NASDAQ Posts Best First Half in 40 Years

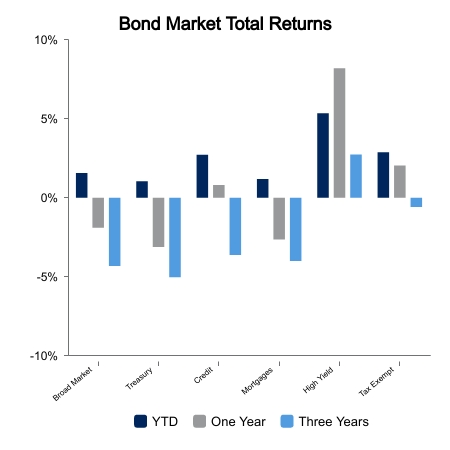

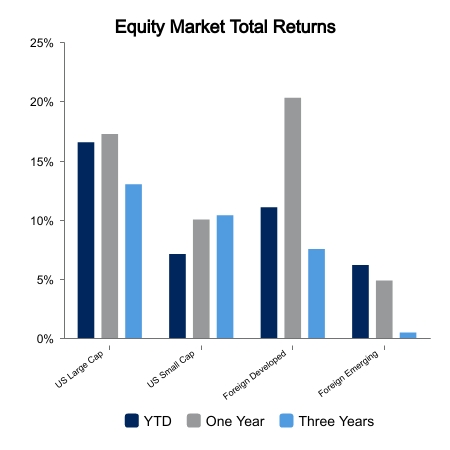

Equities rallied back toward year-to-date highs to close out a strong first half performance. The S&P 500 was up 16.9% in the first two quarters of the year. The NASDAQ led the way with returns of 32.3%, its best first half since 1983. Small cap equities advanced 8.1%. Foreign developed returned 12.2% while emerging markets lagged with a return of just 5.0%. Core fixed income posted gains of 2.1%.

Is Inflation contained?

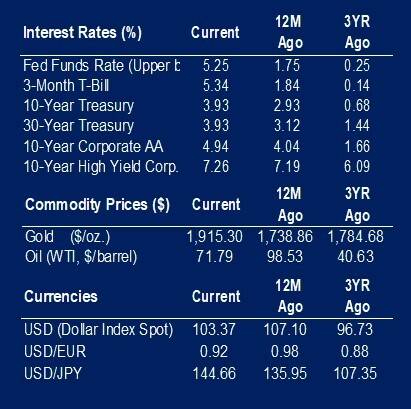

Personal Consumption Expenditures (PCE) May inflation, which was reported at the end of June, rose 0.3% on the month and 4.6% versus the prior year. This measure of inflation peaked at 5.4% and has only moved marginally lower. Given lagging housing data, there is also attention on a super core inflation series which measures core services less housing. It came in at 4.6% as well but peaked at 6.5%.

The next PCE report is likely to see another sizeable drop in the yearly numbers because we are rolling off a 0.63% from 2022. The current Cleveland Fed Inflation Nowcast for June shows a monthly gain in the PCE of 0.38%, which would drop the year-over-year number to 4.35%. If this forecast pans out, the series will have five consecutive months between 0.3-0.4% and an annualized rate of 4.2%. Many would consider this to be much too high for the Fed. On the other hand, the super core series printed 0.50% in February and then went 0.40%, 0.11%, and 0.24%. The super core has shown a clear decline in recent months and contributes to the many conflicting opinions on the trajectory of inflation.

ISM manufacturing was also reported this week and it again missed expectations. The prices paid component came in at 41.8 versus a peak reading of 92.1 in 2021. This supports the “inflation is contained” narrative that helped fuel the current equity rally. The question remains to be seen whether structural inflation is contained.

In 1974, the same prices paid series of the ISM fell from 97.6 to 42.6 into 1975. During this time the unemployment rate rose from 4.6% to 9.0%. In response, the federal deficit rose from 0% to 4.4% in 1976 to support the economy. Even this modest government support was sufficient to help contribute to another wave of inflation. Some analysts are forecasting much higher structural inflation specifically because the U.S. is running an 8% budget deficit with unemployment at 3.7%. The deficit increased by 4% in the last year as employment went to a 70-year low. This combination is truly unprecedented. If this does help avert a recession it may be viewed negatively by the market as the Fed is forced to chase inflation once again.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.