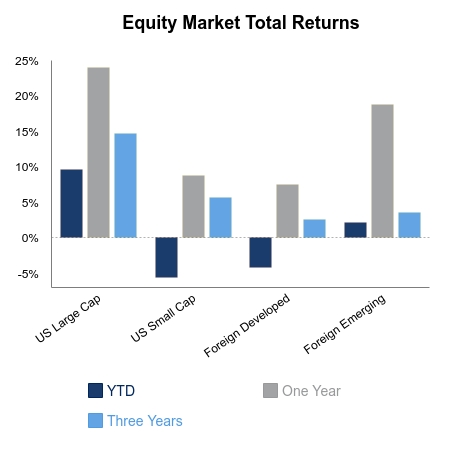

Equities posted strong moves on the week led by large caps and technology. The NASDAQ advanced 4.7% on the week, whereas the small cap Russell 2000 was down 0.7%. Emerging market equities advanced 1.8%. The U.S. dollar has had a pretty sharp decline since its March high. Still, the S&P 500 has outpaced emerging market equities by more than 10% over this time span. The last time the dollar had a similar move, emerging market equities significantly outperformed. Weakness from emerging markets under an optimal backdrop could be a red flag and signal a more pronounced period of underperformance in coming quarters. Keep in mind, domestic equities have already outperformed emerging markets by more than five times in the last decade.

The leading economic index was up 1.4% versus the prior month as the economy continues to improve from low levels. Existing home sales surged in July with a 24.7% increase versus June. This was the largest monthly percentage change on record. New home sales also showed a large uptick. The Conference Board Consumer Confidence Index reversed course and set a new cycle low as economic realities outweigh all-time highs in equity indices.

The Dow Jones Industrial Average (DJIA) made a major shake-up this week. The index comprised of 30 members removed ExxonMobil, Raytheon Technologies, and Pfizer. ExxonMobil was the oldest member of the index following its inclusion in 1928. The changes appear to be a reaction to Apple’s upcoming stock split. Joining the index will be Salesforce.com, Amgen, and Honeywell. This will help reduce the impact Apple’s split would have on the technology weighting due to the price-weighted structure. Energy’s weight fell to roughly 2%, down from a peak around 25% in the mid-80s. If you believe in contrarian indicators, then the dropping of ExxonMobil from the DJIA, in a year with negative oil prices, is about as big as they come.

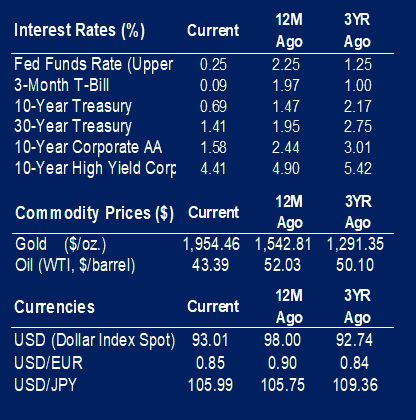

Federal Open Market Committee (FOMC) Chair Jerome Powell gave a keynote speech for the virtual Kansas City Fed Economic Policy Symposium. It was widely anticipated and expected to move markets. Powell outlined a goal of average inflation over time, which was anticipated. They pretty much removed the logic that low employment will lead to high inflation. Therefore, low employment must be accompanied by high inflation before the desire to act is present. Previously, this was assumed, and given the lag in monetary policy, it might justify action before actual inflation readings moved higher. Essentially, the FOMC is more supportive of higher inflation going forward.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.