Investment markets continue to react to the COVID-19 pandemic. Wide daily swings in performance have become the norm over the last few weeks. The $2 trillion virus relief package, the CARES Act, was approved by the Senate and the House, and President Trump has signed it. Now, the Department of Treasury is figuring out how to make it happen. The expectation is for qualified individuals to start receiving checks in the coming weeks. However, one question keeps coming up. Will the fiscal stimulus be enough? It is difficult to tell, especially since the duration of pandemic lockdown is unknown.

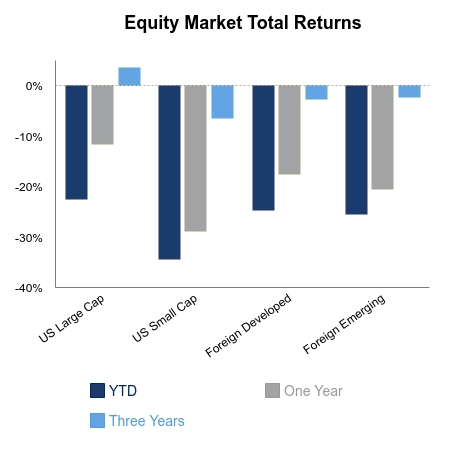

Domestic equity markets were flat for the week. The return of -0.17 hides the daily volatility we saw this week. Defensive sectors like consumer staples and health care led in performance. The sectors recorded positive performance of 4.94% and 4.69% respectively this week. Company earnings numbers will be coming in the next couple of weeks. This should give an initial indication of the impact the virus has had on U.S. publicly traded companies.

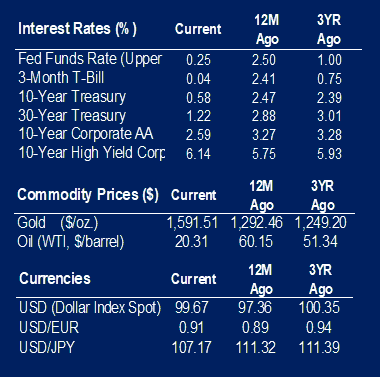

We are starting to see an impact on macroeconomic numbers. The big macro news from the week is the initial unemployment claims, as 3.283 million people filed claims for unemployment insurance. This is the highest this number has been since it started being recorded. The number of unemployment claims is expected to double.

Manufacturing numbers rolling in are turning negative. The Markit PMI Manufacturing for March was at 48.5. This is slightly lower than the expected 48.6. The PMI is a diffusion index, therefore numbers below 50 reflect a contraction. The ISM Manufacturing number for March was also released and is another diffusion index. The reading for the month was 49.1. Better than the expected 46, but still less than 50. The PMI and ISM numbers have historically been leading indices.

Kansas City Fed Manufacturing numbers for March weren’t that much better. The number for the month was -17, with an expectation of -8. The index measures manufacturing activity in the Tenth Federal Reserve district.

However, consumers remain confident. The announcement of 120 was higher than the expected 110, but lower than the previous month’s 132.6. Consumer sentiment as measured by the Michigan Sentiment Indicator was at 89.1. This compares to the expected 90.1 and the prior month’s 95.9.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.