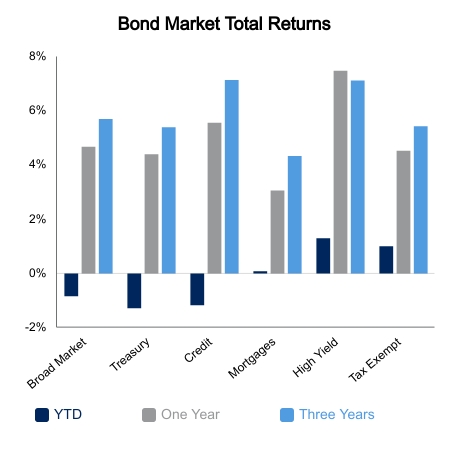

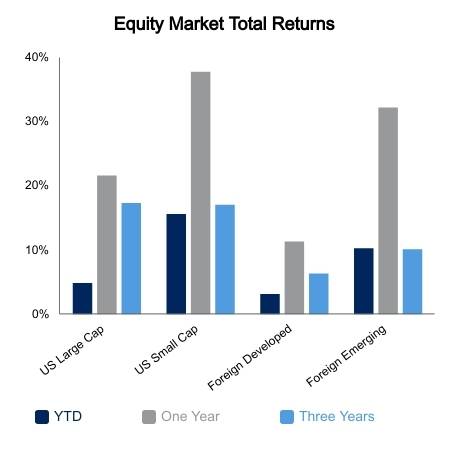

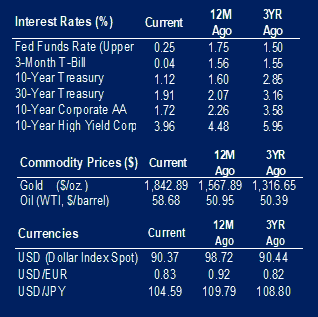

Equities posted a strong week as major indices pushed to record highs. The S&P 500 advanced 2.1% with the Energy Sector being a large catalyst. The S&P 500 Energy Sector is up 18.0% year-to-date and far outpacing the 4.2% advance in the S&P 500. Small cap domestic equities are also strong to start with gains of 15.6% year-to-date while emerging market equites have more than doubled the gains for the year in the S&P 500. The Bloomberg Barclays Aggregate Bond Index was up fractionally on the week, but is down 0.8% for the year as yields continue to push higher. The 30-year Treasury yield traded above 2.0% this week, its highest level since February of last year.

Economic data was highlighted by the monthly jobs report on Friday. Nonfarm payrolls were up 49,000 with private sector jobs up just 6,000. These were well short of expectations and were also accompanied by downward revisions to the prior month. It was the third consecutive weak report and highlights stalling in the job recovery. As has been the case for a while, bad economic data was met with a rising stock market in anticipation of more stimulus. Average weekly earnings have exploded to their highest level since 1981 and running about 8% versus the prior year. The Consumer Price Index came in weak as expected due to its lagging nature. It will be interesting to see how the market responds to its inevitable rise as it laps low energy prices from a year ago given that everyone knows it is coming.

Earnings season continues to advance with strong sales and earnings surprises. Growth in both sales and earnings has been broad based across sectors. Tesla, which is now one of the largest components of the S&P 500 disclosed a large purchase of Bitcoin. This propelled the cryptocurrency to new highs and invariably linked Tesla to the price of Bitcoin and thus the S&P to the price of Bitcoin. Global regulators and Treasury Secretary Janet Yellen have been hitting the wires hard this year to highlight they will not cede ownership of the currency and that regulations will be coming. Despite negative implications from regulators, many investors continue to have blinders on. This year could well give us the answer as to whether Bitcoin is too big to fail and if the answer is no it would likely have a negative feedback loop into other risk assets.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.