Equities Fall as Rising Yields Finally Take a Toll

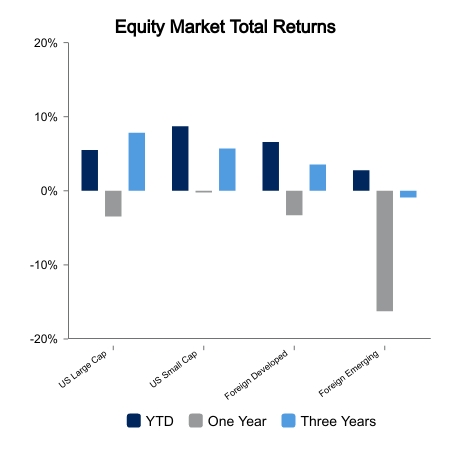

The S&P 500 was down 3.8% on the week. Small caps fared slightly better and the NASDAQ slightly worse. As has been customary in recent market corrections, foreign developed markets exhibited a smaller downside move. The MSCI EAFE Index was down 0.9% on the week.

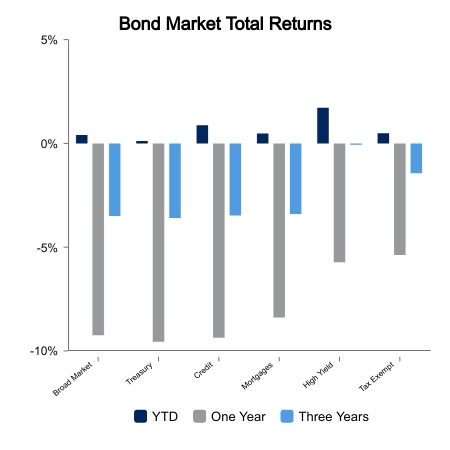

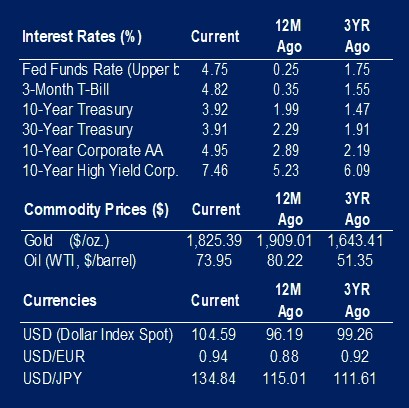

Core fixed income was down 0.8% on the week as the rise in yields has become significant. Better economic data caused the fixed income market to remove the cuts they had previously forecasted. It was controversial at the time, and many said the bond market must be right. Instead, the bond market has moved yields closer to the Fed’s initial target path.

There were some who thought the bond market would remove the implied cuts, but this was often accompanied by a bearish outlook on equity markets as it unfolded. The 2-year Treasury was down 60 basis points from October to early February. Since then, the entire drop has been removed and this week the 2-year Treasury closed at a 15-year high at 4.72%. The S&P 500 rallied more than 17% off its October low and has since pulled back 4.4%. The net result is the index is still up more than 12% despite the retracement in fixed income yields.

Can the Economy Continue to Surprise?

Economic data remains weak but is not as bad as feared, especially globally.

- U.S. annualized existing home sales of 4.0 million hit a 12-year low, falling below the worst month of the pandemic.

- U.S. producer prices came in well above expectations despite being down sequentially.

- European services Purchasing Managers’ Index levels came in much better than expected with a composite of 52.3.

- The German survey on growth expectations has surged from a September 2022 low of -61.9, which is on par with the financial crisis of 2008, all the way to 28.1 and above the 30-year average.

The result is amid all the recession talk the last couple of months the global Citi Economic Surprise Index (G10 countries) has gone from -57 to +44 with zero being the center of the diffusion index. This is usually what happens as participants become too bearish too quickly. We will only be certain of a recession in hindsight, but the net percentage of domestic banks tightening standards for commercial and industrial loans reached 44%. A spike of this magnitude has always preceded recession over the last 40 years. And the one soft landing in 1994 was achieved with this series staying below zero, meaning no tightening in standards.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.