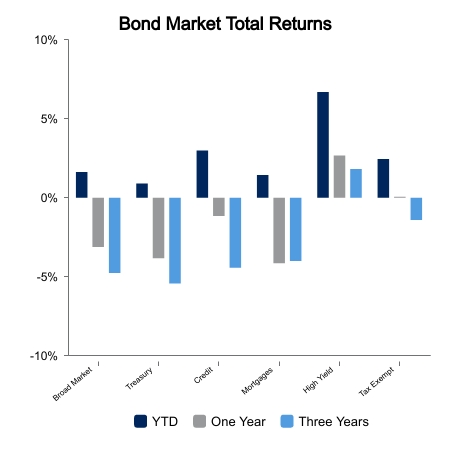

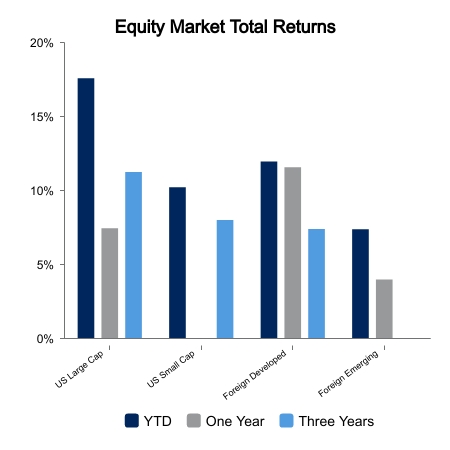

Growing Global Macro Risks Push Equities Lower

Markets are off to a weak start to begin August. The S&P 500 is down 2.6% to begin the month, but this masks deeper drawdowns for many names. Apple fell 4.8% after earnings, which was its largest drop in nearly a year and helped ignite a larger sell off in the technology sector. The NASDAQ is down 4.3% in August while more beta driven technology indices are down more than 6%. Semiconductors have fallen nearly 7% from their highs while the AI bellwether, Super Micro Computer, fell 23% after its earnings release this week. Small caps, foreign equities, and core fixed income are down as well.

Global Macro Forces are Being Watched More Closely

Market sentiment appears to have shifted in recent days as most headlines have been viewed in a negative sense even when they sometimes counteract each other. Below are a few noteworthy items:

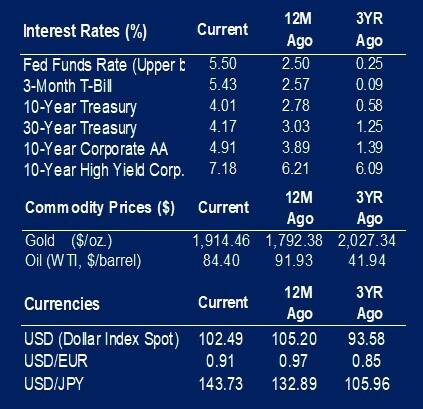

- Japan’s loosening of yield curve control is helping push bond yields higher.

- China’s exports and imports were weaker than expected. This helped bring yields a bit lower, but caused growth concerns and wasn’t a tailwind to equities.

- Oil prices hit $84 per barrel, which is the highest level of the year, and raises concern regarding a second wave of inflation.

- European natural gas prices are popping this week as well.

- The Dollar Index has regained nearly all the losses following Janet Yellen’s trip to China.

The U.S. economic data was highlighted by the nonfarm payroll report which showed 187,000 jobs being added in July. This could be taken as a good step toward a soft landing as it eases pressure for the Fed to hike rates. Focus shifted to the fact that it was the fifth straight month of revisions being lower than the initial release. The unemployment rate fell to 3.5%. Not often followed are the average weekly hours, which has slipped to 34.3 versus 35.0 in early 2021.

Upsized Deficits

The Treasury upsized its anticipated borrowing this quarter to $1 trillion, which is 36% more than its initial estimate. This likely contributed to higher yields as it drew attention to the large deficit. The Treasury General Account has increased by about $500 million, which draws liquidity out of the system, but was offset by a drop in the reverse repo pool from $2.3 trillion to $1.8 trillion. The reverse repo buildup can cushion high Treasury issuance for a period, but eventually rolling these over will be a liquidity drain and potential risk factor for equity markets.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.