Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Investor Sentiment

- Unit Labor Costs

- Domestic Auto Inventories

- NFIB Small Business Index

- Real Yields Surge Again

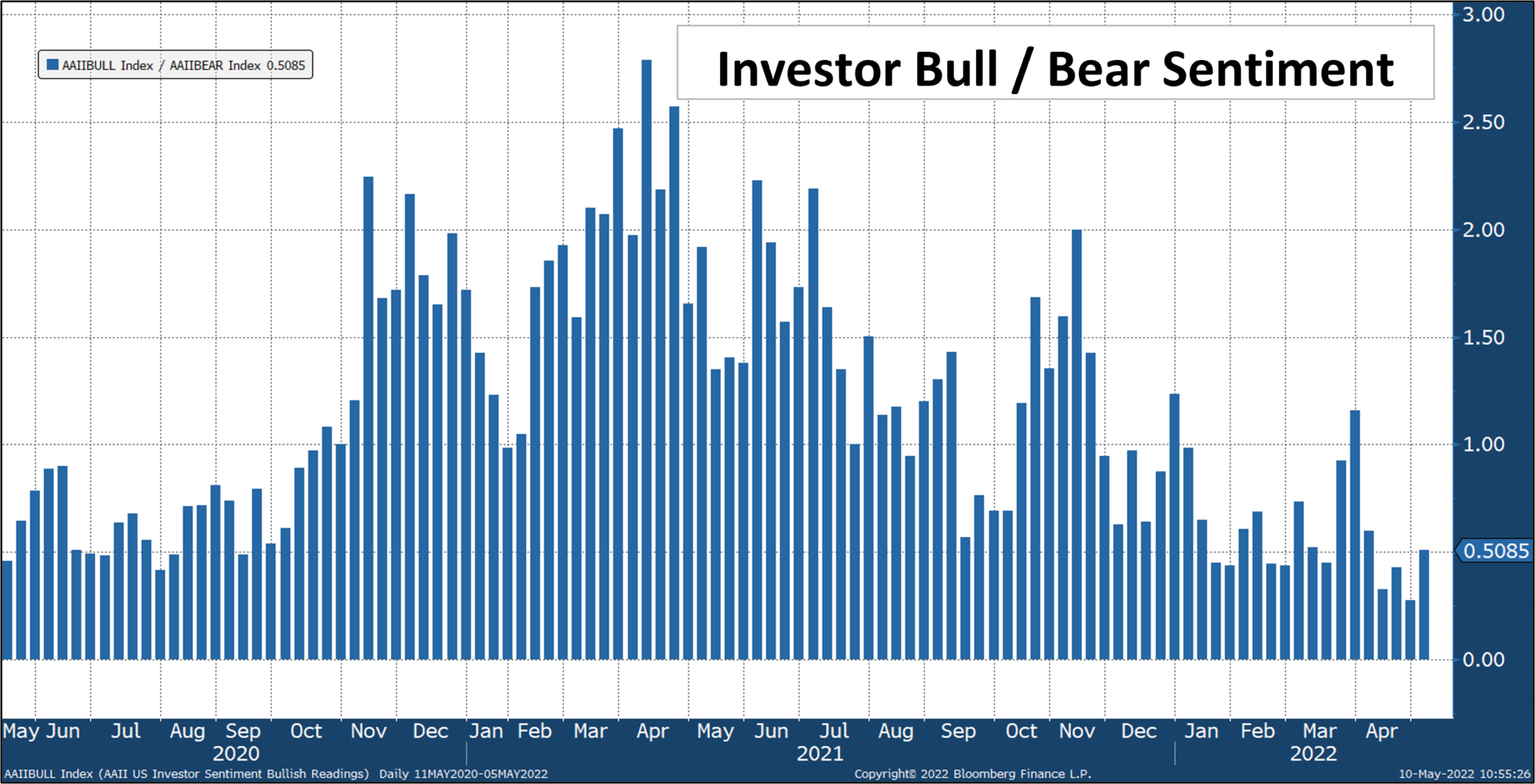

1. Investor Sentiment

- The American Association of Individual Investors survey continues to suggest muted bullish sentiment among investors.

- Historically the ratio of bullish sentiment to bearish is 1.25.

- While bullish sentiment rose in the most recent survey it remains quite low compared to long term results.

- Above-average returns (as measured by the S&P 500 Index) have occurred historically for the six- and 12-month periods following unusually low results for bullish sentiment and for the spread between bullish and bearish sentiment.

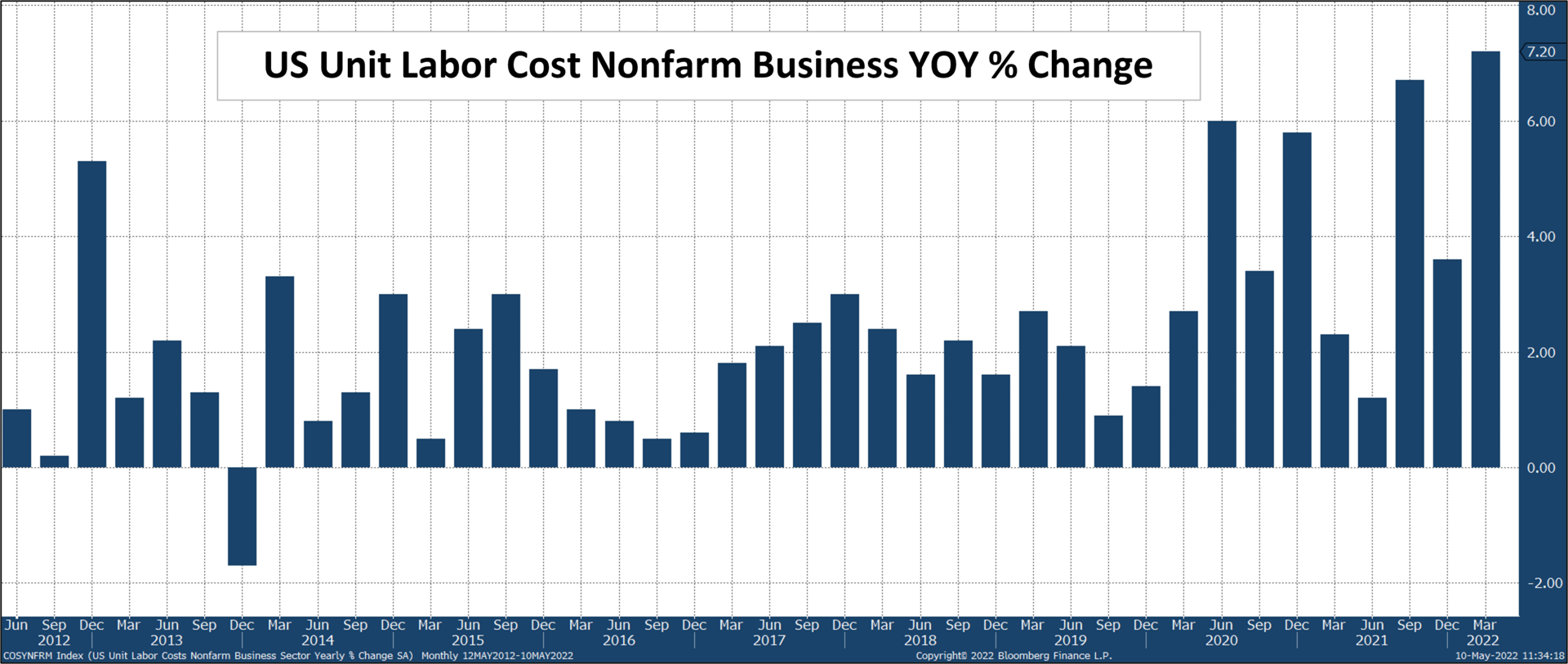

2. Unit Labor Costs

- With its first quarter increase of 11.6%, unit labor costs rose 7.2% year-over-year, the fastest pace since the third quarter of 1982.

- The measure reflects ongoing increases in compensation (salary and benefits) combined with a decline in the productivity rate.

- Labor cost increases reflect continued strength in the labor market and ongoing wage pressures.

- One key variable to watch gong forward in regard to unit labor costs will be the labor participation rate. More workers (higher participation rate) could lead to moderation in wage growth helping moderate cost increases.

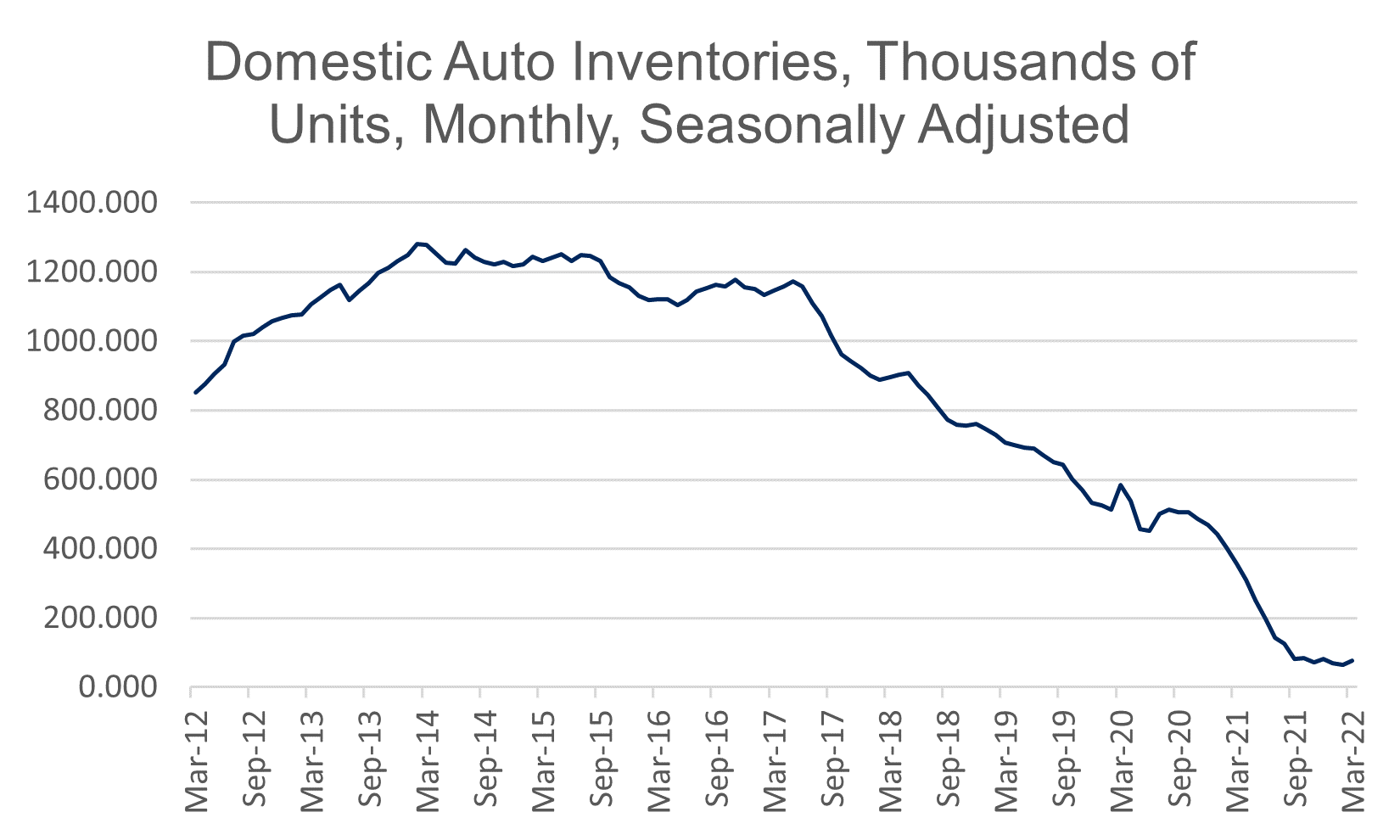

3. Domestic Auto Inventories

- Auto inventories have been dropping for almost a decade.

- Supply chain disruptions during 2020 accelerated the decline in inventories.

- The decline in inventory numbers began flattening in late 2021.

- Inventories are expected to improve through 2022 as car manufacturers resolve production issues.

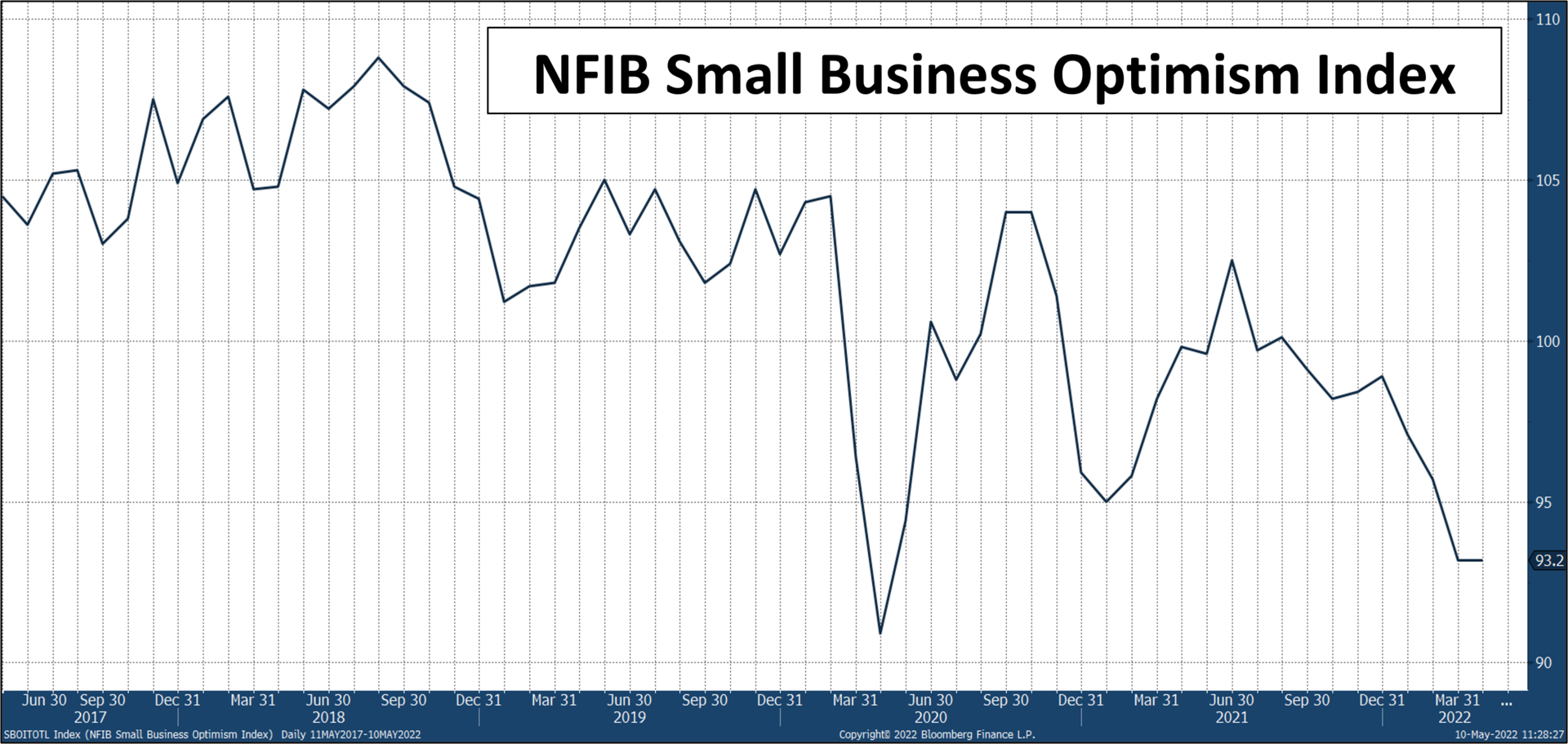

4. NFIB Small Business Index

- The National Federation of Independent Business (NFIB) Small Business Optimism Index was unchanged in April with a reading of 93.2, the fourth consecutive month below its 48 year average level of 98.

- Inflation was the single most pressing issue according to 32% of owners, the largest share of respondents since the fourth quarter of 1980.

- The results of the survey did show a positive step regarding inflation as the share of owners raising average selling prices did decline slightly from the previous month’s survey.

- Business owners are still unable to fill open positions at their companies as the share of respondents reporting open jobs was unchanged at 47% in April.

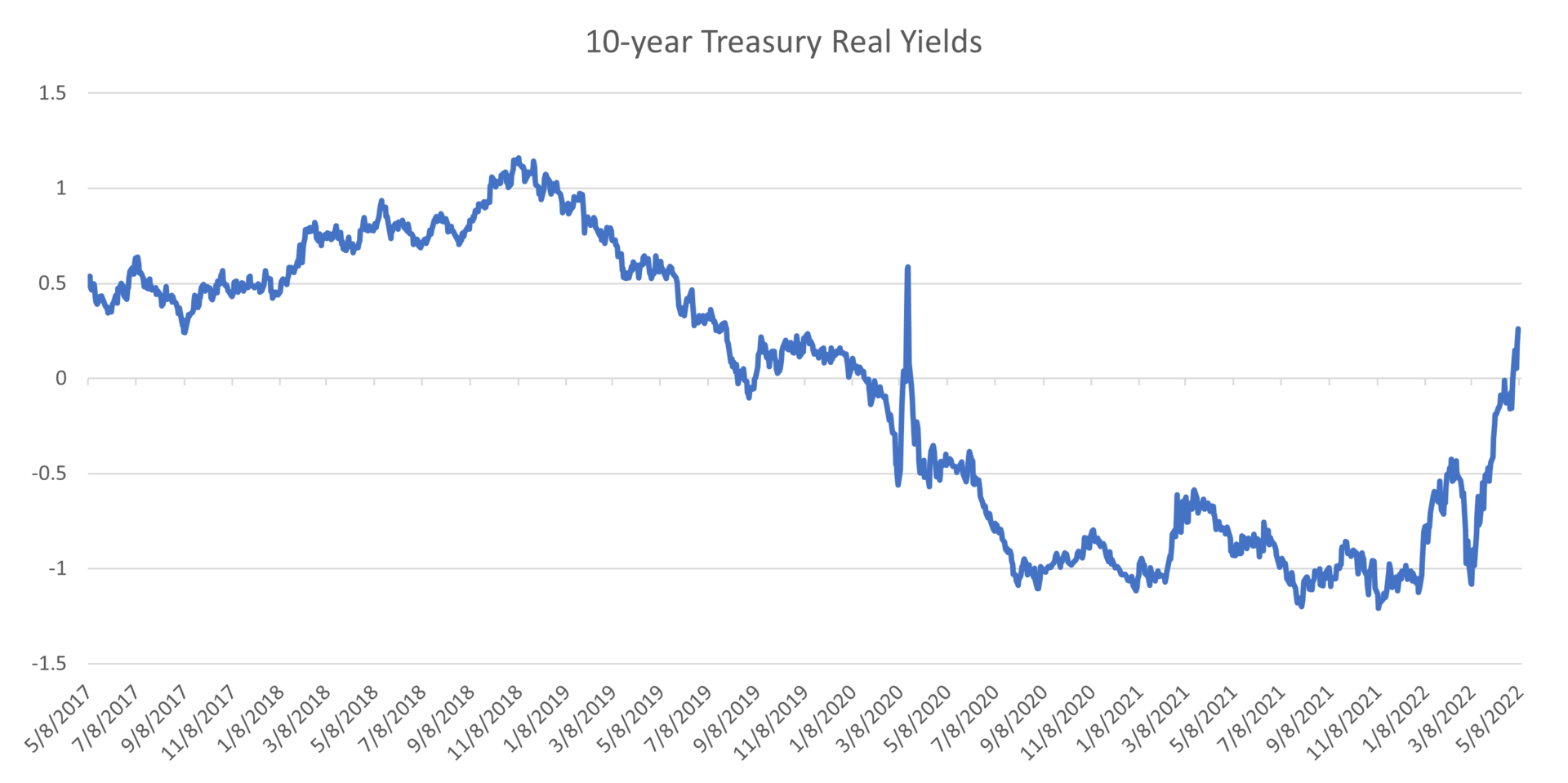

5. Real Yields Surge Again

- 10-year Treasury real yields (10 year U.S. Treasury yield minus expected inflation rate) are up another 45 basis points this month.

- That’s an increase of 1.33% in just 43 days.

- This increase is currently acting as a headwind to risk assets such as equities.

- This development will moderate growth and inflation going forward.

- Credit spreads have widened during this move, but remain below the widest year-to-date levels.

Source: BTC Capital Management, Bloomberg Finance L.P., Federal Reserve Bank of St. Louis

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.