Welcome to Five in Five, a new monthly publication from the Investment Team at BTC Capital Management. Each month we’ll share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Job Openings and Unemployment

- Airline Industry Overview

- Investors Continue to Favor Stocks

- Volatility Overview

- Fed Slowing Bond Purchase Program

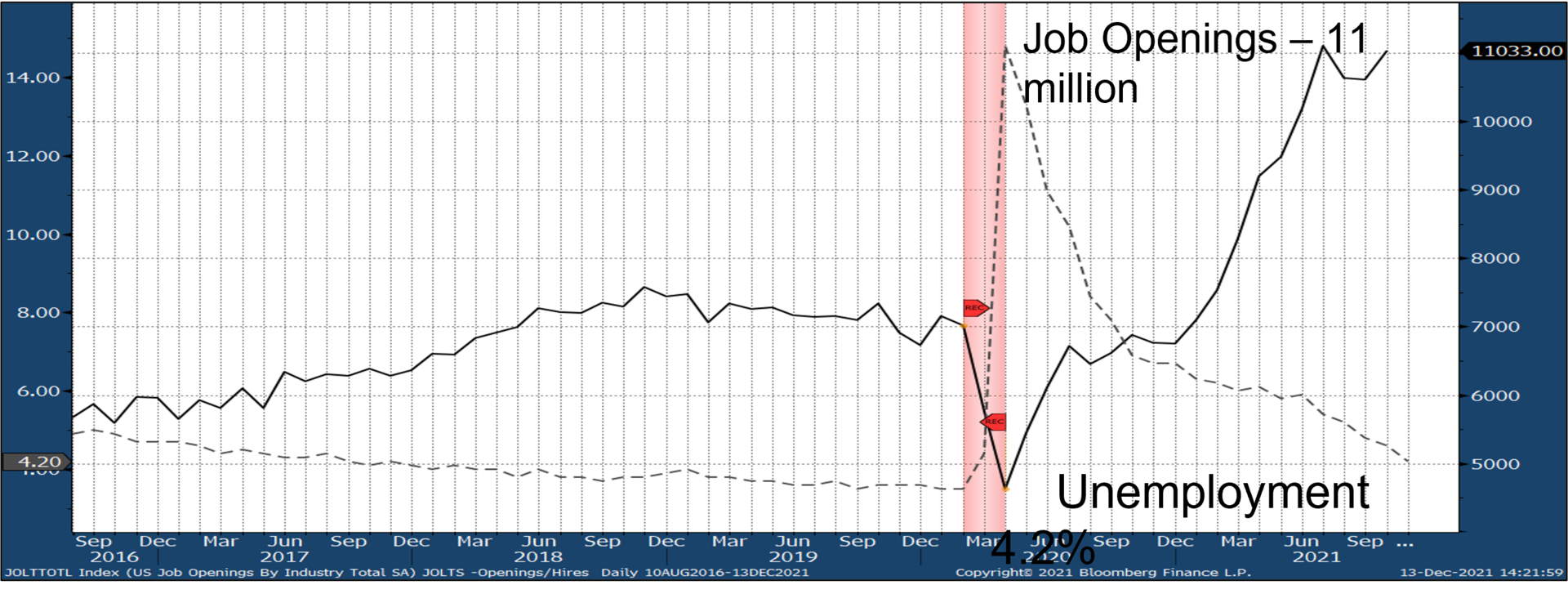

1. Job Openings and Unemployment

- In the most recent JOLTS release, job openings hit the 11 million openings threshold for the second time since July.

- While job openings increased in October, unemployment continued to decline in November, registering 4.2%.

- The strong JOLTS reading in October, indicating strong labor demand, was likely a factor in November’s unemployment rate decline.

- While job openings grew in October, the quits rate (the percentage of workers voluntarily leaving their jobs) declined for the first time since May.

- Combing the most recent releases for JOLTS, the unemployment rate, and the quits rate point to ongoing strength in the labor market.

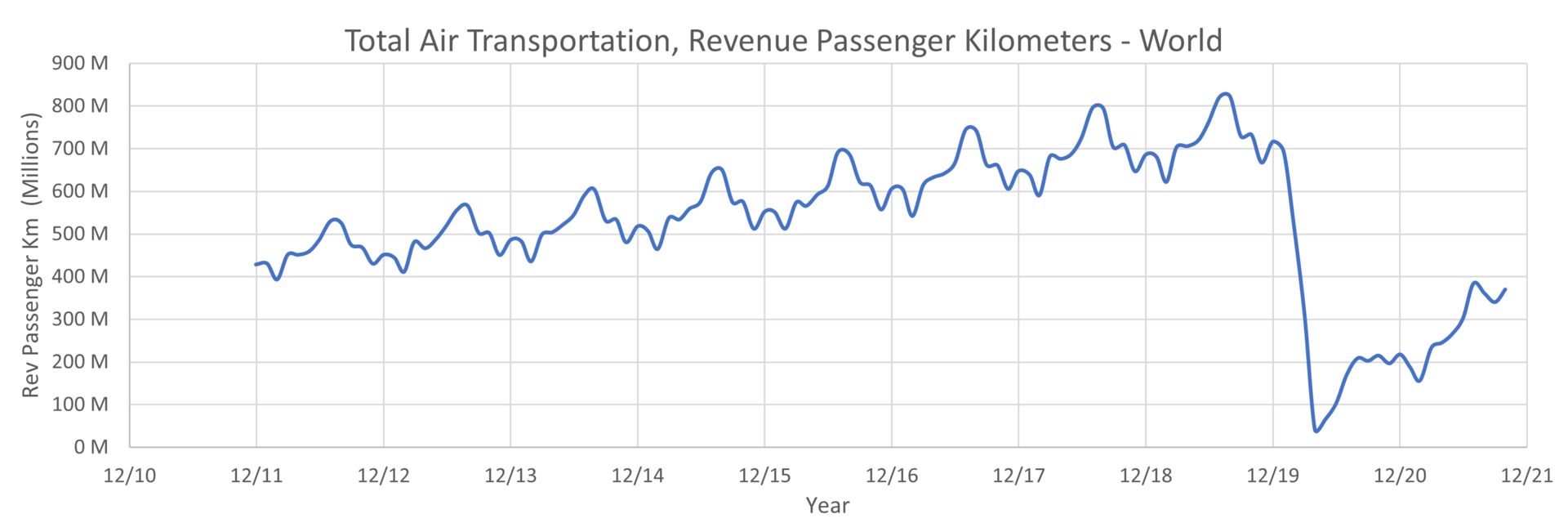

2. Airline Industry Overview

- Airline passengers are travelling 55% less than they did in August 2019, the last peak.

- Airline stocks were among the worst hit through the pandemic. The US Global Jets ETF lost 60% of its value in the first months of the global lockdown.

- Airlines gained 125% from COVID lows to March 2021, and 23% of those gains have been giving back from March to now. Fears of COVID variants Delta and Omicron have led to the price drops.

- Labor issues and increasing oil prices have contributed to additional strain on airline company operations.

- Global travel is not expected to stay at these levels. Air travel is expected to increase through 2022.

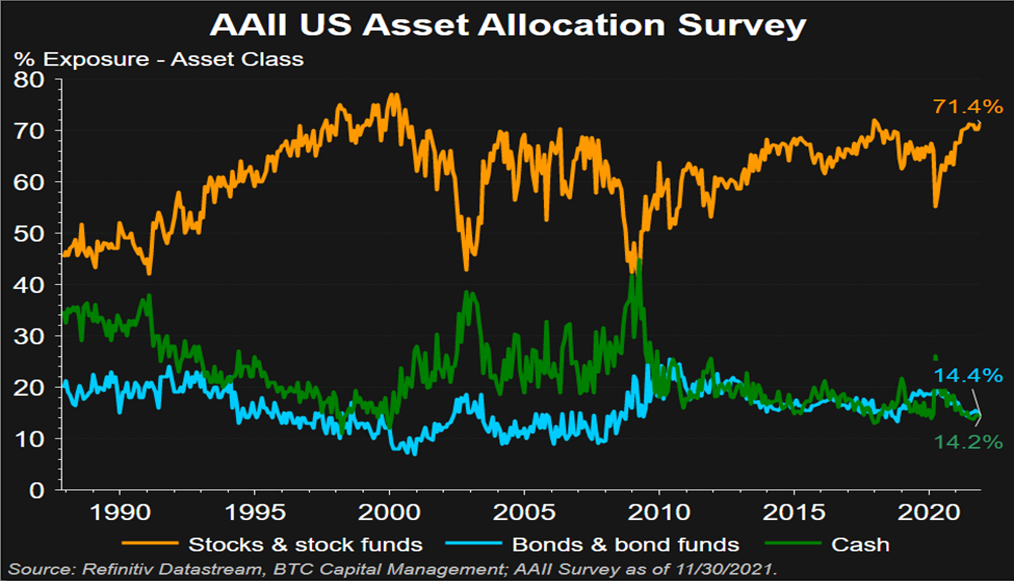

3. Investors Continue to Favor Stocks

- The American Association of Individual Investors (AAII) Investor Sentiment Survey has become a widely followed measure of the mood of individual investors.

- Individual investors continue to allocate to stocks, which represent approximately 71.2% of an average survey respondent’s portfolio.

- Investors’ appetite for stocks does not seem diminished even as equity valuations appear stretched, with the price-to-earnings ratio of the MSCI USA Index at 25.1x versus it’s average of 20.0x over the last 15 years.

- Surprisingly, according to the most recent AAII survey, investor outlook for stocks over the next six months indicated 26.7% bullish, 31.0% neutral and 42.4% bearish, this last measure exhibiting a one year high in bearish sentiment.

- Investors apparently see some “safety” in cash, which bears an average allocation of 14.2% currently.

4. Volatility Overview

- The VIX, officially the Chicago Board Options Exchange Volatility Index, is a real-time indicator that provides investors with a measure of equity market’s expectations for the relative strength of near-term price changes of the Standard & Poor’s 500 Index. The index is seen as a quantifiable way to gauge market sentiment, and in particular the degree of fear among market participants. The higher the reading, the higher the assumed level of fear.

- The “MOVE” Index is the bond market’s equivalent to the equity market’s VIX index. The index rises as concerns grow that interest rates are moving higher.

- While the MOVE Index has been trending higher, it is still materially below the average level of 92.74 which uses a time period going back to Jan. 1, 1987.

- The VIX index saw a recent move higher two weeks ago which reflected Omicron variant concerns on the part of investors. Since that time, it has since declined back to a reading of approximately 20.

- Extreme levels of both indicators can be seen during the early stages of the COVID pandemic in March 2020.

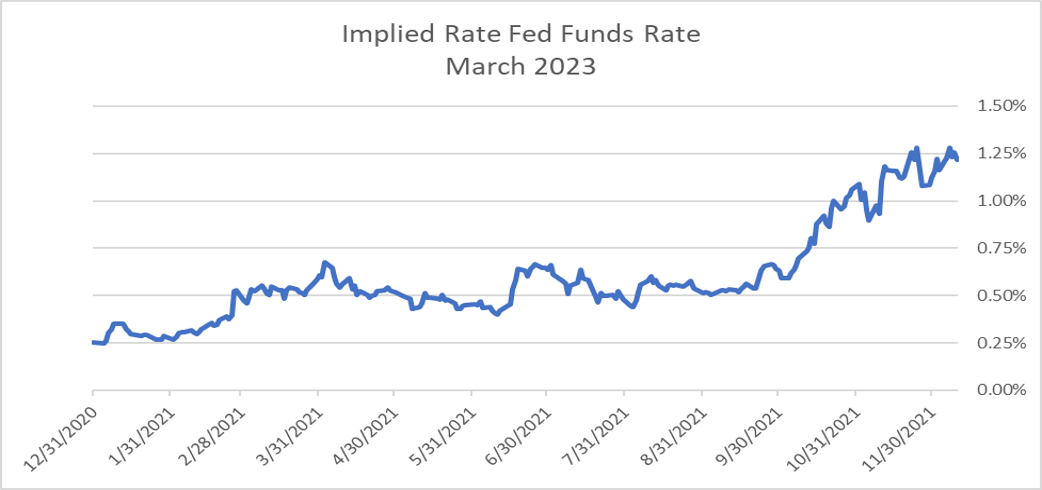

5. Fed Slowing Bond Purchase Program

- Federal Reserve Chair Jerome Powell made a major hawkish pivot when testifying before the U.S. Senate Banking Committee on Nov. 30. He said policy makers should consider speeding up the tapering and that the threat of persistently higher inflation has increased.

- This comes in the early stages of the reconfirmation process when a replacement for Chair Powell was strongly considered.

- At the Nov. 1 Federal Open Market Committee press conference Chair Powell noted that there was no evidence of a wage-rise spiral, that inflation may wind down by the second or third quarter of next year, that inflation is a result of supply bottlenecks, that there is no tight labor market, and that the Fed can be patient when it comes to rate hikes.

- It therefore appears the politicization of inflation is underway amid low Presidential approval ratings.

- The bond market is currently pricing in a Fed Funds Rate near 1.25% by March 2023 as depicted above.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.