A Fork in the Road?

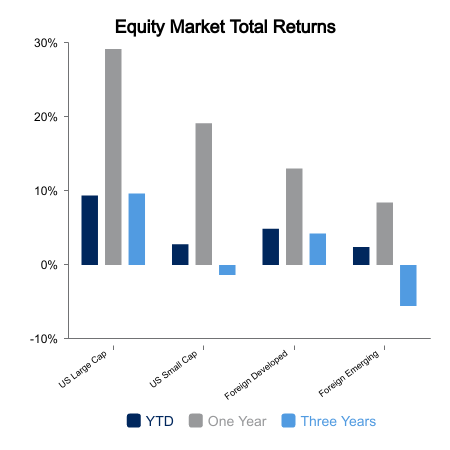

The first quarter of 2024 gave equity investors much to celebrate. Broad equity market performance was solidly positive as the Russell 3000 Index advanced 10.0%. Outside of the United States, the MSCI All‑Country World Index ex-USA (ACWI ex‑USA) rose 4.7%.

Then came April and sentiment turned, which so far appears to have induced a pause on this year‑to‑date ascent. Over the last week equities modestly retraced as the Russell 3000 Index declined 0.8%, while ACWI ex-USA fell 0.3%.

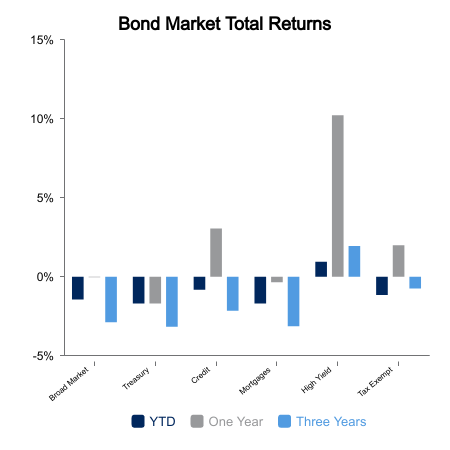

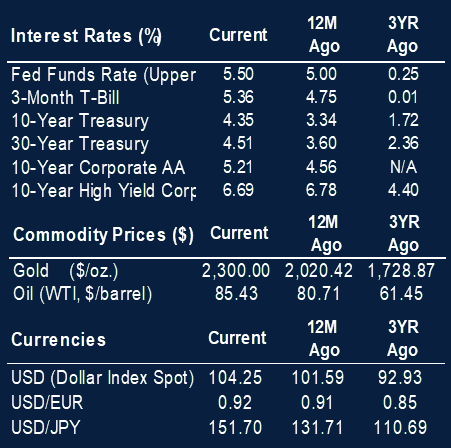

Bonds declined by 0.8% as yields rose across the curve over the last week.

What Happened?

The third and final estimate of the United States Gross Domestic Product (GDP) for the fourth quarter of 2023 was released last Thursday. GDP grew by a revised 3.4% quarter‑over‑quarter, which was up from 3.2% as reported in the second estimate. This was boosted by an upward revision in consumer spending to 3.3% from 3.0%. Corporate profits from current production increased 4.1% outpacing the 3.4% increase of the prior quarter.

The University of Michigan released its final Consumer Sentiment Index for March. The Index came in at 79.4, which was its highest reading since July 2021. This exceeded both consensus and the prior month’s print driven by a rise in confidence that inflation will continue to abate.

The Bureau of Economic Analysis (BEA) released its report on Personal Consumption Expenditures for February, which increased 0.80% month‑over‑month, materially higher than both consensus and January’s rise of 0.16%. According to the BEA, this increase reflected a continued increase in consumer spending for both services and goods. This uptick may indicate that inflation may be stickier than expected.

Markit released their final Purchasing Managers’ Index (PMI) for March, which was basically flat month-over-month. The Composite posted a reading of 52.1, which was in line with consensus. Services, which is the larger component of the Composite, came in at 51.7 which missed consensus but reflected a continuation by firms to “increase their staffing levels amid improved optimism about business prospects in the year ahead.” Manufacturing continued to register expansion and hit a 22‑month high given signs “of improving wider economic conditions and market demand”. All components exhibited expansion (a measure above 50 indicates expansion, while a measure below 50 indicates contraction).

What’s Next?

Unemployment for March will be reported Friday. Key reports on the consumer include hourly earnings and consumer credit. Next week companies begin reporting earnings for the first quarter of 2024. Stay tuned.

|

|

Sources: BTC Capital Management, FactSet, Bureau of Economic Analysis, Bureau of Labor Statistics, IHS Markit

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.