Mixed Market Performance

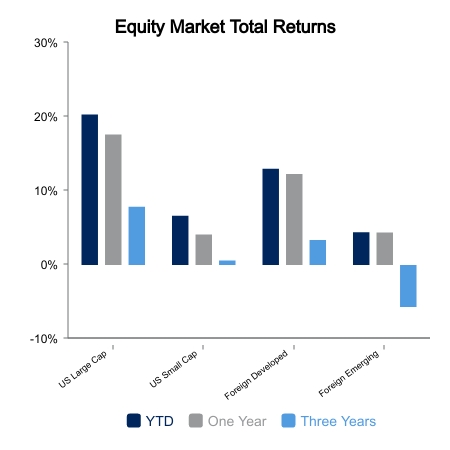

Broad equity markets exhibited mixed performance over the last week. Domestic equities rose 0.3%, as small caps advanced 2.7% while large caps rose 0.2%. Foreign equities increased 0.3% as foreign developed advanced 0.7% while emerging markets fell 0.4%.

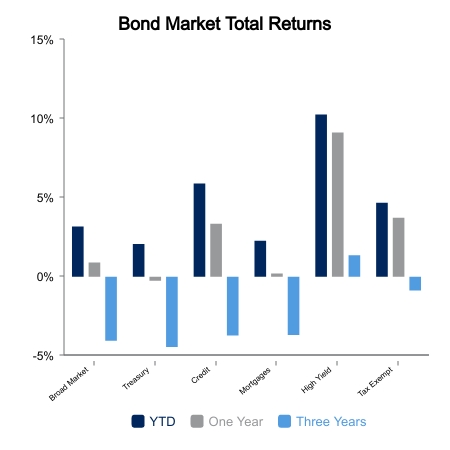

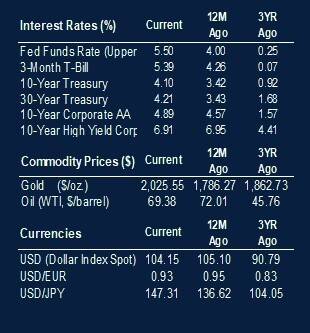

Bonds rallied 1.0% over the last week given the plunge in interest rates. The yield on the 10‑year U.S. Treasury closed yesterday at 4.1%, versus 4.3% a week ago and materially lower than 4.6% at the beginning of the fourth quarter.

Macro-Environment

The second estimate of U.S. Gross Domestic Product (GDP) for the third quarter was released during this past week. For the quarter, GDP growth was revised upward to 5.2% versus the first estimate of 4.9%. According to the Bureau of Economic Analysis, the change “primarily reflected upward revisions to nonresidential fixed investment and state and local government spending that were partly offset by a downward revision to consumer spending.” Consumer spending has, to a large degree, sustained economic growth within the U.S.

The Institute for Supply Management (ISM) released results from its manufacturing and services surveys. For November, manufacturing exhibited a reading of 46.7, modestly below consensus and unchanged from October. According to ISM, “the manufacturing sector contracted in November for the 13th consecutive month”. New orders rose modestly during the month but remained in contraction. Production declined while its Prices Index rose 4.8% over October’s print. One may consider these two in conjunction relative to inflation as manufacturers can absorb higher wages if production (read efficiency) increases.

Services, which is the larger of the two sectors covered by ISM, rose in November to 52.7 from October’s 51.8, which extended this sector’s expansion to 11 consecutive months. Inventories appear to have expanded for the seventh consecutive month, while the Backlog of Orders contracted to 49.1 versus October’s 50.9.

Outside the U.S., the big news was Moody’s downgrade of China’s credit rating to A1 from Aa3. The agency stated that “broad downside risks to China’s fiscal, economic and institutional strength”, will emanate due to the downgrade. This is resulting from anticipated government fiscal and monetary measures to sustain local governments, state‑sponsored firms, in addition to supporting China’s impaired real estate industry. Moody’s subsequently cut its outlook for eight major Chinese banks to negative from stable. The iShares China exchange traded fund (ETF) fell 3.5% over the last week.

Tomorrow brings a slate of economic reports, including unemployment and payrolls for November in addition to the preliminary report of consumer sentiment by the University of Michigan for December.

|

|

Source: BTC Capital Management, Bureau of Economic Analysis, Institute for Supply Management, Moody’s

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.