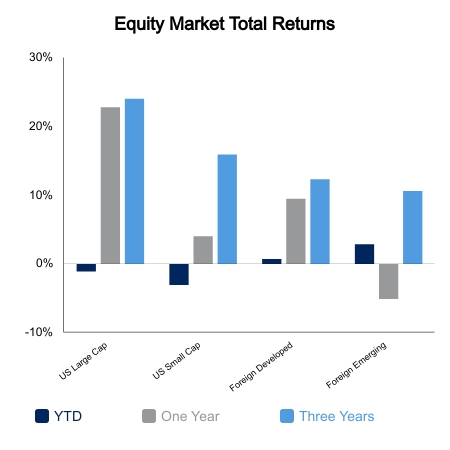

The S&P 500 lost 4.08% this week. This loss comes as investors react to the increased likelihood of contractionary monetary policy from the Federal Reserve. The FactSet Policy Rate Tracker has the probability of a rate hike of greater than 25 basis points at over 99%. Some investment firms are expecting as many as four rate hikes this year. The potential hikes are to address inflation concerns. These increases are expected to contribute to slower economic growth.

The Producer Price Index (PPI) continued to be high through December. Over the year, PPI growth was 9.7%. PPI measures the average change in selling prices that producers get for their output. The expectation was for growth to match the previous month’s increase of 9.8%. Over the month, PPI increased less than expected; the 0.2% growth came in lower than the expected 0.4%.

Retail sales were weak in December. The weakness added to the story of demand being pulled forward in 2021. Growth was expected to be flat for the month. Instead, there was a decline of 1.9%. The largest declines came from furniture and home furnishing stores, sporting goods, hobby, musical instrument and bookstores, and clothing and clothing accessories stores. The declines here contributed to the drop we saw in S&P 500 consumer discretionary companies. For the week, the sector was down 6.55%.

Consumer sentiment is down in January. The Michigan Sentiment reading of 68.8 is down 2.5% from the previous month. This reading is the second lowest reading in the last decade. The initial decline through 2021 was blamed on the Delta and Omicron variants of COVID-19. The blame for the recent decline has been laid at the feet of inflation. This number could stay low for some time. The inflation fight will likely lead to lower growth which could contribute to lower sentiment.

Business inventories were up 1.3% in November. The increase could be reflective of companies stocking up for the holiday season or companies over anticipating demand.

Oil continued its upward climb this week. The price of a barrel of WTI Crude was up 3.33% to $82.82. This week’s increase contributes to a year-to-date rise of 13.86%.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.