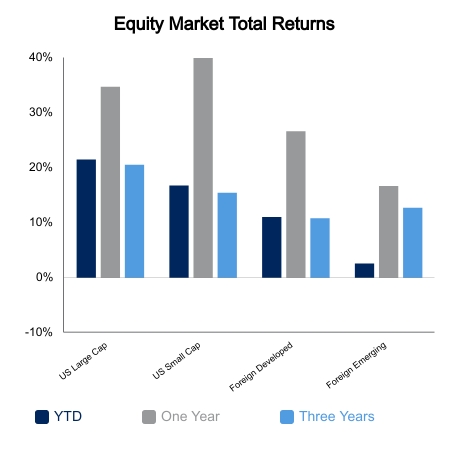

Earnings season is moving. 20% of S&P 500 Index companies have reported their financial performance for the third quarter of 2021. The companies that have reported show earnings growth of 45% over the third quarter of 2020. This is 12.08% better than expected. Sales are up 16.48%. This is 2.16% better than expected. So far, growth has been led by companies in the energy and materials sectors.

Retail sales were stronger than expected at 0.70% even though a decline of 0.10% was projected. Sales were led by businesses in sporting goods, hobby, musical instruments and bookstores. People may be buying holiday gifts earlier than normal this year. Strong demand is a contributing factor to some of the higher inflation numbers we have seen. Year-over-year, retail sales are up 13.9%.

Consumer sentiment as measured by the Michigan Sentiment Indicator dropped to 71.4 from 72.8 last month. The indicator is at 2012/2013 levels. The decrease in confidence has been attributed to COVID-19 Delta variant fears and increasing prices.

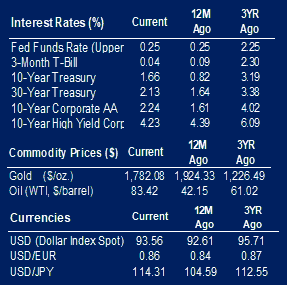

The September Producer Price Index remained high at 0.50% over the month and 8.6% year-over-year. The numbers are within range, but they are historically high. The five-year monthly average is 0.26%, and the yearly average is 1.69%. 80% of the increase can be attributed to a 1.3% increase in prices for final demand goods. Final demand services were up 0.2%.

Business inventories were up by 0.60% in August. The increase is in line with expectations and last month’s increase. Companies stocking up on inventories is an indication of future demand for their products. This year’s monthly numbers are likely negatively impacted by the difficulty in stocking inventory due to supply chain issues.

The Federal Reserve’s October Beige Book showed economic activity grew at a modest to moderate rate across the Fed Districts. According to the report, growth was negatively impacted by supply chain disruptions, labor shortages and COVID-19 Delta variant fears. The Districts saw broad increases in consumer spending. Low inventory levels and higher prices contributed to auto sales being lower than previous periods. Wages are increasing at a moderate pace as competition for talent increases. Labor growth was slow due to low labor supply. According to the report, most Districts saw sharp increases in prices due to high demand for goods and raw materials. Transportation and labor supply have contributed to some of the supply chain issues we are experiencing.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.