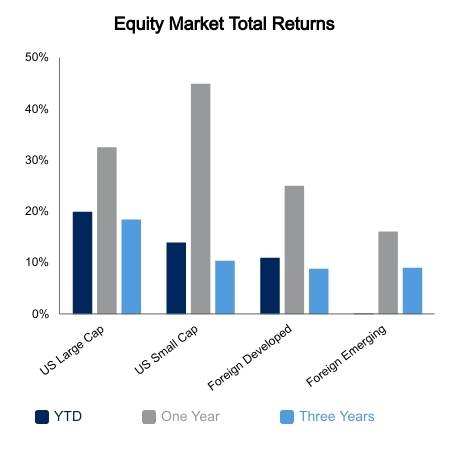

Domestic equities moved higher on the week as small caps bounced, just as it looked like the trap door was opening. The S&P 500 tacked on 2.2%, but advances of 3.6% in the NASDAQ and 3.7% in the Russell 2000 helped cyclicals outpace defensives. Emerging market equities continue to underperform with gains of 1.1% on the week. The Bloomberg Barclays Aggregate Bond Index was down 0.2% as yields moved up on the week. It is very rare to have the market perform as well as it has amid such weak breadth as measured by the NYSE McClellan Summation Index and the NYSE Cumulative Advance-Decline Line. The bears continue to highlight the above point, but the breadth momentum is improving which could lend itself to another surprise rally in equities.

The economic data continues to weaken and disappoint to the downside. The U.S. Citi Economic Surprise Index went negative recently and garnered some media attention. But this underplays the extreme and persistent nature of global economic disappointments when looked at on a rolling one-year basis. We are currently at extremes only seen in the 2008-2009 recession, the Euro crisis in 2011 and the last recession in 2020. On top of this there has been no turn yet to suggest the data will be better than expectations. In each of the prior instances the S&P 500 would approach or exceed a decline of 20%, yet this week it made new highs.

Helping hold the markets up thus far is that the data on an absolute basis continues to be fine, i.e., the Purchasing Managers Indexes (PMI) are in the upper 50’s. However, the narrative will likely turn quickly should these approach the lower 50-area in coming months. It remains to be seen whether this will happen, but indicators of consumer sentiment have been in free fall of late as higher prices have reduced the volume of goods purchased. For example, the Shanghai to Los Angeles Container Freight Index continues to go up at a 45-degree angle. The current price is now more than four times higher than any price in the prior decade.

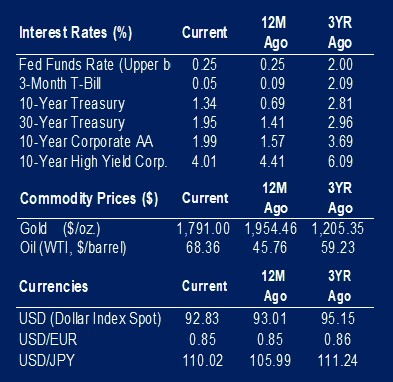

Against a backdrop of falling economic momentum and high realized prices the Federal Reserve is meeting in Jackson Hole, Wyo. to conclude the week. It is a highly anticipated event as every word will once again be scrutinized for any hints on whether the committee is closer to slowing asset purchases.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.