Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Fed’s Preferred Inflation Gauge

- Core Bond Monthly Returns

- Magnificent 7 Notably Absent in November’s Rally

- Factory Orders

- Consumer Confidence Drops Alongside Falling Inflation

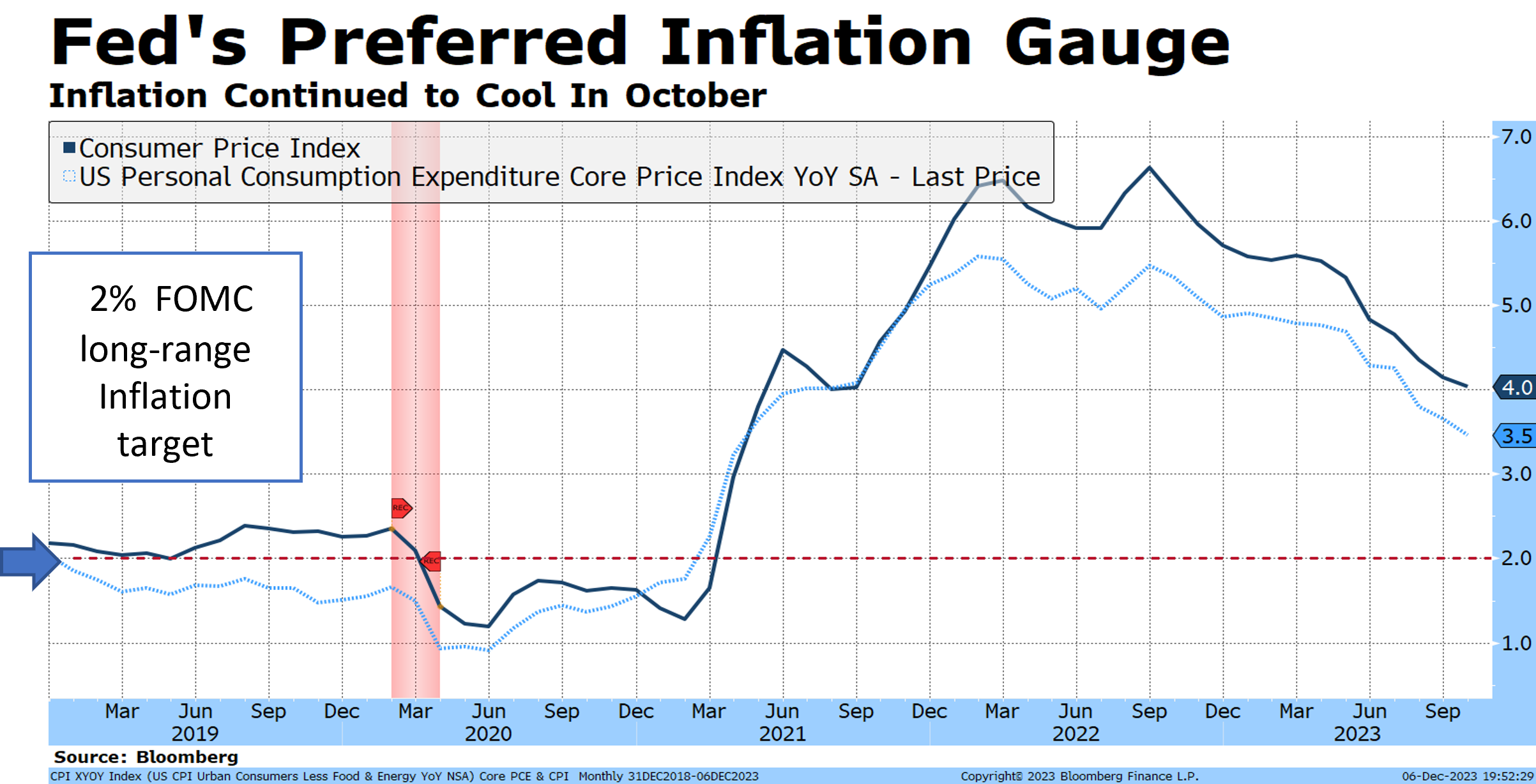

1. Fed’s Preferred Inflation Gauge

- US Personal Consumption Expenditure Core Price Index (Core PCE) is the inflation measure most noted by the Federal Open Market Committee (FOMC) members as better at revealing underlying inflation trends.

- The Core PCE Index measures the prices paid by consumers for goods and services excluding food and energy which tend to be volatile.

- Economist estimates provided by Bloomberg show that Core PCE is likely to be below 3.0% by July 2024.

- Last month this measure grew only 0.16% or an annualized rate of 1.96%. A level in line with the Federal Reserve’s long-term inflation target of 2.0%.

- This declining inflation trend has made the FOMC increasingly confident that rates are sufficiently restrictive.

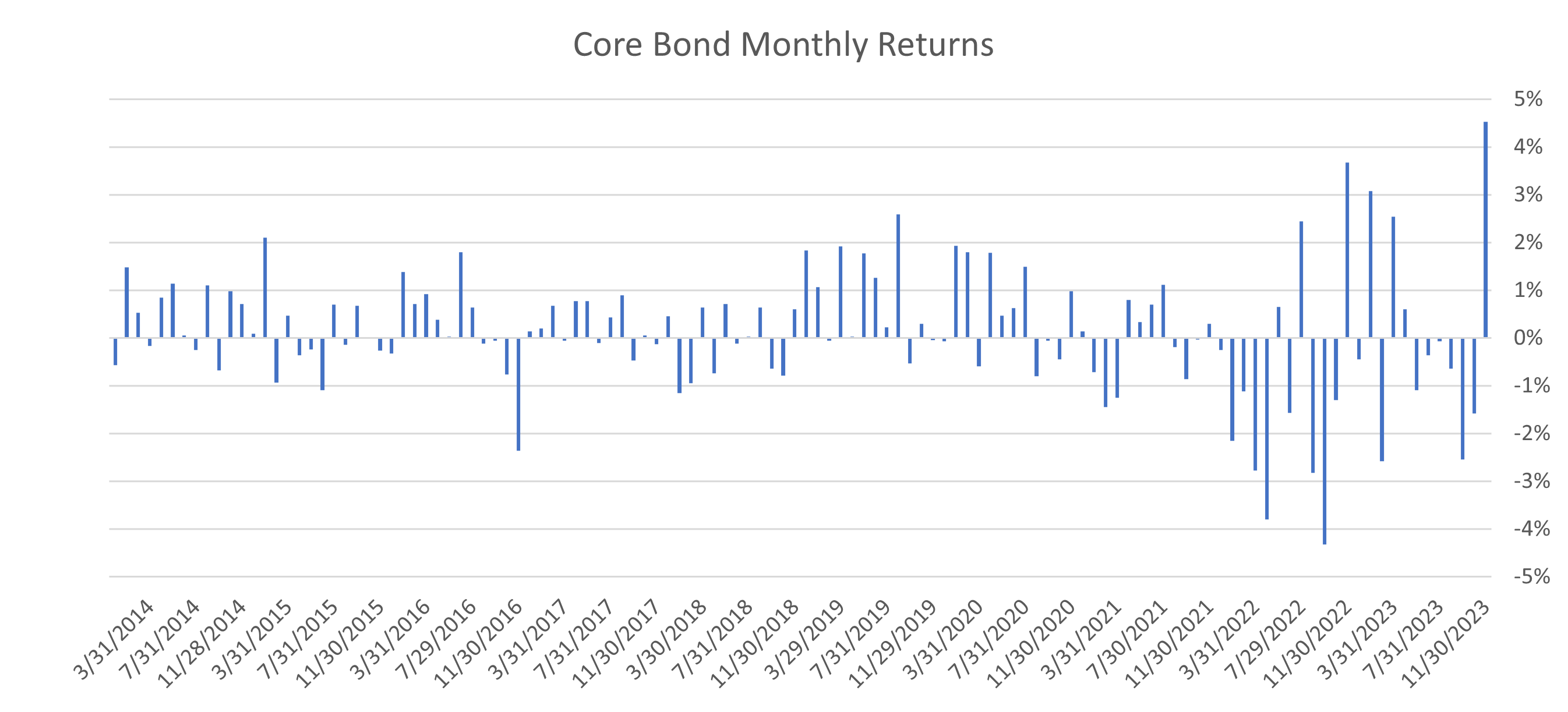

2. Core Bond Monthly Returns

- Core bonds gained 4.5% in November.

- It was the largest monthly gain since 1985.

- Core bonds year-to-date return is +1.6% heading into December.

- Core bonds have historically performed well after the last Fed Funds hike.

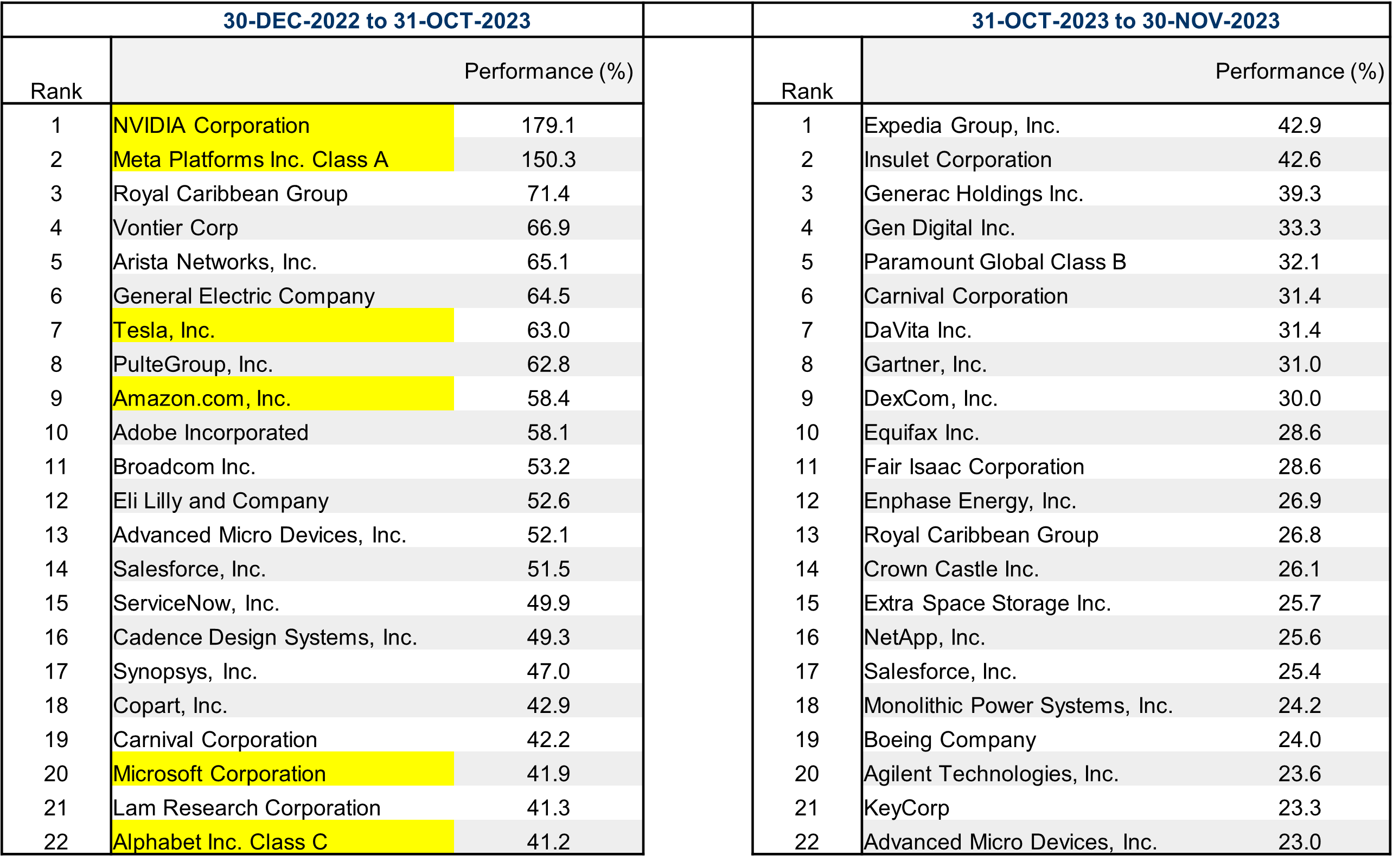

3. Magnificent 7 Notably Absent in November’s Rally

(% returns of stocks in the S&P 500)

- The top performing stocks in the S&P 500 were dominated by the Magnificent 7 (NVIDIA, Meta, Tesla, Amazon, Microsoft, Alphabet, and Apple) for the first 10 months of the year.

- Markets rallied significantly in November. However, the Magnificent 7 were notably absent from the top performers in the S&P 500.

- While technology stocks were represented among the top performers, companies other than the “mega-caps” had a very strong November, indicating a more broad-based rally in the markets.

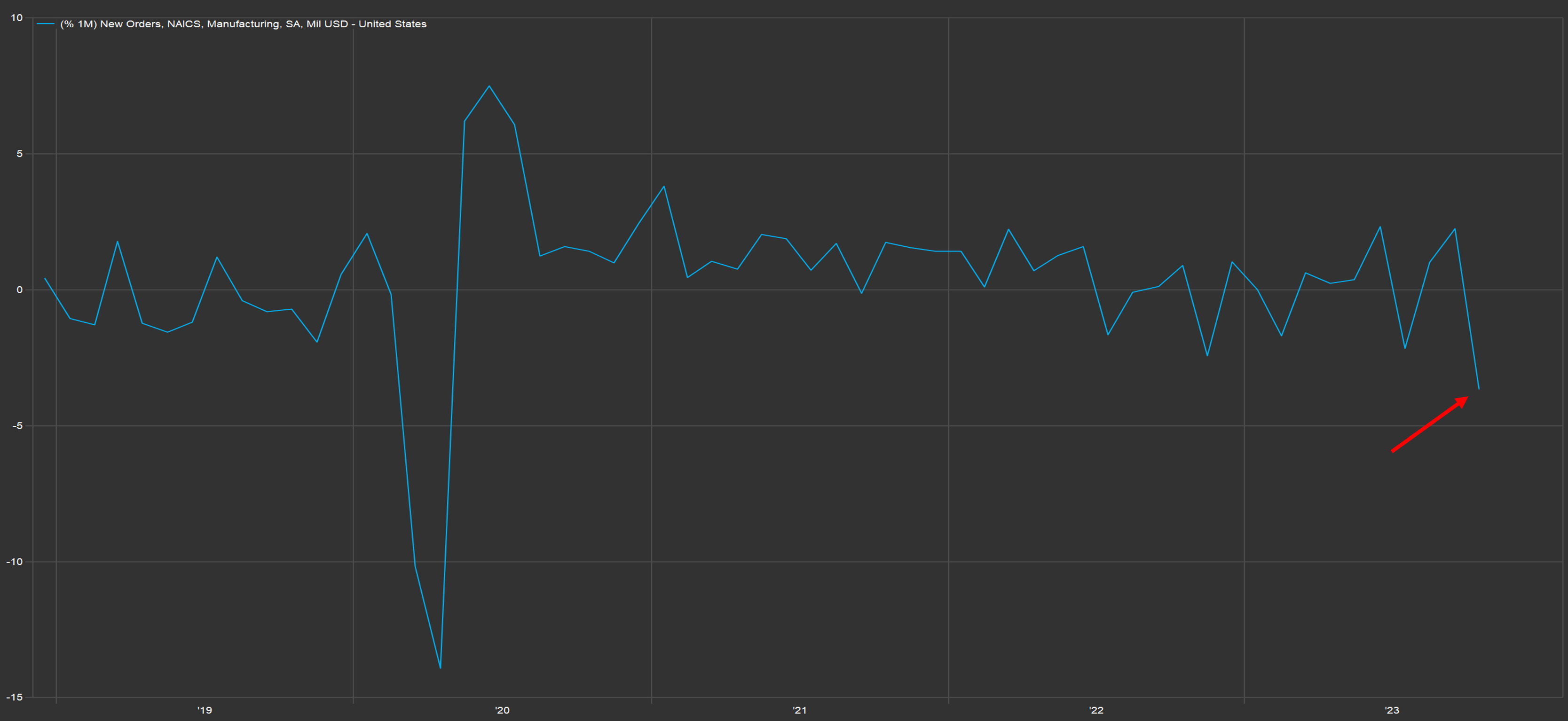

4. Factory Orders (Month/Month % Change)

- Factory orders fell 3.6% in October, the largest decline since Spring 2020 (COVID era). This metric is used as a gauge of manufacturing activity and as an indicator of future business trends.

- Persistent high interest rates are potentially limiting spending as relatively higher inflation levels has constrained all levels of expenditures.

- The “higher-for-longer” scenario for interest rates may continue to put a damper on factory order growth.

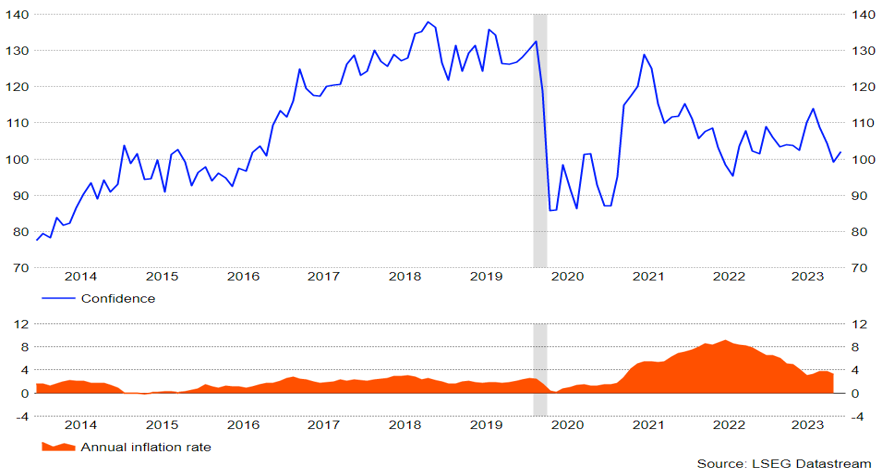

5. Consumer Confidence Drops Alongside Falling Inflation

- Despite decreasing inflation rates during 2023, consumer confidence has not responded positively, and in fact, has fallen for the latter part of 2023.

- The most recent reading in November showed a small uptick, reversing the trend of the last several months.

- Consumers remain preoccupied with rising prices and persistently high interest rates, putting a damper on consumption expectations.

Sources: BTC Capital Management, Bloomberg Finance L.P., FactSet Financial Data and Analytics, Refinitiv Datastream

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.