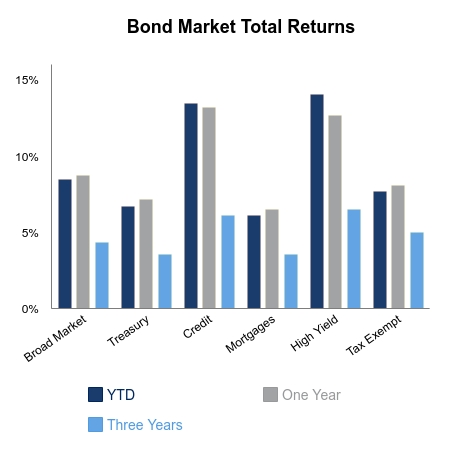

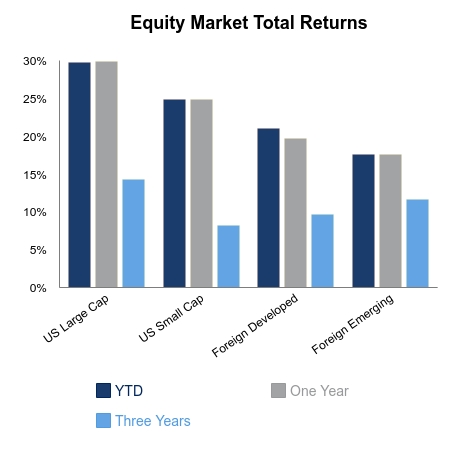

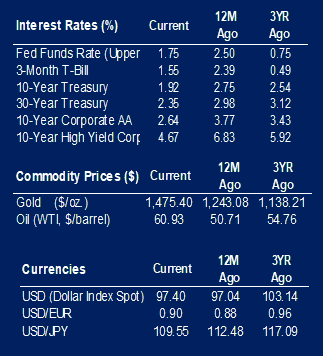

Equities posted a solid week of gains. We noted at the end of November how it was rare for December to be down in back-to-back years. Despite a tough start to the month, the S&P 500 has gained in eight of the last 11 trading days. For the month, the S&P 500 is now up 1.7%, whereas small caps have gained 2.4%. Emerging markets are now leading the way with gains of 6.7% in December. Emerging markets have been aided by a weaker dollar and more indications of a pick-up in global growth. The MSCI All-Capital World Index hit a new all-time high this week after almost two years of consolidation, and domestic small caps hit a 52-week high. Bond yields have been bleeding higher in recent days with the 10-year Treasury now 50 basis points higher, at 1.92%, than the September low.

The December 15 China tariff deadline came without any new escalations. Reports are the United States and China agreed to something, although details remain out of sight. Ultimately, it was the lack of escalation that provided a tailwind to markets. The threatened tariffs will not go into effect and some previous tariffs labeled at 15% will be cut in half. Nothing has been penned, although key U.S. trade representatives have said negotiations are finished regarding this phase of the deal.

Retail sales for the month of November missed expectations by a pretty good margin. On a year-over-year basis, growth has slipped and now sits below the five-year average. Job openings have been soft to say the least and are down versus the prior year for three consecutive months. This is the longest streak of declines since the last recession. Housing remains strong with building permits up double-digits versus the prior year.

The U.K. elections were a landslide for the Conservative party. This has improved the odds Brexit will be resolved rather quickly. President Trump is likely to turn his trade focus to Europe in the coming weeks and we all know what his preferred bargaining tool is. “Tariff Man” may return in early 2020, and equity markets at highs only embolden him in this pursuit. Japan and China are considering fiscal initiatives, which was a huge tailwind to global equity markets during their last occurrence. And lastly, the Swedish Central Bank raised interest rates from -0.25% to zero and ended five years of negative rates.

|

|

Contributed by | Justin Carley, CFA, Managing Director

Justin is a Managing Director, providing portfolio management and credit analysis for fixed income strategies. He also manages the firm’s multi-manager portfolio strategies and contributes to the asset allocation framework. Justin has more than 10 years of experience focusing on management, analysis and trading of fixed income portfolios. Previously, Justin was a fixed income portfolio manager at American Trust & Savings Bank. Justin has a bachelor’s degree from Truman State University, holds the Chartered Financial Analyst designation and holds a Fellowship in the Life Insurance Management Institute.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.