We were blessed with the largest nonfarm payrolls increase in 10 months in June, with 850,000 jobs added. We also saw unemployment increase from 5.8% to 5.9%, however this is not a bad sign. The increase is attributed to more people on the sidelines starting to actively look for jobs. And since individuals not actively looking for jobs are not included in unemployment rate calculations, these folks are adding to the total population of individuals counted in unemployment calculations. Job growth was strongest in leisure and hospitality, public and private education, professional and business services, retail trade, and other services.

There were slightly fewer than expected job openings at 9.209 million versus 9.3 million in May.

Wage increases in June were nominal at 0.3% month-over-month. The growth recalls back to slow pre-pandemic rates. Year-over-year, average hourly wages were up 3.6%. We will be patiently waiting for Consumer Price Index numbers to see if real wages grew after accounting for inflation.

Construction spending was down 0.3% in May. Decreases in private construction was the largest contributor to the dip. Public construction was down 0.2% over the period.

Final durable goods orders numbers were released this week. No changes were made from the first report. Durable goods orders grew by 2.3%. We have seen growth in orders in the last 12 of 13 months. The growth this month was led by orders of transportation equipment, up 7.6% after a two-month decrease.

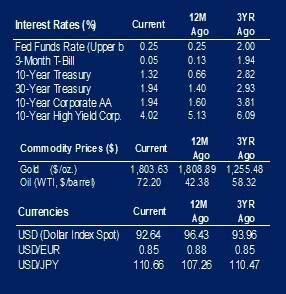

Barrels of WTI Crude Oil hovered around $70 this week as OPEC continues to negotiate production increases. The UAE blocking proposals to increase supply came as a surprise. There are fears that if an agreement is not reached, oil-producing countries may flood the market with stockpiled oil, trying to gain as much market share as possible. This would lead to a significant drop in oil prices. However, it is unlikely this will happen.

The S&P 500 was up 1.44% this week. The increases were led by the information technology and health care sectors. There was a narrowing of performance variances between value and growth in June. Value started the year strong, but we have seen large growth companies with strong returns through June.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.