Welcome to Five in Five, a new monthly publication from the Investment Team at BTC Capital Management. Each month we’ll share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Chinese Stock Performance

- Value vs. Growth

- Inflation – Transitory?

- Waiting for Federal Reserve Action

- Employment Update

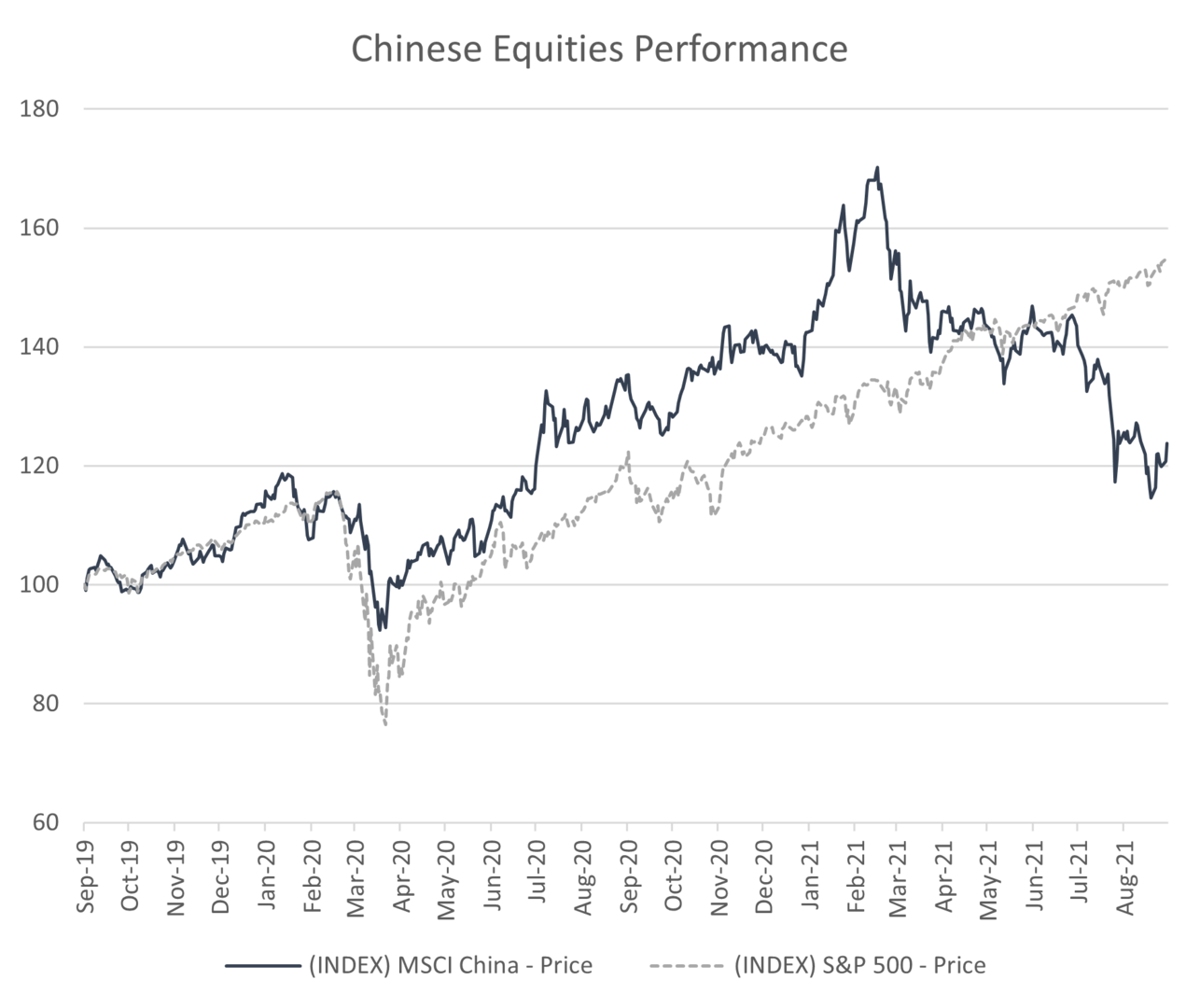

1. Chinese Stock Performance

- Chinese equities are down close to 30% since a February 2021 peak.

- The drop is due to regulatory tightening by the Chinese government.

- Private Chinese entities in socially important sectors will be impacted the most according to statements from the Communist party.

- Chinese tech company revenues continue to be strong.

- Reduced international capital flows may negatively impact the growth of some Chinese companies.

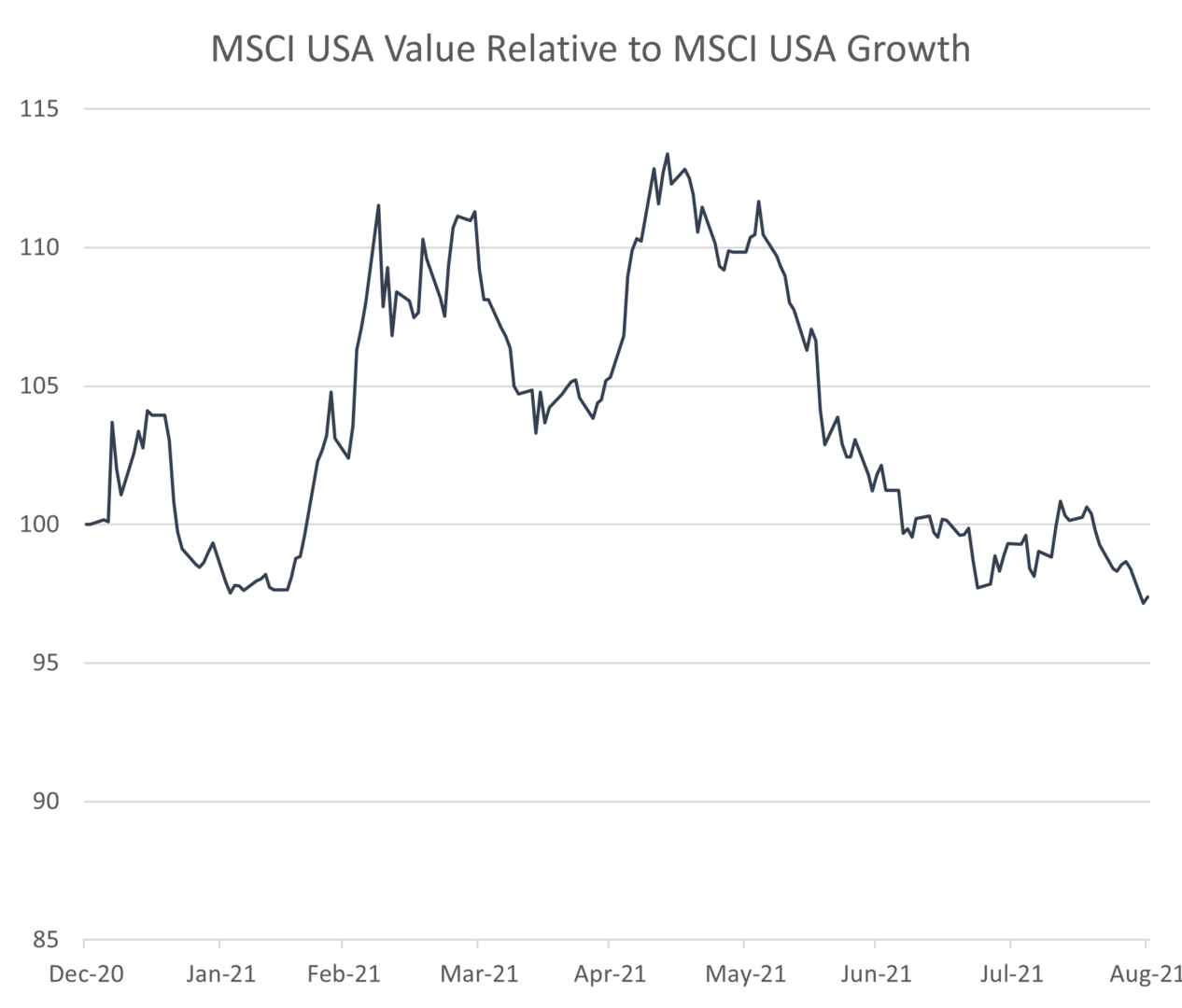

2. Value vs. Growth

- Movement between value and growth factors have been dynamic.

- Value outperformed growth in the first half of the year.

- Growth outperformed value by over 400 basis points in the second half of the year.

- Information technology, health care and communication services sectors have contributed the most in the second half of the year.

- Energy has underperformed the most in the second half of the year.

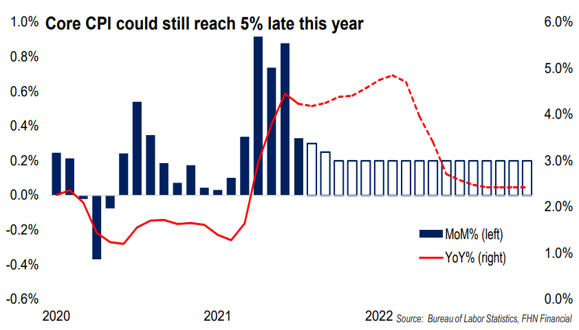

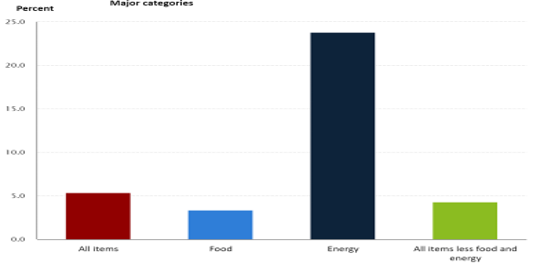

3. Inflation – Transitory?

12-month percent change, CPI, selected categories

- Inflation continues to register strong year-over-year increases and may push higher in the near term.

- Large price increases for energy and used vehicles have been key components of the 2021 increase.

- Continue to expect the inflation rate to moderate in 2022 as economic growth decelerates and pricing increases ease for durable goods.

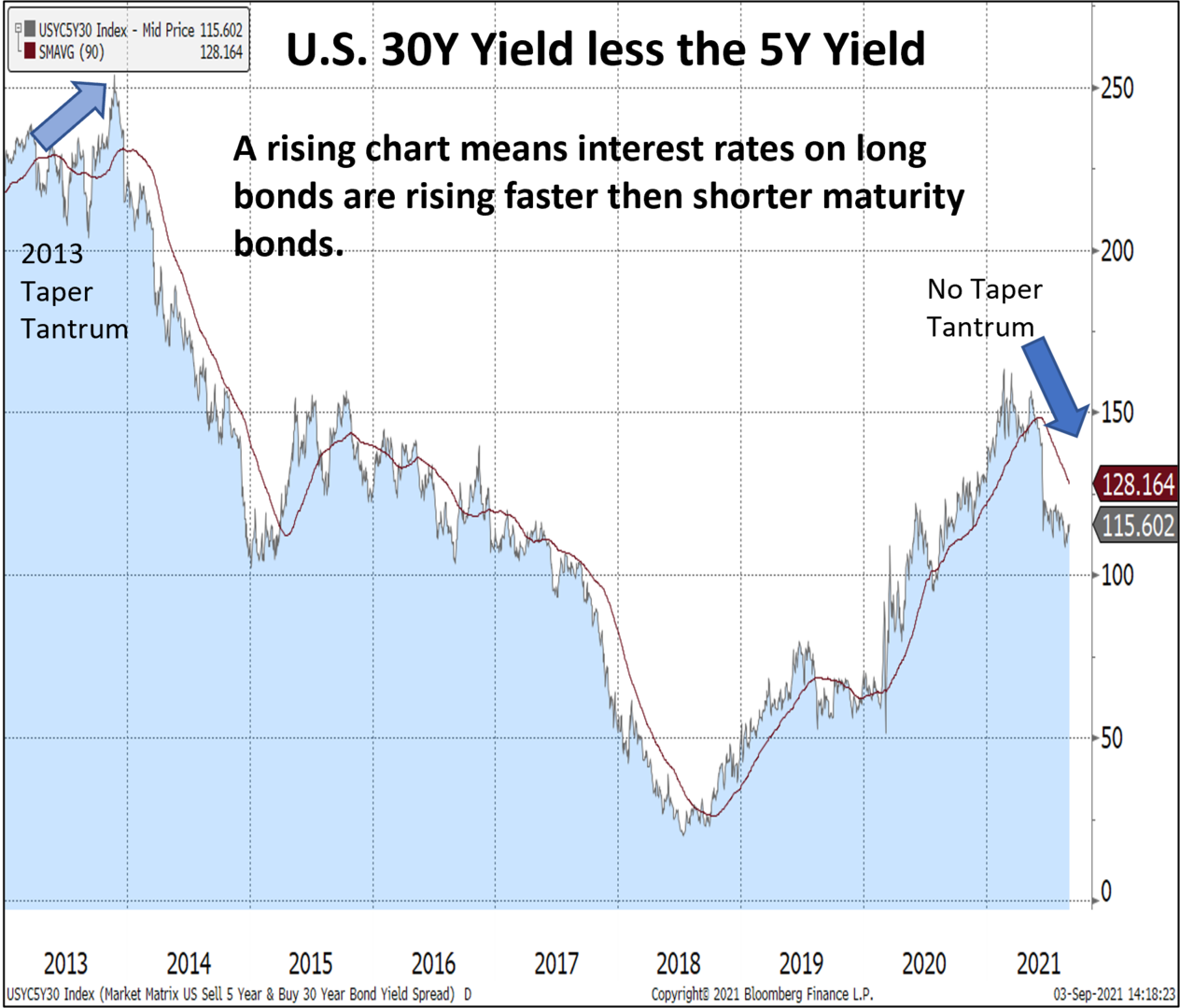

4. Waiting for Federal Reserve Action

- A flattening yield curve reveals:

- Easing concerns of long-term inflation.

- The Federal Reserve’s efforts to be transparent regarding tapering its monetary stimulus programs.

- Monetary balancing act: Bond prices may fall if the Federal Reserve cannot find the right balance of tapering of its bond purchases and removing excess liquidity that has supported bond prices over the last year. To date the balancing act has worked.

- Countries continue to be in different phases of recovery. An uncoordinated global monetary, regulatory and fiscal policies will result in slower economic growth.

- Slower global growth will help keep rising bond yields in check, therefore supporting bond prices.

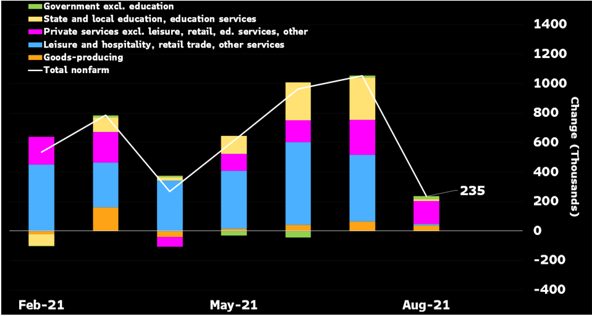

5. Employment Update

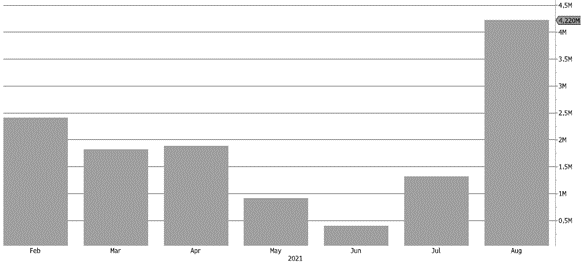

U.S. Confirmed COVID-19 Cases – Impacting Employment

- Non-farm payroll growth in August was substantially lower than forecast.

- Job growth for leisure and hospitality related industries was virtually non-existent.

- Coincidental to lower-than-expected job growth was a significant rise in COVID-19 cases.

- Despite the weak August result, the three-month average shows increases exceeding 700,000.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.