Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- U.S. Multi Asset Class Performance

- S&P 500 Performance

- Too Early to be Pessimistic?

- Corporate Bond Update

- Pandemic Average Hourly Earnings

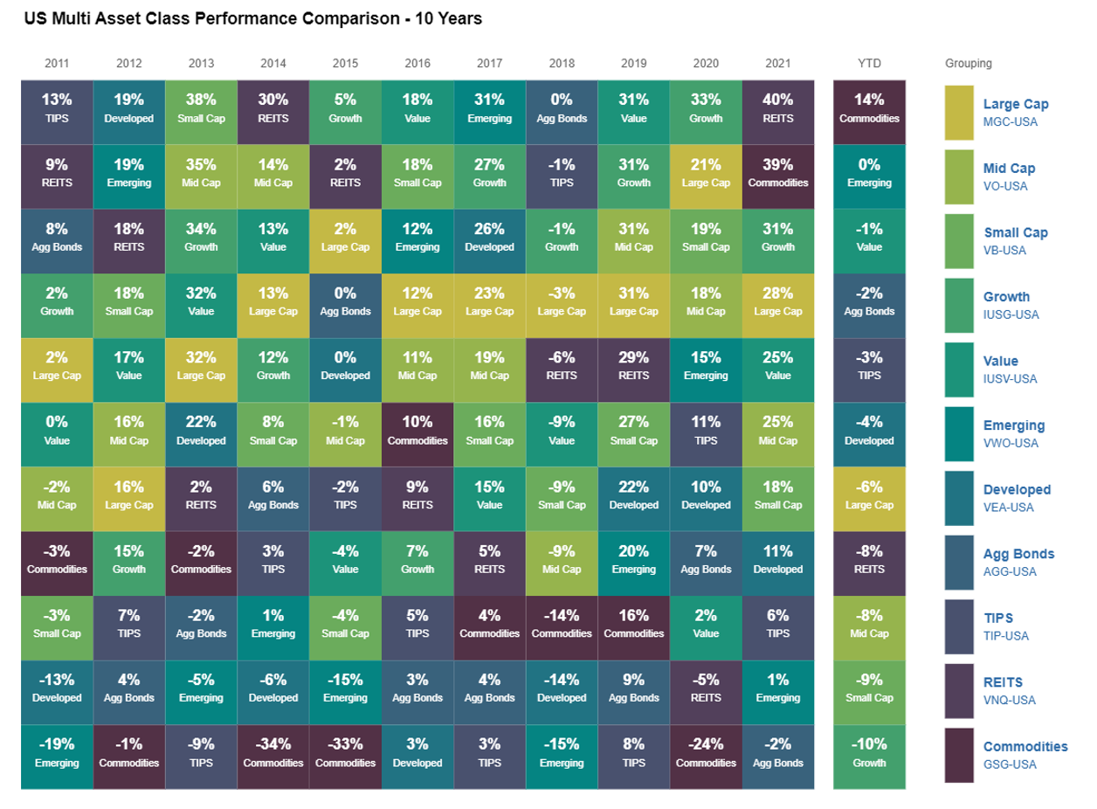

1. U.S. Multi Asset Class Performance

Source: FactSet

- There is weakness across most asset classes year-to-date.

- Volatility in equity markets have contributed to a lag in performance.

- U.S. large caps have been in the top 50% of performers for nine out of the last 10 years.

- Commodities performance surprised to the upside in 2021 and are expected to stay elevated through 2022.

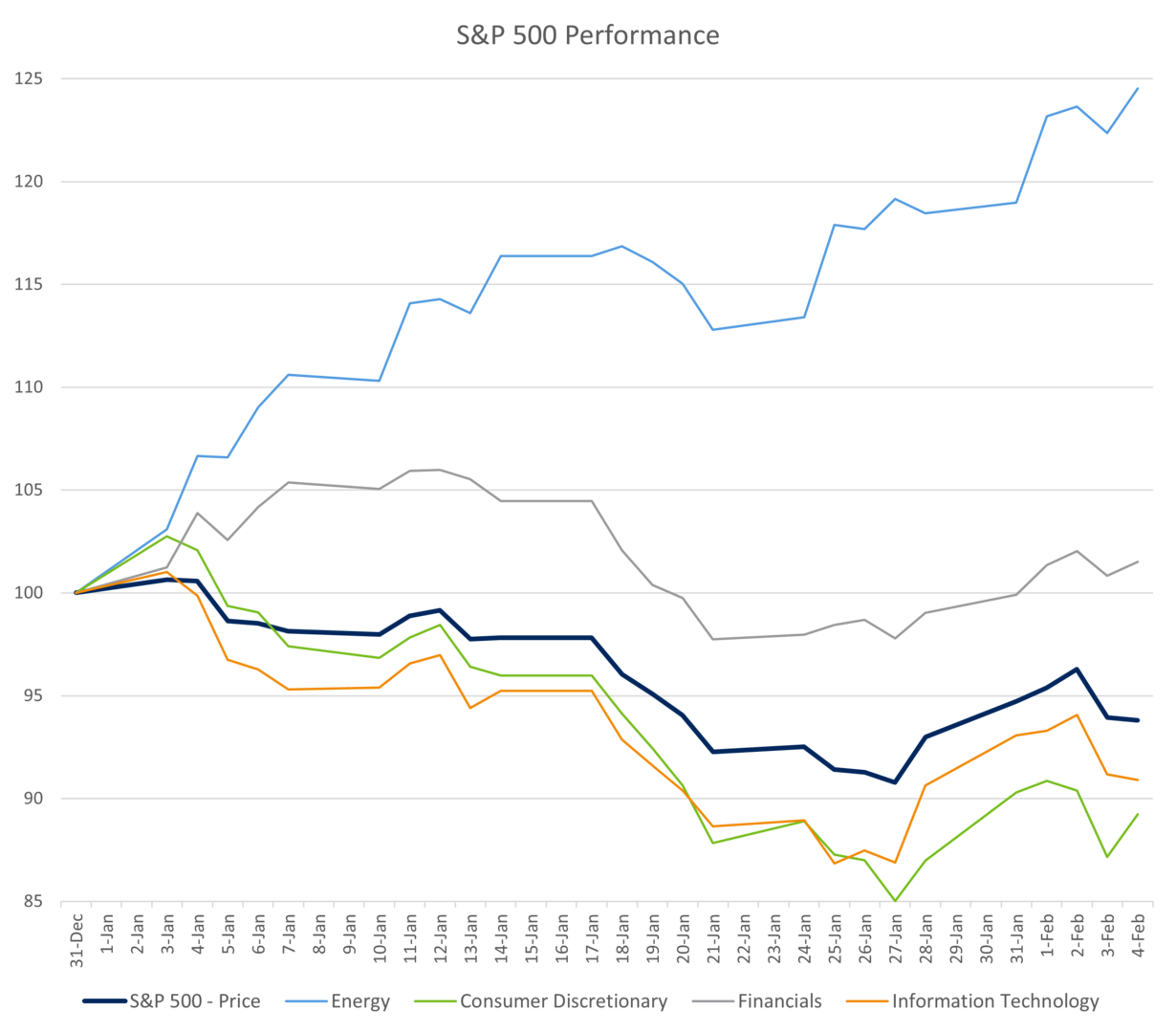

2. S&P 500 Performance

- More losers than winners in the S&P 500 year-to-date (YTD).

- Close to 70% of companies currently have negative YTD returns.

- Two sectors with positive performance were Energy and Financials at 20%+ and 1%, respectively.

- Worst performers were Consumer Discretionary and Information Technology at -13% and -9%, respectively.

- This indicates opportunities for strong individual stock selection.

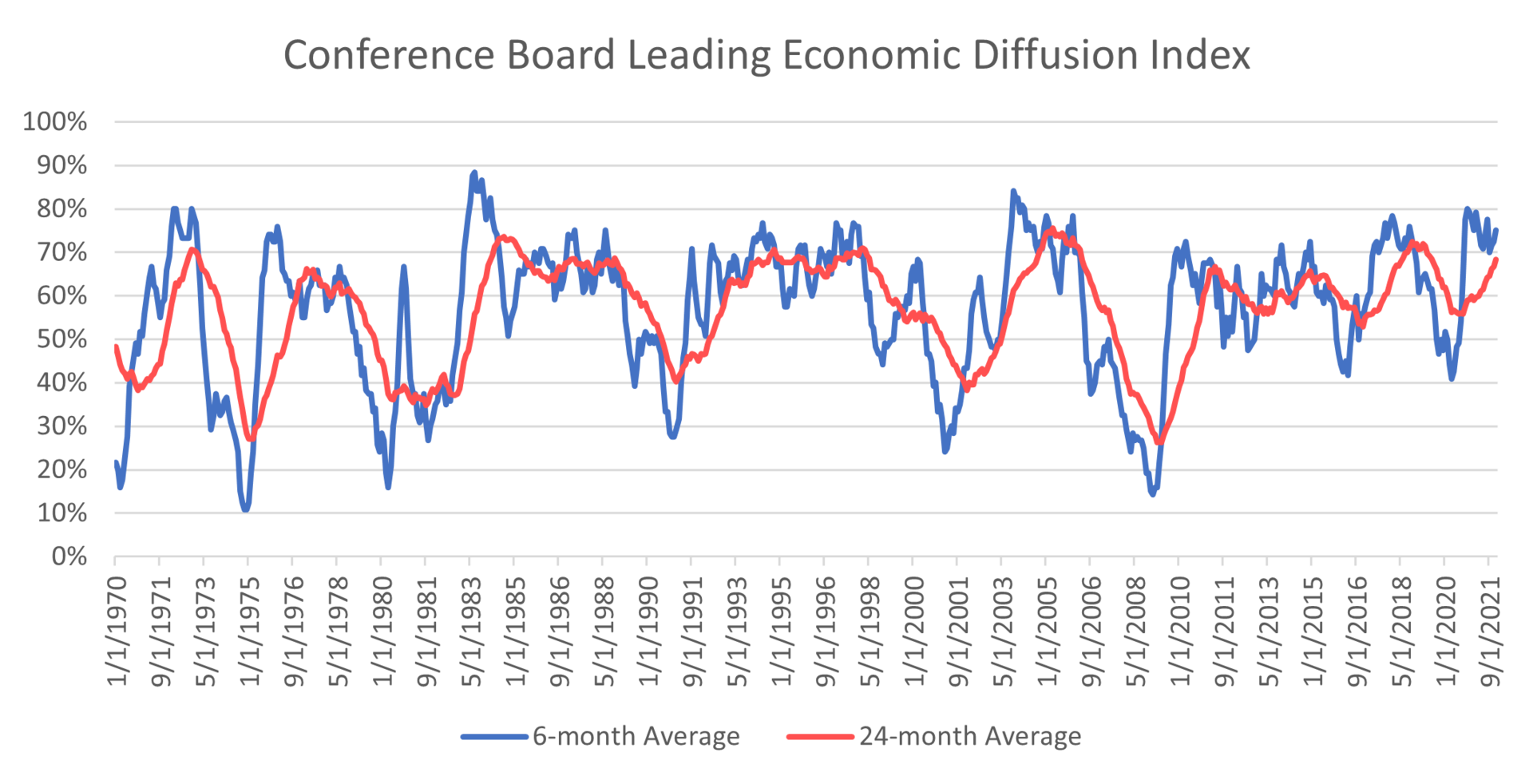

3. Too Early to be Pessimistic?

- Leading indices provide a better roadmap for the economic outlook.

- The Diffusion Index represents the percentage of the 10 components in expansion.

- Diffusion levels often weaken prior to the actual index falling.

- Currently the six-month average is well above a rising 24-month average.

- Historically, this would indicate sufficient runway in the current expansion that may well exceed consensus expectations.

4. Corporate Bond Update

- Excess Return compares an equal duration corporate bond and Treasury.

- A positive number implies that corporate bonds are outperforming.

- Drawdown versus Treasuries is 1.6% ≥ Treasuries outperforming recently.

- Spreads have started to widen but are outperforming their historical relationship to equities.

- Time will tell if the failure to reach new highs on last rally is a signal for more weakness.

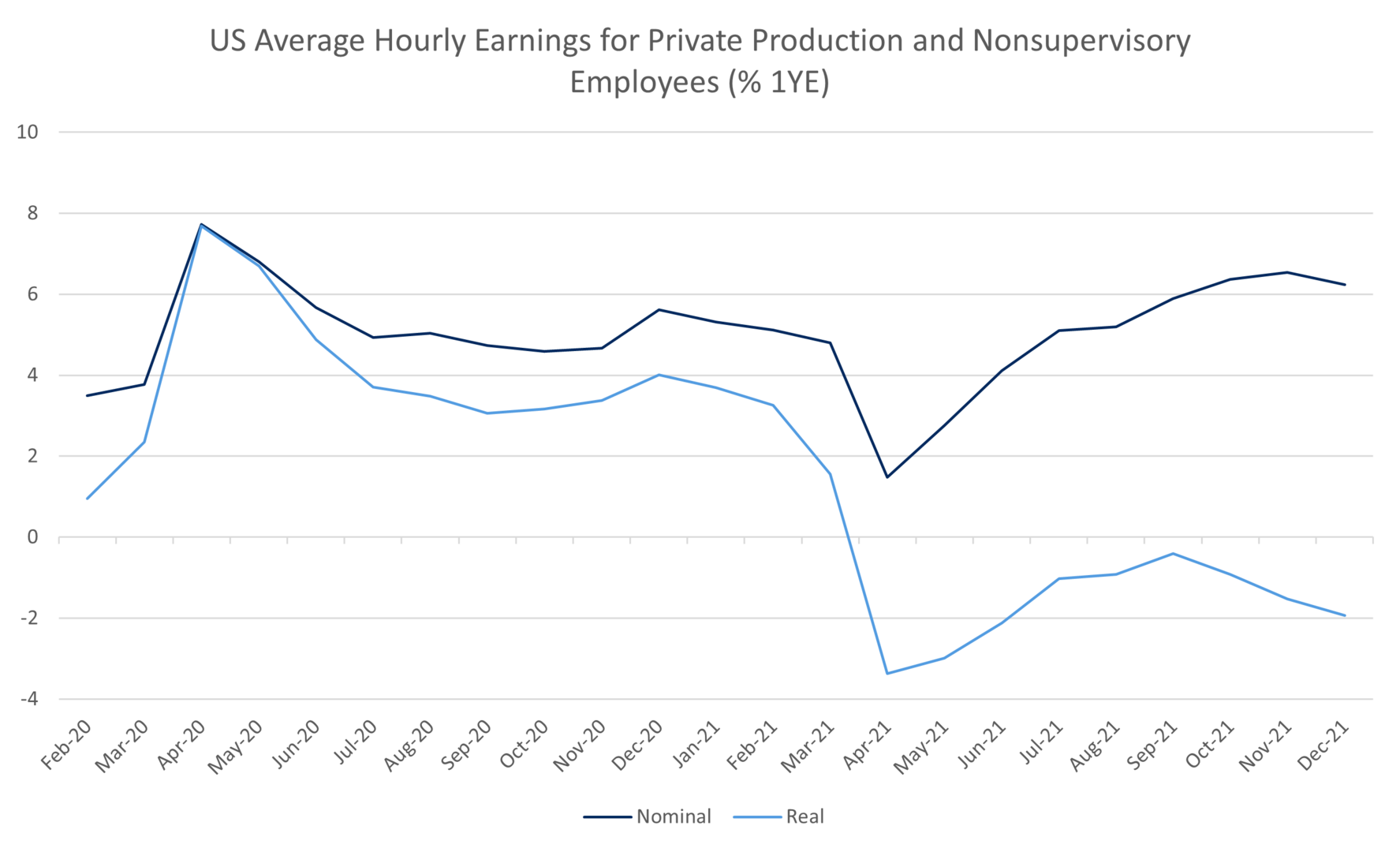

5. Pandemic Average Hourly Earnings

- There has been growth in nominal wages through the pandemic.

- Growth in wages has been negatively impacted by increases in inflation. Real wages have declined since March of 2021.

- Real wages are expected to increase through 2022 as companies compete in a tight job market.

- Higher wages may negatively impact company earnings.

Source: BTC Capital Management, Bloomberg L.P., FactSet, The Conference Board

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.