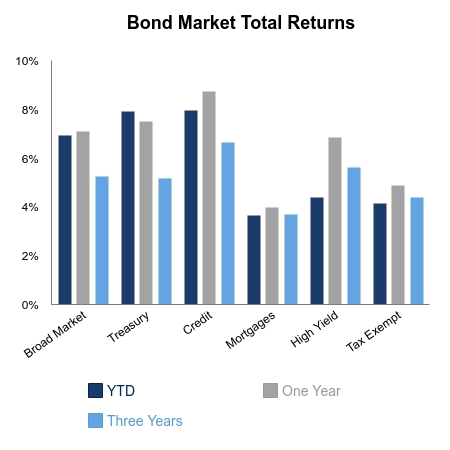

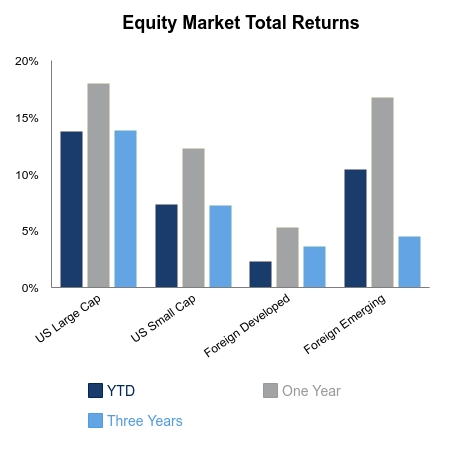

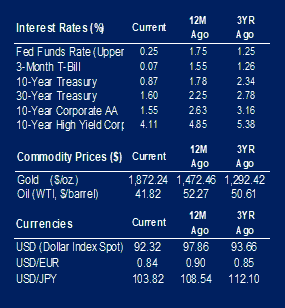

The S&P 500 finished the week flat despite more positive news on vaccine developments. Small caps continued to perform well and gained 1.9% on the week. Value outpaced growth by 1.3% on the week and now more than 6% over the last two weeks. The 10-year Treasury yields approached 1% but have backed off to 0.85%. The Bloomberg Barclays Aggregate Bond Index was up 0.24% on the week.

Pfizer’s shares jumped 15% in initial trading following their vaccine announcement two weeks ago but faded throughout the day and now trade more than 8% below the high. Pfizer’s CEO sold more than half his stock on the day of the announcement. He took cover by saying it was a planned sale at a pre-determined price following a 10b5-1 trading plan. This may be true, but it does not instill confidence in the stock when the CEO is looking to cash out at a price below the two-year high. Moderna followed suit this week with favorable results in their study. And lo and behold the stock jumped 15% on Monday. It did not fade as much on Monday, but this time waited until Tuesday and Wednesday to give up all the gains and trade lower than last week’s close. Moderna has been the most prolific regarding stock sales. Their management has consistently been dumping their stock despite promoting favorable news and updates on trial progression.

Data was light on the economic front. The Consumer Price Index was up 1.2% versus the prior year for the month of October. Initial jobless claims came in at 709,000, a new low in the recovery. Continuing claims also logged a recovery low. The University of Michigan Consumer Sentiment Index took a turn down in their preliminary November reading. Retail sales came in well short of expectations and building permits were also behind expectations. Despite these reports, the Conference Board of Leading Economic Indicators pointed toward accelerating economic growth. This is a monthly report that has a bit of a delay. A timelier weekly leading index from the Economic Cycle Research Institute points to continued economic acceleration.

Despite this, the market attention has turned toward the accelerating lockdown announcements. The equity market appears at a key inflection point after the S&P 500 rejected the all-time high following Pfizer’s vaccine announcement. A growing consensus is the equity market will look through weak data with a vaccine on the horizon, but these consensus views often fail to come to fruition.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.