Welcome to Five in Five, a new monthly publication from the Investment Team at BTC Capital Management. Each month we’ll share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Consumers Face Rising Costs

- Fed’s Tapering Launch Date

- Inflation – Putting a Chill on Holiday Shopping

- Corporate Bonds Focused on Third Quarter Earnings

- Analyst Estimates – Third Quarter 2021 Earnings MSCI USA Index

1. Consumers Face Rising Costs

- The comeback in retail sales continues but appears to be shifting away from goods to increasing demand for COVID-sensitive services.

- Continued headwinds exist as exhibited by rising costs for transportation, inputs and warehousing.

- A slight rise in The University of Michigan Consumer Sentiment Report for September revealed consumers are regaining confidence after August’s decline attributed to rising COVID infection rates.

- Sluggish payroll additions for the third quarter evidenced a tug of war as employers continue to search for employees prior to the holiday season coupled with a slow return to workforce. We anticipate a pickup in payroll adds in the coming months as schools have reopened and the expanded federal unemployment benefits have come to an end.

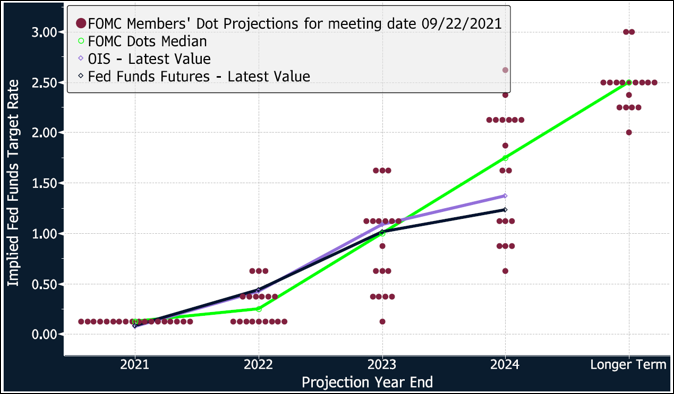

2. Fed’s Tapering Launch Date

- Tapering is the process where the Federal Reserve (Fed) reduces its open market bond purchasing program of $120 billion a month, a program that has supported both bond and stock prices.

- The new dot plot release from the Fed was viewed by investors as an acceleration of the Fed’s tapering plan which lifted rates higher. Weak September employment data may cause the Fed to rethink, thus slow, their tapering timeline.

- Conditions for tapering have “all but been met” with inflation above 2%, real GDP forecasts of 5.9% for year-end, and the unemployment rate, which is now at 4.8%, below the Fed’s 5.0% target for tapering.

- The U.S. debt ceiling debate continues, but the bond market seems unphased as Congress kicked the issue down the road until after the Thanksgiving recess.

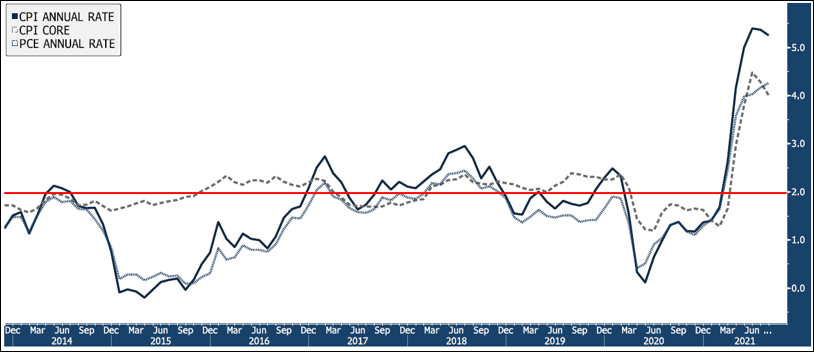

3. Inflation – Putting a Chill on Holiday Shopping

- Rising energy prices may put a chill in holiday shopping with oil and natural gas up 9.5% and 34.0%, respectively, for the month of September.

- Rising inflation has outpaced earnings as U.S. Real Hourly Earnings year-over-year (YOY) posted -0.9% in the September report. Without positive real wages, economists have started cutting forecasts for fourth quarter GDP.

- When does transitory inflation become part of consumer expectations? A Federal Reserve Bank of New York survey shows that consumers are expecting inflation at the 5% level over the next year and 4% over the next three years. Inflation and bond prices generally move in opposite directions.

- Home prices grew 19.7% from 2020 pandemic low levels. A better measure of housing cost is the U.S. CPI Urban Consumers Owners Equivalent Rent. It is up 2.6% YOY, albeit growing slower than 2019 levels.

- Inflation figures are still dominated by sector-specific supply factors including energy (production below 2019 levels), autos (semiconductors) and food (input commodities and worker shortage).

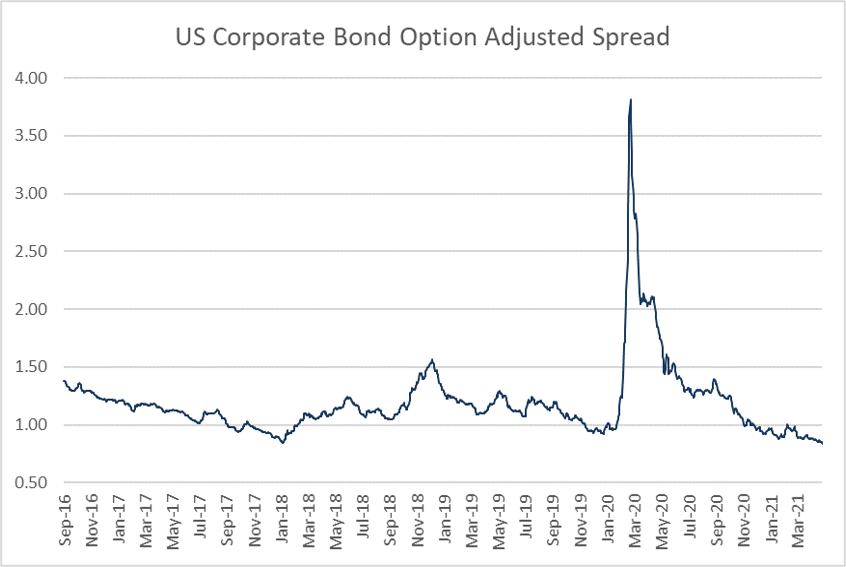

4. Corporate Bonds Focused on Third Quarter Earnings

- Earnings for the third quarter will be a key driver for corporate bond performance as spreads have reached five-year lows. Weaker earnings would likely widen sector’s spreads.

- Yield-curve flattening during July and August gave way to steepening during September given inflation news and changes to the Fed’s tapering plan.

- A steeper yield curve from two-year to 10-year timeframe indicates that the longer-term economic outlook is positive. Note the Federal Reserve Bank of New York’s Probability of Recession in the next 12 months remains below 2018 levels.

- Average earnings are rising faster than mortgage rates, improving homeowner ability to service mortgage debt while providing for further paydown of delinquencies that developed during 2020-2021.

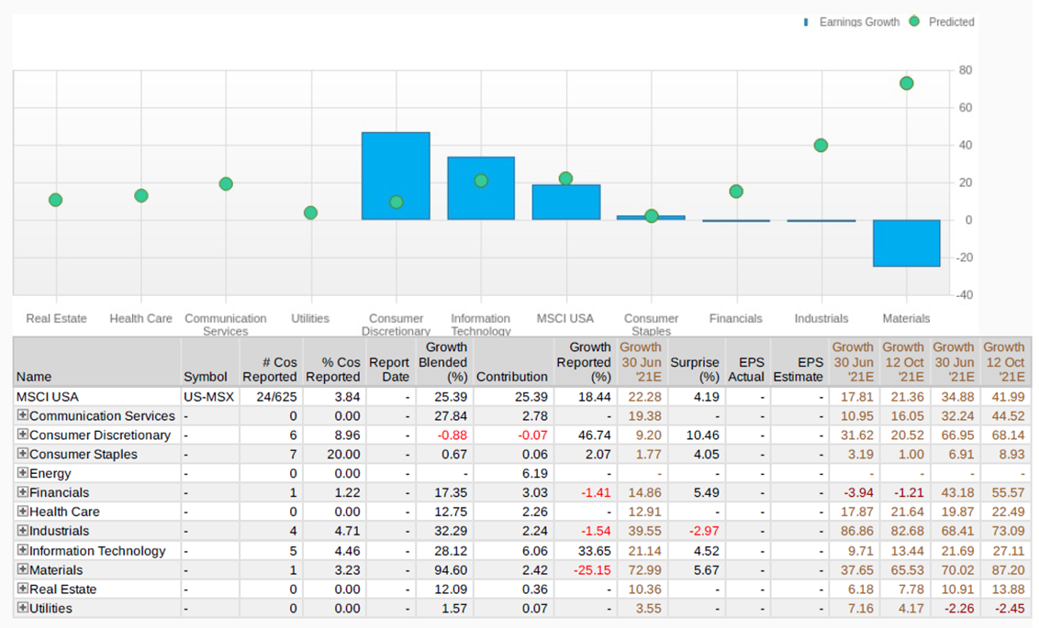

5. Analyst Estimates – Third Quarter 2021 Earnings MSCI USA Index

- Regarding the MSCI USA Index, analysts currently project third quarter earnings growth of 25.4% year-over-year (YOY). The chart and table above blends analyst estimates with that of companies which have reported earnings (24 companies of 625 that comprise the Index).

- Cyclical sectors such as Materials (+94.6%) and Industrials (+32.3%) exhibit the highest YOY growth rates.

- For Information Technology, the largest sector within the Index, earnings are estimated to grow 28.1% YOY.

- The forecasted growth in earnings is supported by projected growth in revenues. Revenues are expected to increase 14.8% YOY, driven primarily by growth within the Energy (+52.8%), Materials (+29.1%), Communication Services (+19.5%) and Information Technology (+19.4%) sectors.

- According to Refinitiv, recently the ratio of analyst upward-to- downward revisions is zero, which was last observed in July 2020. Through most of the latter half of 2020 continuing through August 2021 analyst upward revisions had outpaced downward revisions.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.