There’s something I’ve been wondering lately. Why haven’t hedge funds performed in line with expectations? For example, when the going got tough for the equity markets earlier this year they were a disappointment, as evidenced by the Barclays Hedge Fund Index return of -2.61% for the first six months of 2020.

What are hedge funds?

A hedge fund is a pool of money collected by a money manager from accredited investors that invests in securities, derivatives, physical assets, or virtually anything that can generate a positive return. One of the more controversial things about hedge funds is the compensation structure. Hedge fund managers often take up to a 2% cut of total assets managed in addition to 20% of returns over a specified performance hurdle rate. Historically, we have seen the strongest interest in hedge funds right after periods of market decline or when an incredible bull market run leads to significant returns.

It is believed the first hedge fund was started in 1949 when Alfred W. Jones hedged his long stock holdings with short hedge positions. Hedging as a technique is risk management. Hedge funds, therefore, started as risk management tools. In the last couple of decades, some funds have moved away from hedging risk to having direct exposure to risk.

In digging a little deeper into the hedge fund industry, we will focus on a few specific types of hedge funds: global macro, event-driven and long-short strategy.

- Global-macro funds seek to identify prospective broad market swings caused by political or economic events.

- Event-driven strategies attempts to profit from major events such as mergers and acquisitions, bankruptcies, restructurings, or other significant events.

- In a long-short strategy, the manager buys expected market outperformers and sells short expected underperformers.

Investors would be very pleased if the funds performed the way they were anticipated to. Unfortunately, of late, this has not been the case.

Hedge Fund Performance

The justification for hedge fund underperformance pre-2020 was that in times of famine, the hedging strategies used in the management of these funds would bear fruit. The famine came, but the funds were not structured for the kind of events that occurred. In response, we see the advent of new hedge funds after each major market event. After the 2008 Financial Crisis, hundreds of hedge funds were created to protect against the reoccurrence of a similar event. This is a flaw of some hedge funds; they are built to protect from past one-off events. It is like if famine was caused by locusts that flew in from the South. The protection product was a net protecting the farm from that specific event. The next time however, the locusts came from the West.

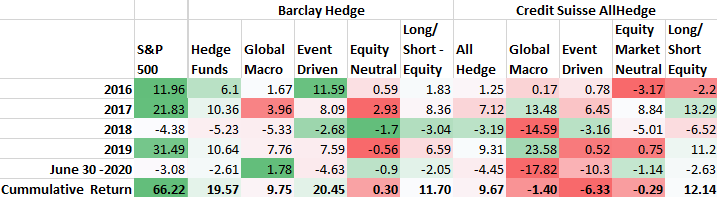

We see this cycle over and over again. In the 1980s, the preferred hedging strategy was portfolio insurance. The portfolio insurance product was built to limit investor losses in a declining market. What happened instead is that it directly contributed to the 1987 Black Monday market crash. We acknowledge this is an extreme example, but it shows how the best intended products can become the issue. We see this in the performance of the S&P 500 Index versus the hedge fund indices highlighted below. The broad market outperformed over almost every time period. There are a few instances in 2020 where some hedge funds have outperformed the market, but the outperformance is nowhere close to the sacrificed returns experienced over longer periods. Over the entire time period evaluated, the S&P 500 Index outperforms the closest returning hedge fund index by 45 basis points.

The data below illustrates how hedge fund performance was hit as markets went up and as they went down. We call this the hedge fund double whammy.

It is difficult to predict the next anomaly, or the next outlier event that sends markets awry. And, it is very tough to protect against all possible market outcomes.

And, as the above data shows, the complexity of a fund is not necessarily reflective of its efficacy.

While we periodically go through periods of market decline, history has shown U.S. markets are resilient. The markets take the occasional punches but have always gotten back up. Downturns are to be expected and good long-term financial plans take this into consideration. When evaluating strategies to mitigate the occasional downturn, it is important to review information like that provided above to ensure proper understanding of investment alternatives.

Hedge funds can play a role in investment management. They are most effective when protecting against specific risks. For example, you may want to hedge against downside Japanese yen risk. If you are, however, looking for broad market protection, a hedge fund, as illustrated above, may not be the best bet.

Grant Voshell, CFP® contributed to this article.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.