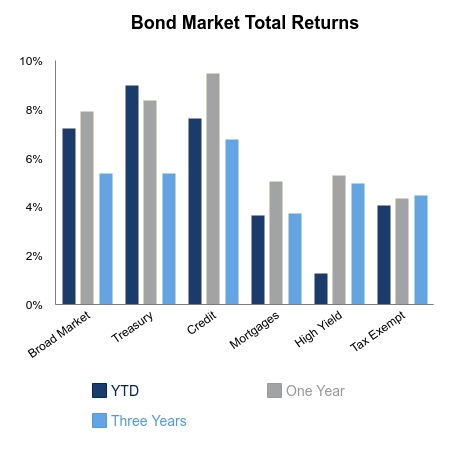

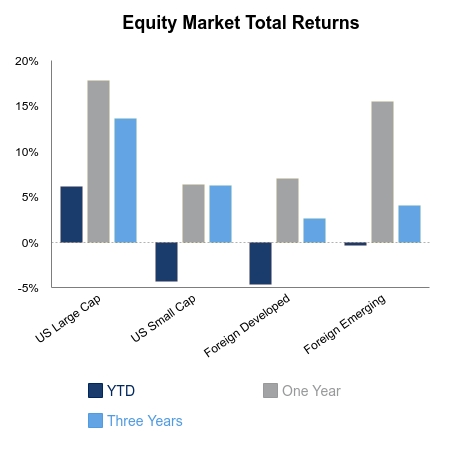

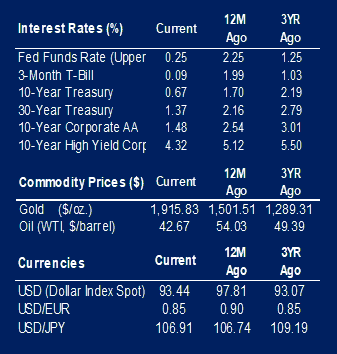

Equities advanced on the week as small caps and financials lead the way. The rotation out of high-growth stocks again caused a notable performance divergence across the equity landscape. Some of the well-known momentum stocks have suffered sizeable drawdowns over the past couple of weeks. Financial equities showed a nice bounce as interest rates moved up. The 10-year Treasury yield has moved up from a record low close of 0.50% to 0.67%. While small in absolute terms, this was enough to cause prices to decline more than 1%. The Bloomberg Barclays Aggregate Bond Index was down 0.5% on the week as corporate bonds continue to perform well.

Economic data was light on the week. Initial jobless claims remain elevated and increased by more than 1 million. The monthly jobs report said that 1.7 million jobs were added in the month of July. The unemployment fell from 11.1% to 10.2%. Business optimism softened a bit and inflation readings came in higher than expected. This helped lift longer Treasury yields and provide support to the value cohort of the equity market.

Congress failed to reach an agreement on further stimulus measures. This caused President Trump to enact several executive actions over the weekend to avert a sudden stop in stimulus proceeds. The enhanced federal unemployment benefit was extended at $400 a week versus the previous level of $600 a week. The payroll tax was deferred for certain pay brackets. Student loan interest and eviction bans were also addressed. While this is clearly a deceleration in the pace of stimulus, the market reacted positively. This likely indicates a fair amount of skepticism from investors that President Trump would follow through with action.

The market seems to be lacking any real catalyst to move it higher as stimulus is likely to show a decelerating trend in the near-term. The rise in COVID-19 cases has not been met with higher fatality rates, and this fear is starting to be pushed out of the market. Despite this, there is still a great deal of isolated shutdowns and cancellations across the country that are difficult to quantify. Rhetoric and actions toward China continue to escalate. The United States continues to ban or reduce access to Chinese-based software applications. These headlines impact both Chinese equities and related U.S. technology companies on an almost daily basis.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.