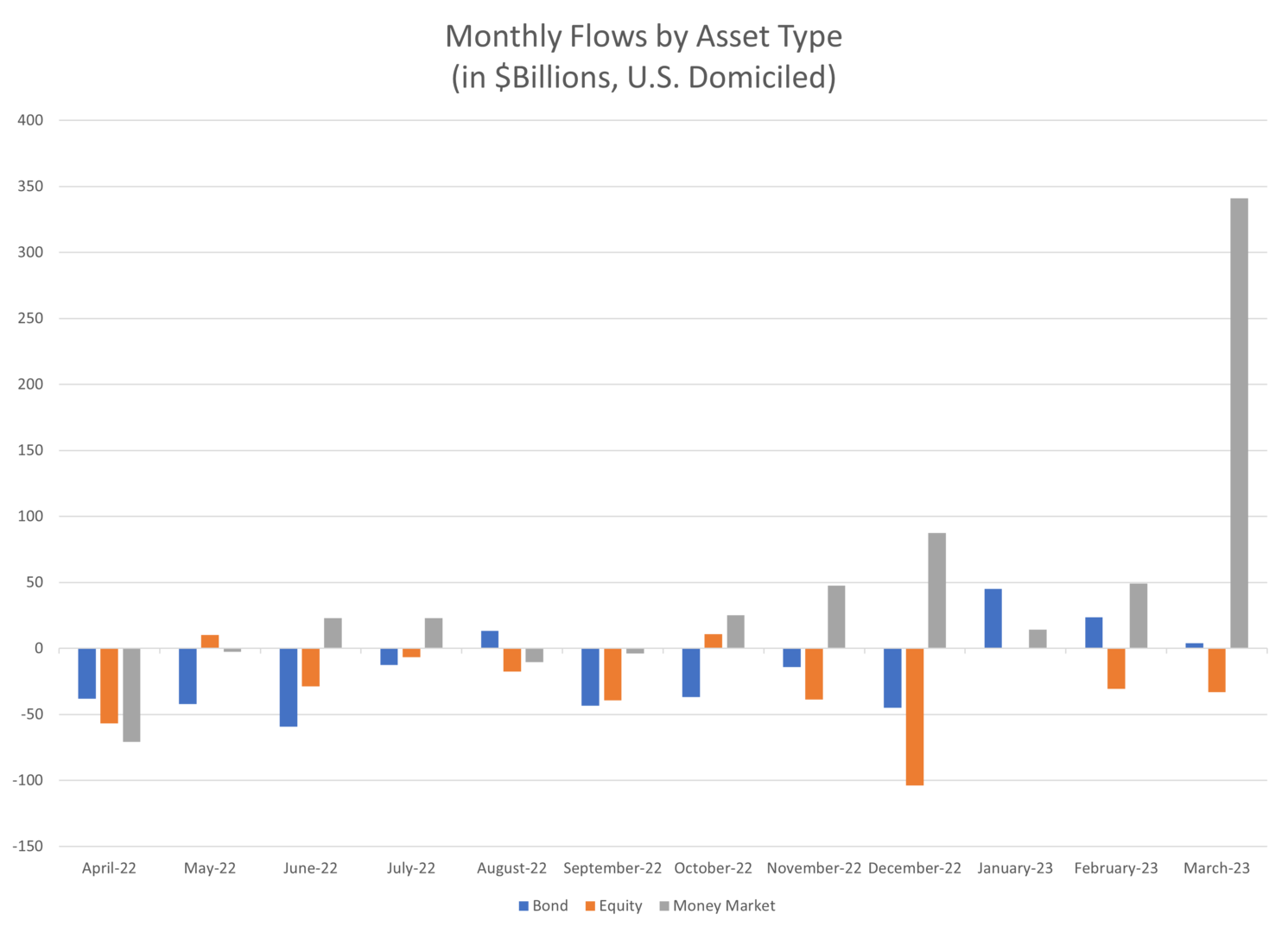

3. Monthly Flows by Asset Type

- Investors have moved assets into money market funds at a significant rate due to concerns regarding regional banks, and volatile capital markets as a result of mixed economic data.

- This has occurred despite a bull run in the equity markets which have seen very strong returns over the first three months of 2023.

- Money market funds are generally yielding higher than what savings accounts at banks currently offer which has also exacerbated the flow of funds into money market funds.

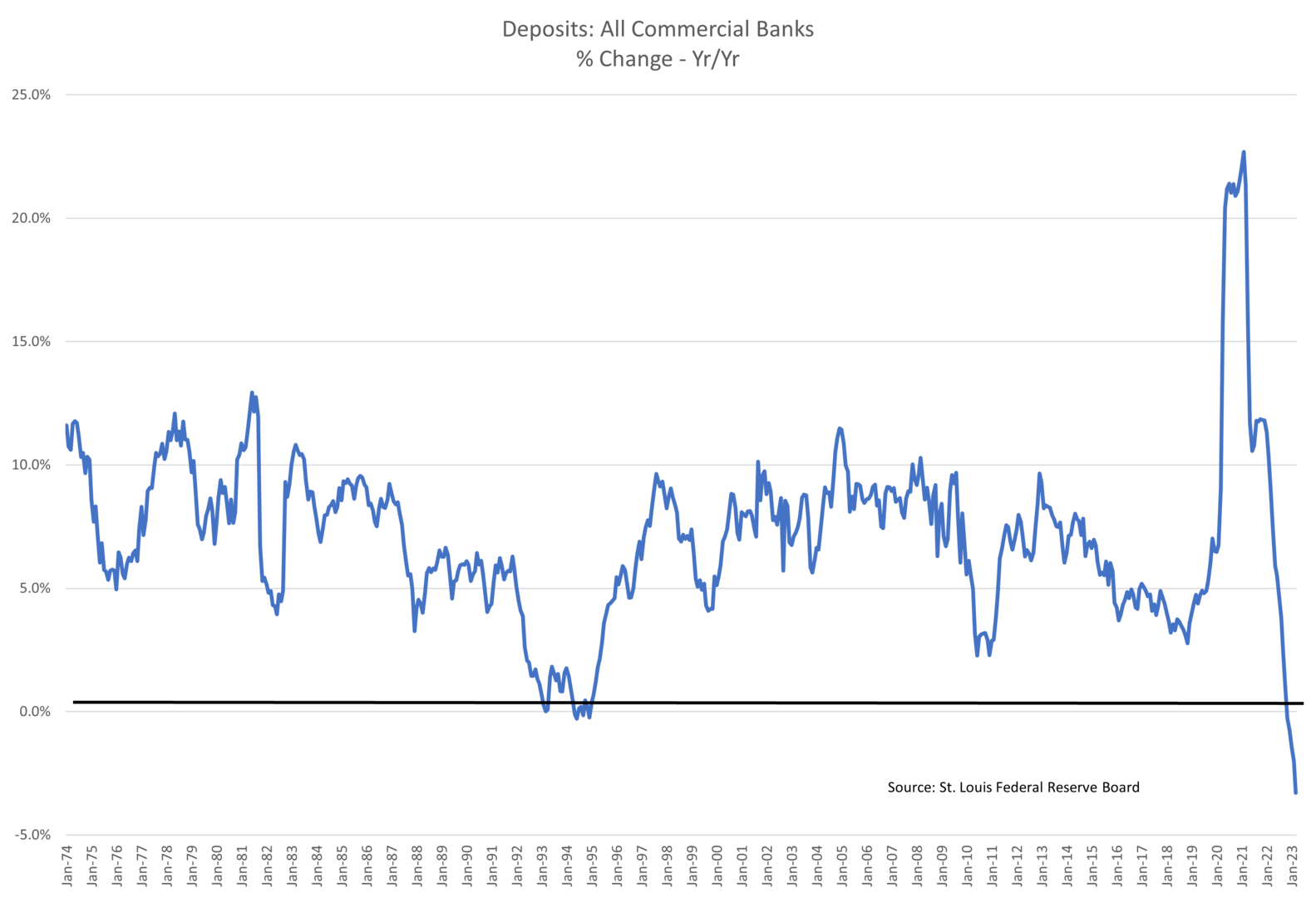

4. Deposits: All Commercial Banks

- Due to fears regarding the stability of regional banks, deposits have recently flowed out of the commercial banking sector as a whole and primarily into money market funds, which currently provide a relatively higher yield than savings accounts.

- This is in contrast to the period during the height of the COVID pandemic, when savings rates increased at multi year highs as recipients of stimulus funds from the government plowed this money into savings accounts at traditional commercial banks.

5. Performance by Asset Class

- The first quarter of 2023 has seen a huge shift in performance of asset classes. Last year, commodities was the top performing asset class with a positive return for 2022. Year-to-date (YTD) for 2023, it is the worst performing asset class.

- Similarly, Growth stocks were the worst performing asset class last year. However, YTD for 2023, it is the best performing asset class.

- As can be seen given the relatively weaker performance of small caps, the rally thus far in 2023 has been primarily concentrated in large cap and mega cap stocks.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.