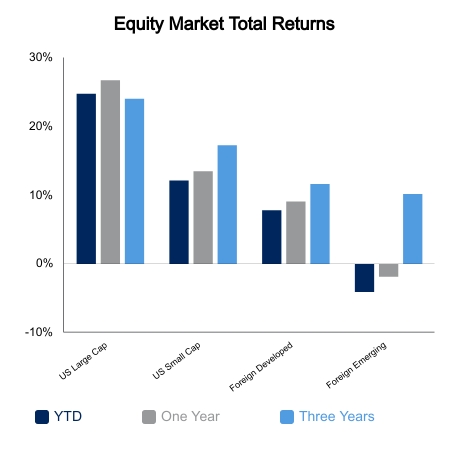

Despite a big rebound to the end the week, equities were trying to get back lost ground. As we have noted earlier, the breadth has seen better days with the average stock significantly underperforming the S&P 500. The S&P 500 ended the week up 0.2% whereas the NASDAQ was down 1.4% and the Russell 2000 down 3.3%. The Bloomberg Barclays Aggregate Bond Index was roughly unchanged on the week.

Economic data for the week was discouraging. The Consumer Price Index pushed up again this month, now at cycle highs of 6.8% versus the prior year. It is also the highest reading since 1982 and outpaces wage growth. However, real hourly earnings are down 1.9% versus the prior year and have now been negative for eight consecutive months. Retail sales also came in well below expectations as the exuberance of last month could have been tied more to consumers buying earlier in fear of supply chain issues. The core retail sales control group was down 0.1% versus expectations of a gain of 0.7%.

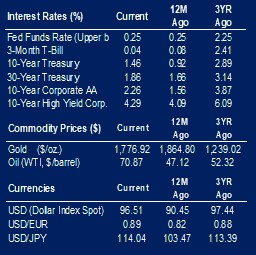

The most anticipated Federal Open Market Committee (FOMC) meeting in some time lived up to the billing with some good market action. The market had sold off stocks in recent weeks on fear of a hawkish outcome. The Fed was about as hawkish as you could be by doubling the pace of tapering and moving up the median interest rate forecast to three hikes next year. Then, they penciled in three more for 2023. Chair Powell used the words “strong” or “very strong” numerous times to describe the economy.

The knee-jerk reaction was for rates to move higher and flatten, which would be the bad quadrant for equities. However, Chair Powell was able to demonstrate a sense of flexibility. The market took this as a sliver of hope the Fed doesn’t hike us right into a recession. And that was all it took for the flattener to flip. The spread on the yield between the 5-year Treasury and the 30-year Treasury went from five tighter right after the FOMC statement but has since widened by 13 basis points in half a day. Equities go from the bad quadrant to the good quadrant and voila, the NASDAQ rallies almost 3.5% from its intraday low. The Fed still has a long run terminal rate at 2.5%, which the bond market pretty much scoffs at and continues to price in a cutting cycle fairly quickly after interest rate increases begin.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.