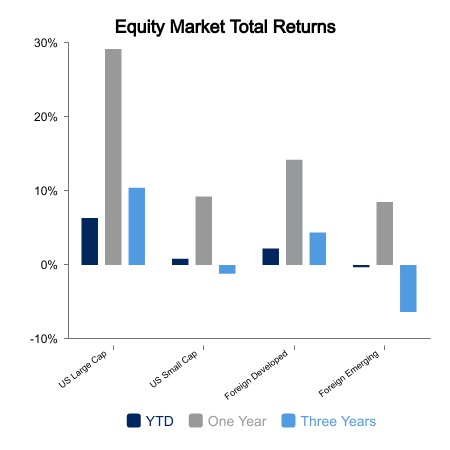

Equities Surge on Strong NVIDIA Results

Equities tacked on more gains this week as NVIDIA’s earnings release led to a one-day 3% gain in the NASDAQ Composite. The S&P 500 was also up more than 2% on the day but has since put in four consecutive days with a tighter daily range. These tight consolidation days can often create the energy for the next advance when a breakout occurs. There still seems to be a large cohort that remain skeptical of the rally and the “inevitable” pullback that should occur with overbought readings. This is what makes the pullback a bit less likely. A push to the upside and you could get a real chase into equities.

Inflation is Picking Up

The economic data continues to be pretty good. The Dallas Fed Manufacturing Survey jumped from -27 to -11. The new order forecast subcomponent jumped to +24, its highest reading since 2022. New home sales came in at 661,000, which was below expectations. Employment in residential construction is at cycle highs and is back to 2007 levels. Excluding the abrupt recession around COVID, residential construction employment contracted noticeably ahead of the 1990, 2000 and 2007 recessions. If it remains a valid signal, it is indicating no recession in the near-term.

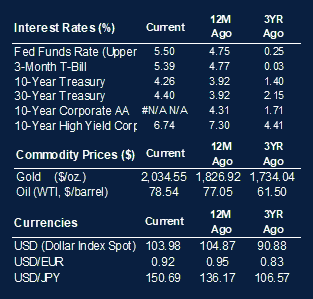

Personal Consumption Expenditures was the most anticipated economic report this week. There seemed to be a view this would refute the hotter Consumer Price Index (CPI) release earlier in the month. Core Personal Consumption Expenditures (PCE) inflation came in at +0.4% versus the prior month. This was in line with expectations and helped fuel a relief rally in stocks and bonds. However, the numbers confirmed the hotter inflation readings. The 0.4% increase was the largest over the last twelve months. Core services ex. housing was up 0.6% in the month, the largest monthly increase since 2021.

Based on recent data, cuts to the Federal Funds Rate appear less likely. The market continues to just move forward the dates instead of reassessing the likelihood they occur at all. Based on market pricing, a June cut is more likely than not, although it is no longer 100% priced in. Overall, markets appear to be inching toward a tipping point as we approach the next two Fed meetings. One scenario is that higher inflation causes cuts to come off the table, likely leading to a sharp pullback in equities. The second scenario is the Fed begins to cut rates with elevated inflation, very tight labor market conditions and already near-record easing in financial conditions. This could very well set off a bullish stampede into risk assets.

|

|

Sources: BTC Capital Management, Bloomberg

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.