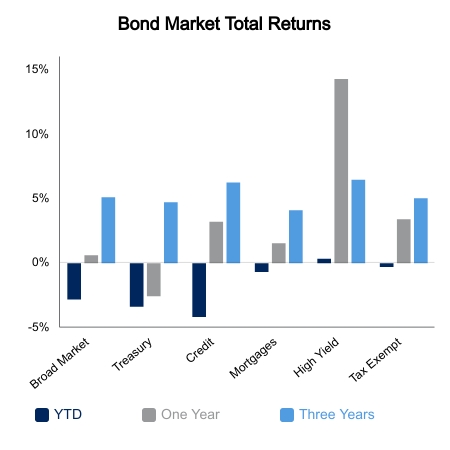

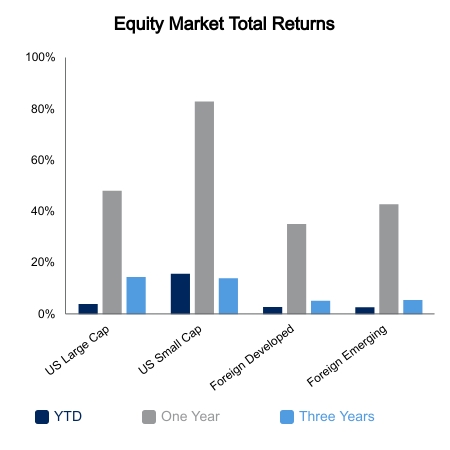

Equities bounced back this week with the S&P 500 advancing 2.1%. Focus continues to be on the outperformance of stocks with lower valuations. The NASDAQ continues to underperform amid big swings in intra-day volatility. Both the Dow Jones Industrial Average and Russell 2000 gained more than 3% this week and far outpaced modest gains in the NASDAQ. The ratio of advancing to falling issues in the NASDAQ registered one of its lowest readings ever. This caused the New York Stock Exchange to register one of its most extreme readings of stocks hitting 52-week highs and 52-week lows. Split markets like this are usually more of a warning sign based on historical cases. The Bloomberg Barclays Aggregate Bond Index was down 0.3% as yields were slightly higher and corporate bond spreads moved wider.

Emerging markets came under pressure this week with a drop of 3.8%. China was soft, especially the technology sector, and this spilled over to Korea as well. It is forgotten emerging markets have seen their information technology weight increase by 200-300% in the last decade. They are no longer a derivative play on energy or commodities.

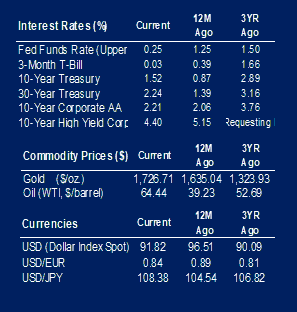

The jobs report came in better than expected with a 465,000 increase in private payrolls. This outpaced the headline number which included a decline in government jobs. Upward revisions to the prior month were also positive. The unemployment rate fell to 6.2%. As has been the case recently, good economic news is bad for stocks as it implies higher interest rates. The NASDAQ plunged 3% right after the report as bond yields popped higher. However, this would flip around by the end of the day as both reversed back toward their starting point by the close. The scrutiny on yields is high for those stocks facing sharp drawdowns in recent weeks and focused quickly turned to the upcoming Consumer Price Index release. It came in lighter than expected and provided temporary relief to the market.

The $1.9 trillion COVID relief bill passed Congress and is likely to be signed by the end of the week. This will send direct payments to a significant percentage of the population. As noted above, the unemployment rate of 6.2% suggests many of the payments will go to those currently employed. Therefore, it is no surprise surveys suggest about 30-40% of recipients plan to put the money in the stock market.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.