Equities Inching Within Striking Distance of an All-Time High

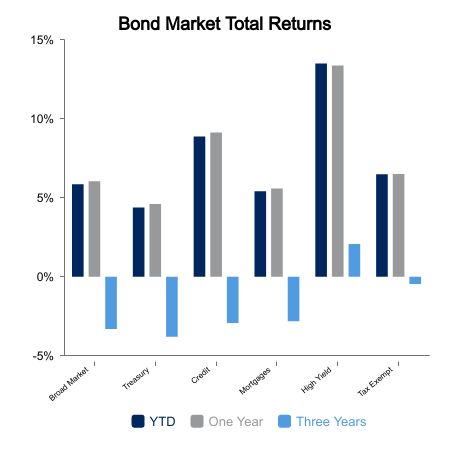

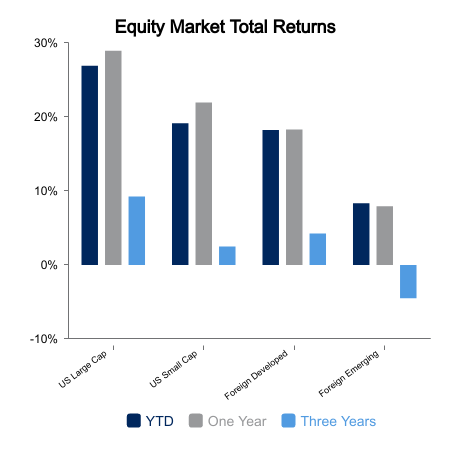

Equities edged higher this week continuing the S&P 500’s longest run of weekly advances since 2017 and inching within striking distance of an all-time high. A turnaround is unlikely in the last two trading days of the year as the so-called Santa Claus rally has, since 1969, produced an average gain of 1.3% return over the last five days of the year and first two of the new year. With a thin economic calendar this week, it is unlikely that either the 1.0% gain for the week or the 26.7% advance YTD will see any meaningful retracement. While stock advances have been fueled by the Federal Reserve’s dovish pivot this month, the prospect of central bank cuts in 2024 has driven bonds to post a fourth straight week of gains, returning 4.7% since Thanksgiving. U.S. bond markets have returned 5.2% year-to-date, with corporate bonds leading the advance. This follows two years of negative bond market returns when interest rates climbed along with rising inflation, which drove bond prices lower.

The Federal Reserve’s preferred gauge of underlying inflation barely rose in November as the core Personal Consumption Expenditures (PCE) Price Index increased 0.1%. On a six-month annualized basis, core PCE rose 1.9%, the first time in three years that this measure registered a reading below the Fed’s 2.0% target. Last week’s 4.9% final reading of third quarter U.S. GDP contrasts with the fourth quarter GDP forecast of 1.2%. Economists predict slow growth in 2024 with the economy modestly advancing 1.2% and the Federal Reserve cutting overnight rates from 5.50% to 4.25% to boost consumption.

Durable goods orders were surprising, advancing 5.4% in November driven by a surge in transportation equipment. Without the planes and trains, durable goods increased 0.5%, which is about flat for the quarter when a revised downward revision of the October figure is considered.

The November jobs report showed an uptick in the pace of hiring and average hours worked, which are both primary drivers of personal income growth. In addition, personal income advanced 0.4% in November and the personal savings rate rose to 4.1% from 4.0%. Nevertheless, with excess demand for labor dissipating, wage growth is expected to slow, meaning expansion of personal income as a driver of consumption will be a missing component from the economy in early 2024.

On the housing front, the median price of a home fell 6.0% from a year ago, with purchases of new single-family homes slumping in November. However, this may represent a temporary setback for housing as mortgage rates fell below 7.0%. While the median home price may have fallen, housing starts reached a six-month high and homebuilder sentiment continued to rise.

|

|

Sources: BTC Capital Management, U.S. Bureau of Economic Analysis, S&P Dow Jones Indices

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.