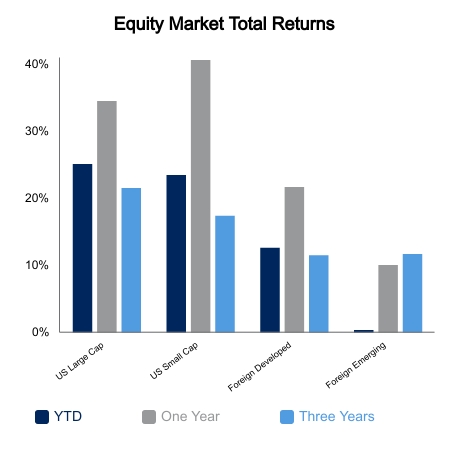

Equity markets maintained their post Federal Open Market Committee (FOMC) meeting gains whereas bond yields reversed course and headed lower. Index level dispersion was minimal with large caps, small caps, and NASDAQ all posting gains between 0.5% to 1.0%.

Facebook recently changed its name to Meta Platforms as they try to highlight their relevance in the metaverse, or virtual world. It took a couple weeks, but last week was the rush into “metaverse” stocks. Ironically, Meta Platforms was not one of the winners. Augmented reality as well as select gaming stocks made good moves. However, the big move was in semiconductors where the ICE Semiconductor Index posted a gain of 5.8% on the shortened week. Nvidia saw its market cap increase more than $250 billion in one month, a gain of nearly 50%. It is hard to put into context how big of a move this is for one of the largest companies in the S&P 500, as it gained the equivalent of a Nike, Coca-Cola, Costco, or PayPal in one month. Tesla’s market cap peaked this week at $1.2 trillion, having gained more than $500 billion in the last month, the equivalent of a JP Morgan or Visa.

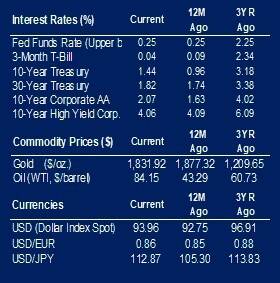

The employment survey from the Bureau of Labor Statistics showed net gains in non-farm payrolls of 531,000. This was better than expected and was accompanied with upward revisions to previous months. The unemployment rate ticked down to 4.6%, but labor force participation remains weak. The Consumer Price Index (CPI) was released this morning and it came in higher than expected. Core CPI was 4.6% versus the prior year, the highest reading in 30 years.

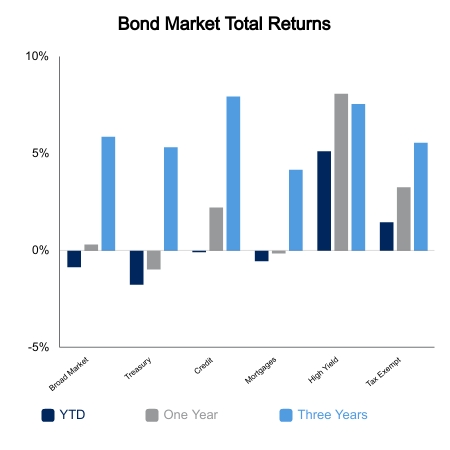

The Fed first used the transitory word in their March FOMC press conference to get in front of what was expected to be a high reading in April, which was lapping the Coronavirus crisis lows. April CPI was 3.0% and now we sit at 4.6% which took out the June high and marks a re-acceleration. This is what we had anticipated happening, and bond yields are up on today, but long dated yields are nowhere near their year-to-date highs. In fact, the 30-year Treasury is up more than 7% since mid-March. Bond volatility continues to be elevated as several hedge funds have been hit hard by the movement in short-term interest rates. This is driven by uncoordinated policy makers that seem to ebb and flow on whether their greatest fear is persistent inflation or going down in history as making a policy error via raising rates.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.