This past week saw the release of several economic reports geared toward the consumer. On Tuesday, the U.S. Bureau of Labor Statistics released its Consumer Price Index (CPI) for January. CPI rose 0.5%, in-line with expectations while above its 0.1% increase in December. Overall, CPI increased 6.4% year‑over‑year (YOY) which was its smallest increase since October 2021. While the markets continue to view peak inflation in the rearview mirror, inflation nonetheless appears to remain ubiquitous.

One sub-component of CPI is the food index, specifically the food at home index which increased 11.3% YOY. Cereals and bakery products rose 15.6% YOY while dairy and related products rose 14.0% YOY. It appeared to be cheaper to eat out over the last year as the food away from home index rose 8.2% YOY while the index for full‑service meals increased 8.1% YOY.

The CPI report dovetailed into Wednesday’s report by the U.S. Department of Commerce regarding Retail Sales, which increased 3.0% in January, well above an estimated increase of 1.7% and followed December’s decline of 1.1%. A separate aspect of this report is the retail sales control group, which includes all U.S. retailers, except for food, cars, construction materials and motor fuel. This control group also rose 1.7% in January, exceeding estimates of 0.8% and a decline of 0.7% for December.

While it may appear the consumer is continuing to spend in the face of persistent inflation, the question remains, “Is the rate of consumer spending sustainable?” Hourly wages increased 0.3% during January versus an estimated decline of 0.2%. While hourly wages grew 4.4% YOY, real wage growth has not kept up with inflation.

Small business owners may be becoming more skeptical regarding the overall economy. The National Federation of Independent Business released its Small Business Optimism Index for January, which increased 0.5 points to 90.3, which is well below its average of 98.0 since 1974. While owners reported “job openings were hard to fill,” most owners expect real sales going forward to be challenging.

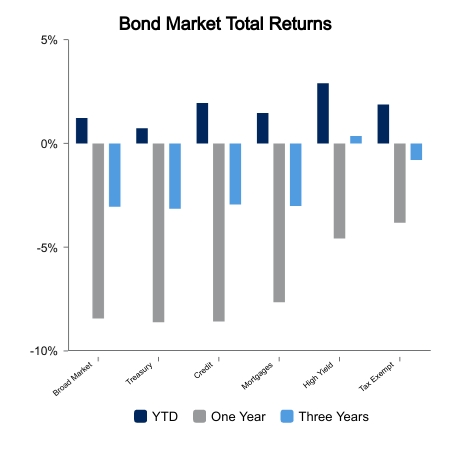

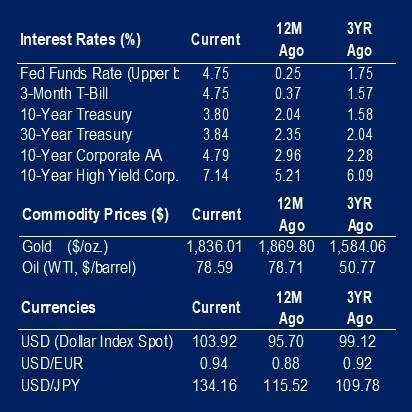

Interest rates increased across the yield curve over the last week. The yield on the 10‑year U.S. Treasury is currently 3.8%, while the yield on the 2-year U.S. Treasury is 4.6%. This spread between the 2-year and 10-year stands at approximately 80 basis points (0.8%), the highest spread in 40 years.

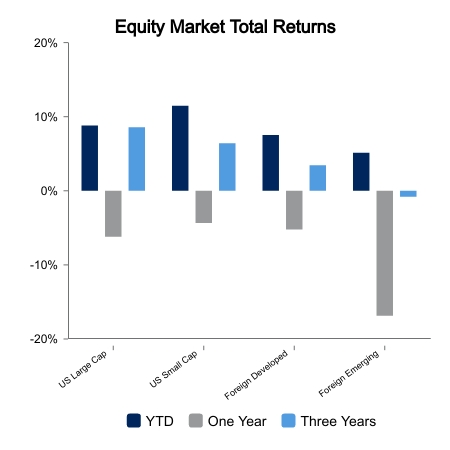

Equities continued their year‑to‑date uptrend over the last week. U.S. equities rose 0.4% while foreign equities rose 0.3%. Stay tuned.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.