Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Mortgage Rates Move Higher

- Sharp Increases in Commodity Prices

- Airlines Negatively Impacted by Higher Fuel Costs

- The Case for Bonds: Diversification

- Coming Back to Work

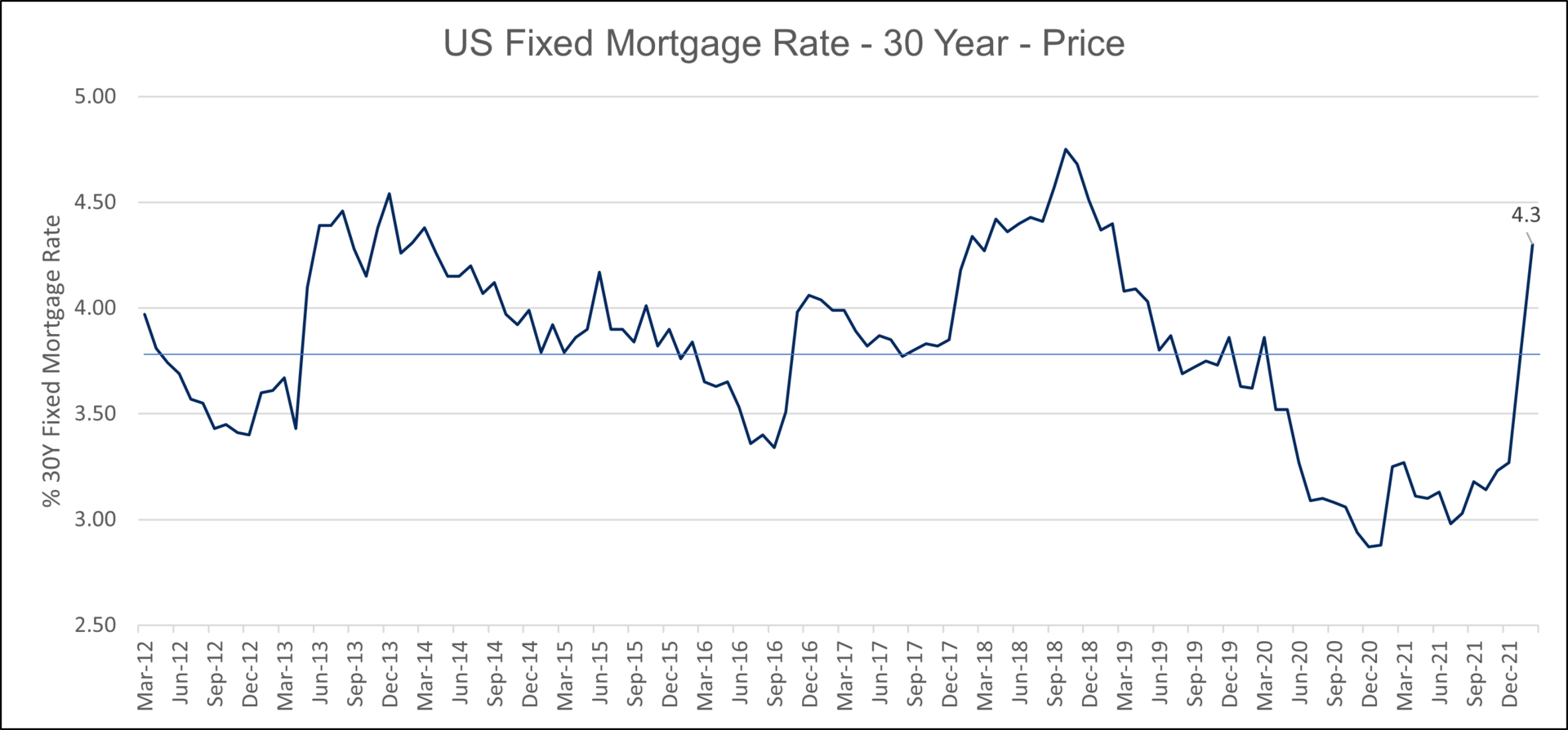

1. Mortgage Rates Move Higher

- Thirty-year mortgage rate now exceeds its 10-year average of 3.81%.

- Housing demand continues to be strong as buyers anticipate further rate increases.

- Rising rental costs are contributing to mortgage demand.

- Increased rates will negatively impact housing affordability.

- Low housing inventory is most acute for homes priced below $500,000

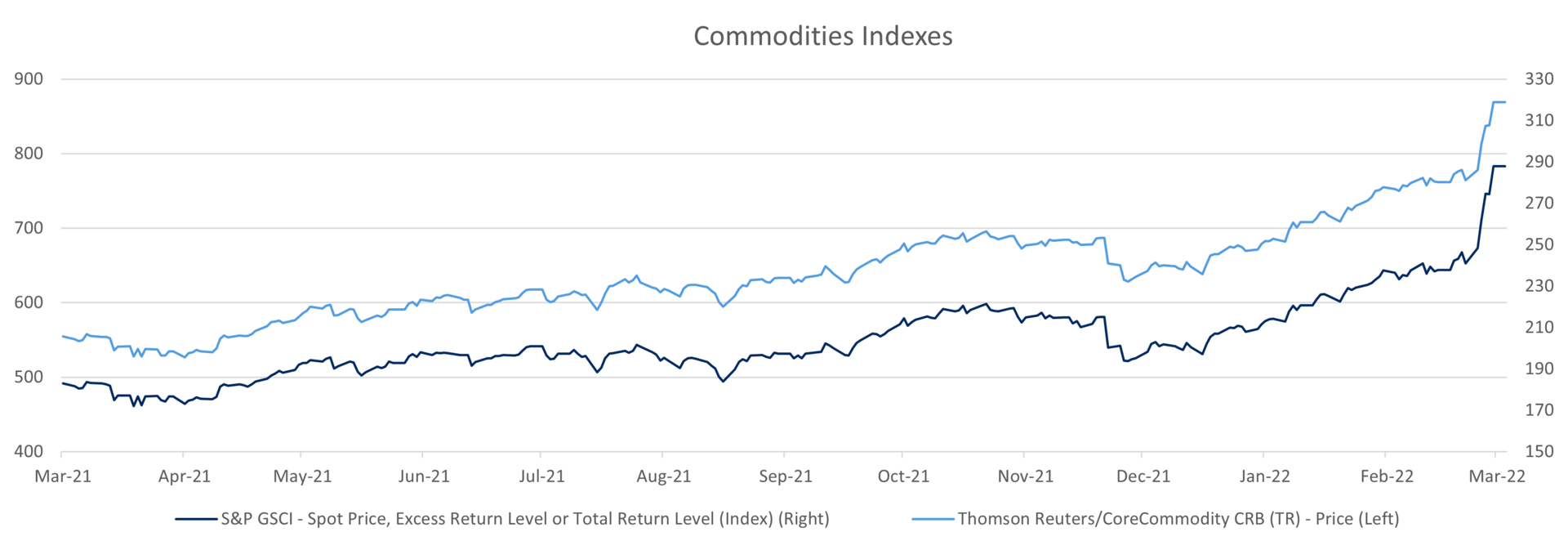

2. Sharp Increases in Commodity Prices

- Due in part to Russia’s invasion of Ukraine, commodity prices are accelerating at a pace not seen in decades.

- Potential sanctions on Russian oil have led the price to increase by over 50% year-to-date.

- Russia is also the second largest producer of natural gas globally, which has seen its price increase by almost 27% so far this year.

- Coal prices have increased 69% over the past month and 355% over the past year. Russia is the third largest producer of coal globally.

- The supply disruption in Ukrainian wheat has contributed to a price increase of over 40% year-to-date.

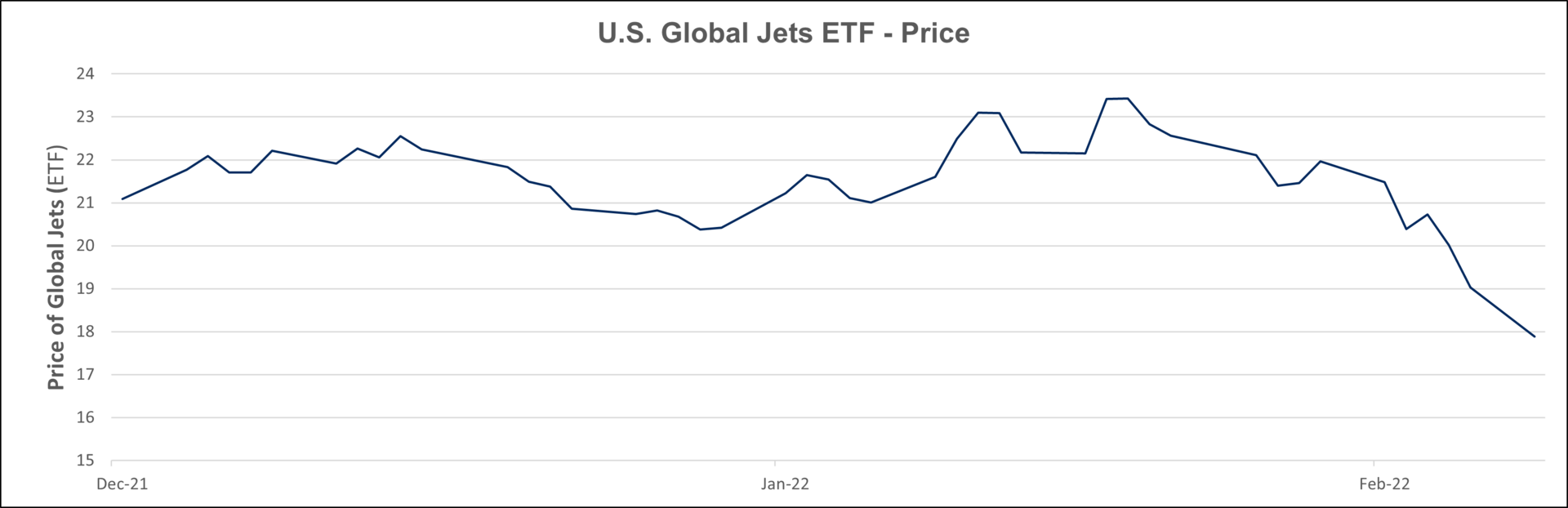

3. Airlines Negatively Impacted by Higher Fuel Costs

- Increasing fuel prices will negatively impact margins for airlines.

- Fuel accounts for 30% of total costs for airlines.

- Analysts have been lowering 2022 growth expectations for the industry.

- Air travel demand has been negatively impacted by the Russia-Ukraine conflict.

- Staffing issues continue to negatively impact operations.

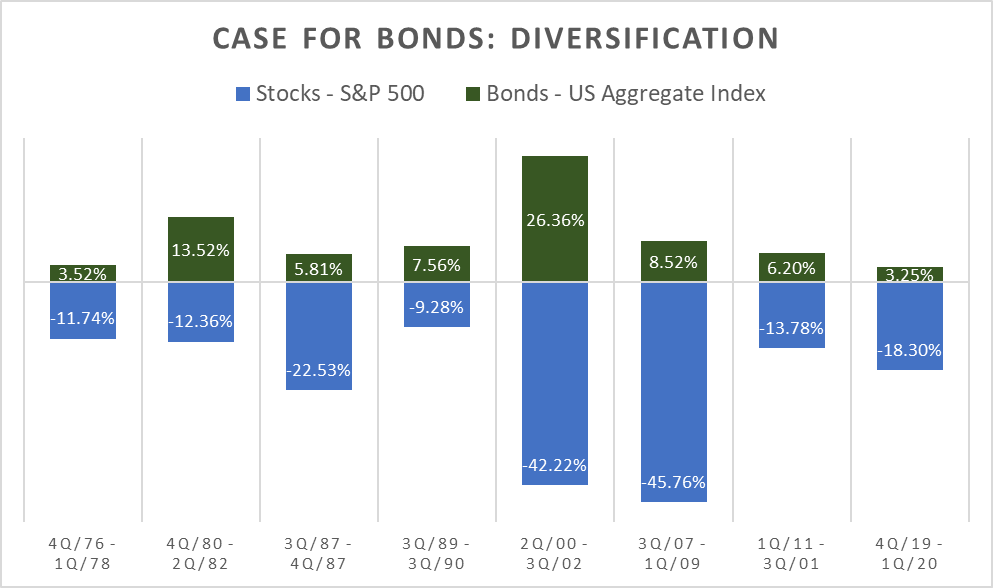

4. The Case for Bonds: Diversification

- One of the most important benefits bonds provide to a balanced portfolio is to help offset the higher volatility of equities.

- Since 1977 only four years have seen a negative return from bonds. 1994 was the year of the largest decline of bond returns at -2.82%.

- 92% of the return generated by bonds over the last 30 years has come from income and only 8% from price changes.

- While bonds (Bloomberg Aggregate Bond Index) have a year-to-date return of -3.5%, equities have returned -11.6% (S&P 500 index). With the self-correcting nature of bonds, the increase in interest rates will produce higher income and offset the decline in prices.

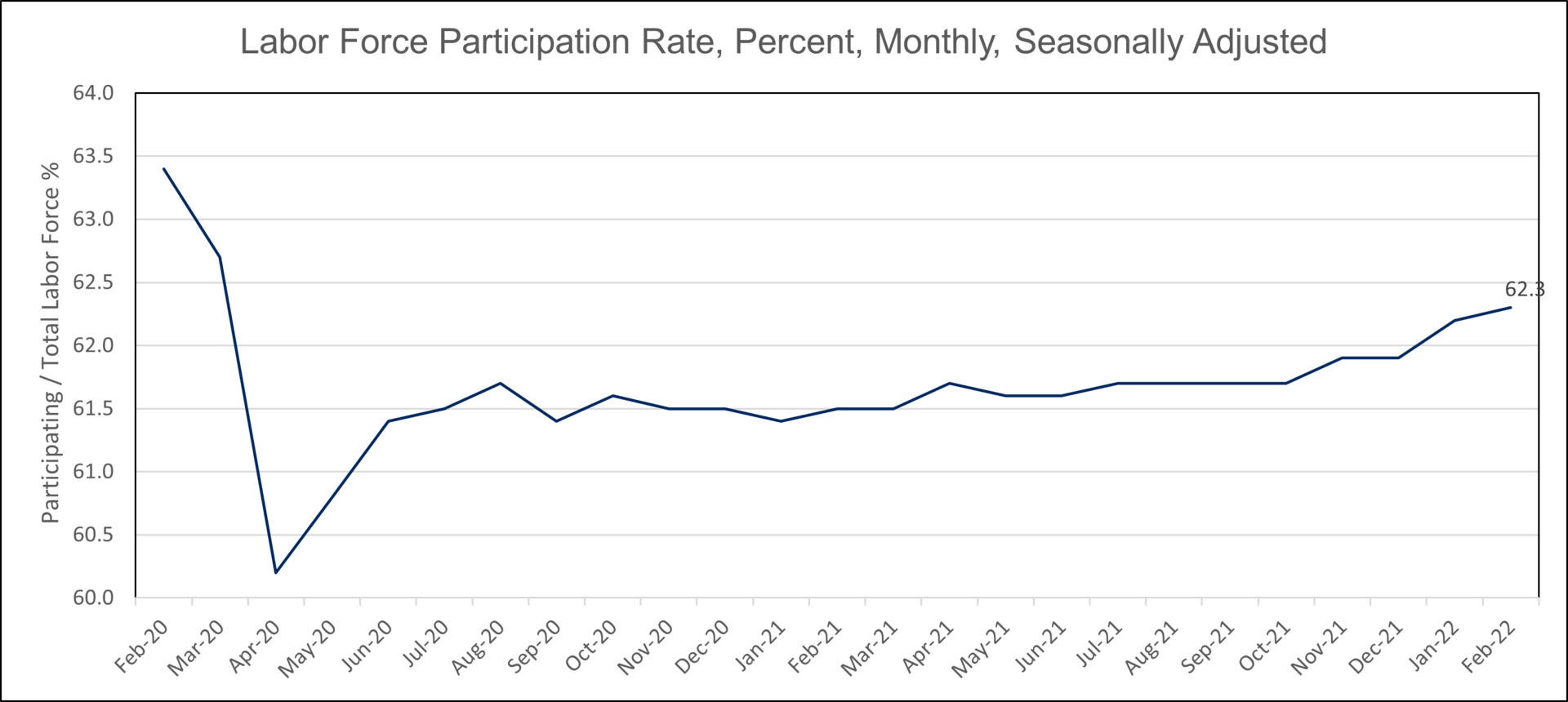

5. Coming Back to Work

- Labor force participation continues to improve as people re-enter the labor force.

- A decreasing savings rate is pushing people back into the work force. The current savings rate of 6.4% is at 2013 levels..

- Although participation is increasing it is still below pre-pandemic levels, due in part to the higher cost of childcare which is keeping some parents out of the work force.

- Labor markets continue to be tight with the last unemployment rate report of 3.8%.

Source: BTC Capital Management, Bloomberg L.P., FactSet, The Conference Board

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.