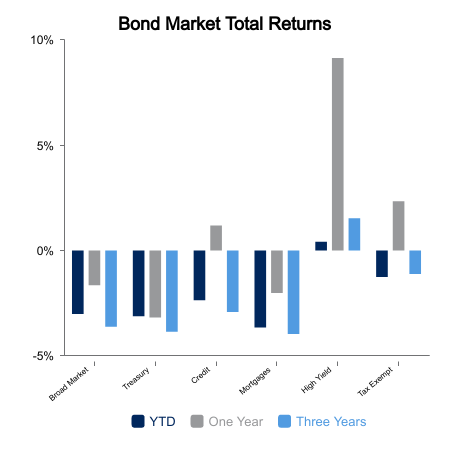

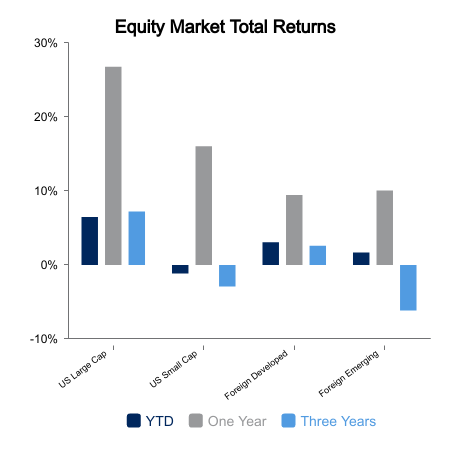

Equity markets rose during the week, reversing the slide seen earlier in April. The S&P 500 finished up 1%, while the NASDAQ rose 0.2%. The Magnificent 7 underperformed the broader markets during the week. Small caps significantly outperformed large caps, rising 2.8%. Treasury yields rose slightly, with bond indices down 0.2% during the week.

Crude oil saw a decline in prices during the week. After reaching a six-month high earlier in April, the price of West Texas Intermediate (WTI) has slid despite ongoing geopolitical volatility in the Middle East.

Muted Economic Growth

United States business activity continued to expand however at a lower rate than forecasted. The Purchasing Managers’ Index (PMI) which tracks a variety of business metrics came in at 50.9 for April, lower than forecasted due primarily to reduced orders (a reading above 50 represents an expansion in activity, a reading below 50 represents a contraction). Both the Services and the Manufacturing components of the PMI came in lower than forecasted with the Services component currently at a five-month low as companies are holding off on backfilling positions created by staff departures. Manufacturing activity is muted due to spare capacity in the supply chain amid lesser demand for inputs.

Durable goods orders for the month of March came in slightly higher than expected, up 2.6%. February’s durable goods orders were revised downward to a 0.7% gain.

Strong New Home Sales

New home sales in March rebounded to a six-month high, coming in higher than expected. Despite concerns on relatively high mortgage rates, demand for new homes is high as the inventory for existing homes for sale is relatively weak.

Earnings Season

First quarter earnings season is in prime focus this week with the lion’s share of earnings growth expected to come from the Magnificent 7 group of stocks with the remaining 293 companies expected to report muted earnings results. Early earnings results, however, are coming in fairly strong. Out of 24% of companies reporting, almost 80% have beat analysts’ expectations.

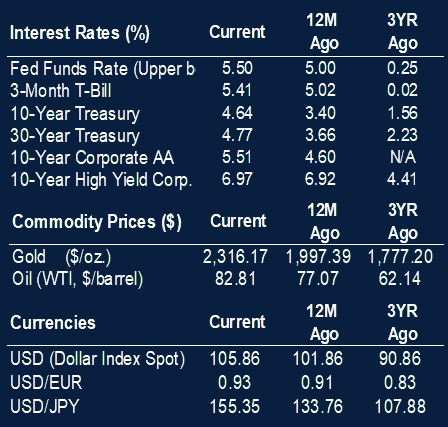

Despite the recent market selloff, the S&P 500 is currently trading close to 20X price-to-earnings (P/E), higher than the 10-year average. However, removing the Magnificent 7 lowers the P/E of the “S&P 493” to below the 10-year average, exhibiting a more reasonable valuation. Investors are currently in a “wait and see” mode, evaluating not only earnings results but forward guidance from companies. Additionally, investors are also taking into account the potential “higher for longer” interest rate environment as persistent sticky inflation has cast uncertainty as to the timing and number of rate cuts by the Federal Reserve.

|

|

Sources: BTC Capital Management, S&P Dow Jones Indices, IHS Markit, FactSet

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.