Equities Cool as the Fed to Go Slow on Rate Cuts

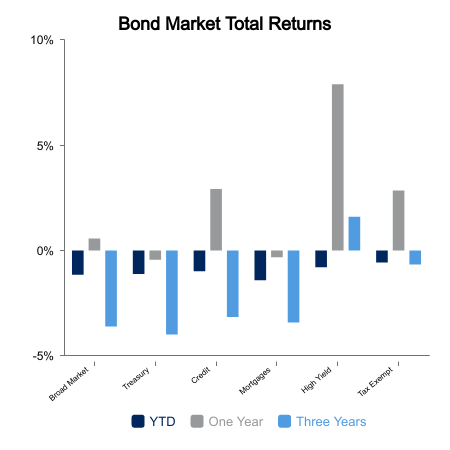

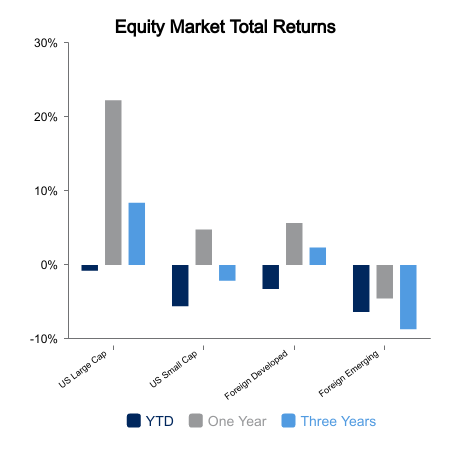

Equities finished the week down 0.9%, but there was weakness in some higher beta industries. Small caps lagged with a 2.9% drop and have started to give back a good chunk of their December outperformance. Small caps outpaced the S&P 500 by more than 10% over a two-month span into the last week of 2023. Since then, they have lagged by 6.5% in just over two weeks. Core bonds were down 0.3% on the week and extended the slow start to the year. The year-to-date return is down 1.2% with the 10-year Treasury higher by about 25 basis points.

Yields pushed higher and equities dipped as Fed official Waller noted that when the Fed begins to cut, they will need to be methodical and careful. It was his dovish comments in November that helped spark the equity and fixed income rally, so his words carried a little more weight. Fed officials continue to push back against the six market-implied cuts for 2024. The odds of a cut in March sit at 56%.

Is Inflation Dead?

Economic data continues to exceed expectations. The highlight this week was a consumer that pushed retail sales well above expectations. The retail control group, which backs out auto, housing, tobacco and a few one-offs, rose 0.8% in December. This easily outpaced the estimate of 0.2%. The Atlanta Fed GDPNow is up to 2.4% for the current quarter and again starting to exceed the highest economist forecast. Jobless claims continue to be the glaring hole in the recession thesis. Today the number came in at 187,000, which is the lowest reading in over a year. Offsetting this somewhat continues to be the relatively weak manufacturing readings.

The Core CPI for December was up 0.3% versus the prior month and ticked up to 3.9% year-over-year. Non-housing service inflation, known as the “supercore,” was up 0.4% for two consecutive months. This annualizes to 5%, which is well above 2%, and it is accelerating now. In July, the four-month annualized rate of change was about 1.6%, but it is now up to 5.1% after the latest reading. This acceleration has mostly been ignored as lagged housing readings push down the overall core number.

Next week we start to see the big central banks make their monetary policy decisions. In two weeks, the Fed will go last. There is a calmer feeling from participants as we head into these weeks versus last year. The big risks have failed to materialize. However, it is when expectations are low that modest surprises have a much larger ripple effect on markets.

|

|

Sources: BTC Capital Management, GDPNow, Bloomberg

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.