Investors are consistently being barraged with a variety of economic and financial market data points. Whether it’s the most recent release of quarterly GDP figures or which stocks saw the biggest price moves during a specific trading session, the onslaught of information is non-stop. Compounding this issue for investors is the never-ending commentary from a multitude of media sources accompanying the release of factual information on the economy, financial markets and specific investments.

As we work through the ongoing clatter of constant noise, we have some observations on where we are currently in terms of the economy and the financial markets.

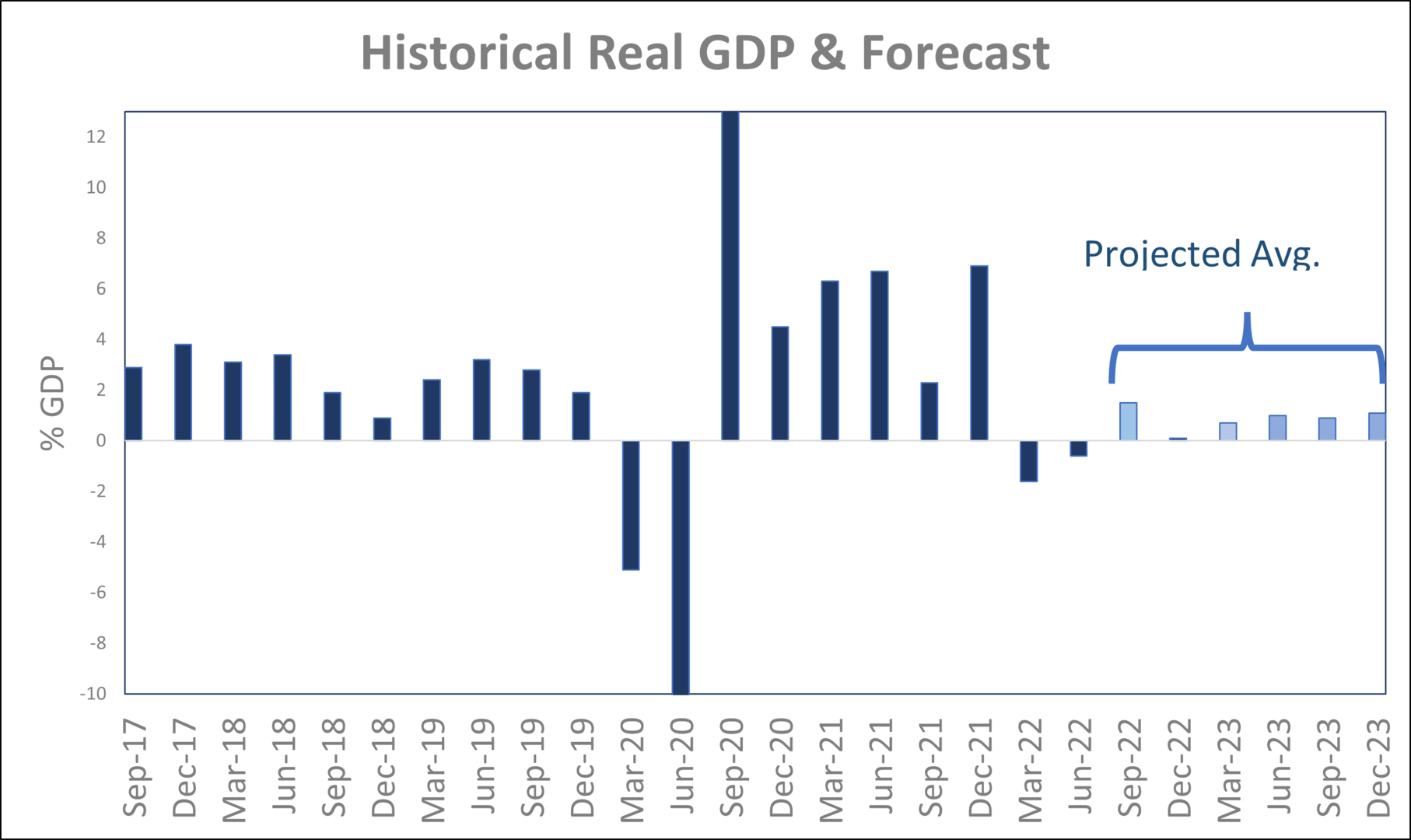

Real GDP

We have now experienced two consecutive quarters of negative real GDP growth in the U.S. This is usually believed to indicate that we are in a recession. While this is a commonly held belief, the official arbiter of when recessions begin, and end, is set by the National Bureau of Economic Research (NBER). In making its determination regarding recession the NBER looks holistically at the overall economy to decide whether a recession is present. And their decisions may not come for months after a recession has begun or ended. However, for the current period they have not defined it as a recession. Additionally, the consensus outlook from the economists surveyed by Bloomberg is for positive real GDP growth over the next several quarters.

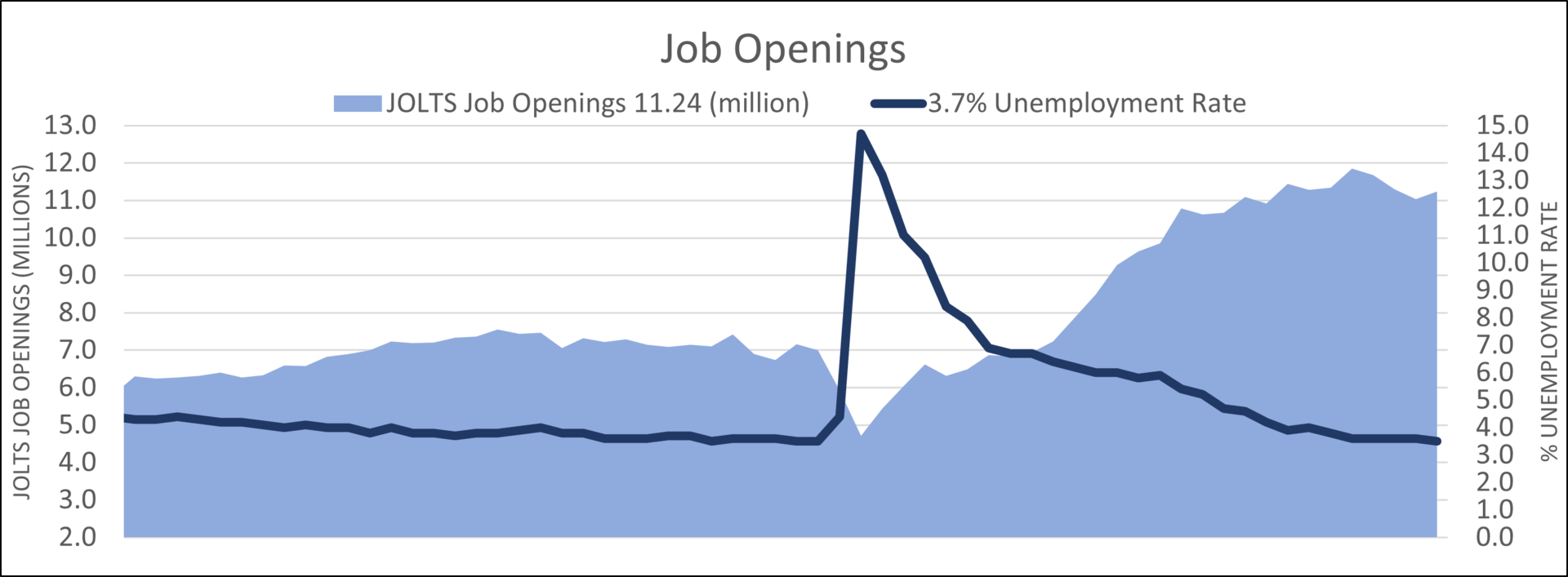

Employment

One component of the economic landscape that continues to point toward ongoing growth is employment. As depicted in the graph below, the number of job openings according to the JOLTS survey is over 11,000,000. And the most recent report of initial jobless claims that was released on Sept. 15 registered a decline for the fifth consecutive week.

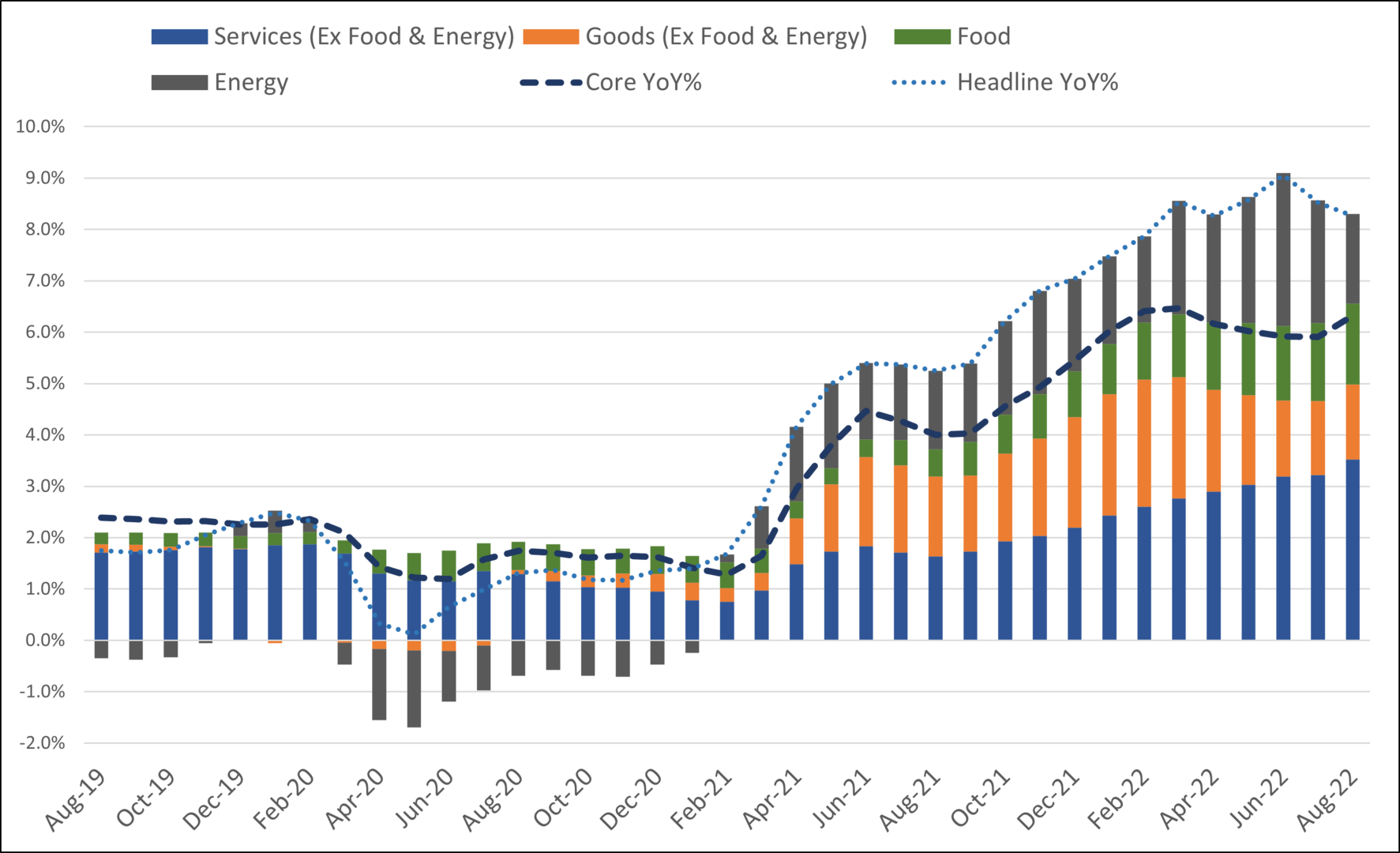

Inflation

While strong employment is typically welcomed as a sign of a healthy economy, the current strength is felt to be a key variable in the efforts of the Federal Reserve (Fed) to bring the rate of inflation down. Not until some weakness materializes in employment data will the Fed have support that their inflation fighting efforts are gaining traction. While some components of current inflation levels have been declining the core rate continues to register unacceptably high readings. Some examples of items showing weakness over the past three months include metals (gold, silver, copper, aluminum), agricultural commodities (corn, hogs, wheat) and oil. Within the core level shelter continues to experience price increases. In fact, approximately 40% of the increase in the core Consumer Price Index over the past year can be attributed to shelter costs. While housing prices are slowing in their rate of increases, rents are anticipated to continue rising at a brisk pace.

While we do not feel a recession is imminent, the probability of one occurring sometime in the future trends higher as long as the labor market remains as strong as discussed above. The Fed has repeatedly stated its determination to bring inflation back to its targeted level of 2.0%. One positive is that we have started to see moderation in some of the components comprising the inflation measure. In the interim investors need to focus more on the data and less on the ample level of noise accompanying the data. By doing so they can minimize the damaging effects of crosscurrents.

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.