Equity Weakness Persists as Yields Hit Cycle Highs

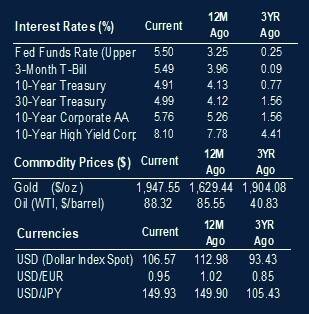

Equities retreated this week as bond yields pushed to new cycle highs. The 10-year Treasury traded up to 4.98%, which sent average mortgage rates to 8.0%. Volatility has picked up due to action in the Middle East, but the theme of stronger than expected growth remains. This is causing back-end rates to move materially higher. The 10-year Treasury yield is up 36 basis points this week.

- The S&P 500 was down 1.4% on the week.

- The NASDAQ was down 2.5%.

- Core bonds were down 2.0%.

Much of the rise in bond yields is attributed to higher term premiums. This could be due to changing correlations with equities, higher deficits or several other factors. Despite the rise, term premiums remain a full standard deviation below the 40-year average. All else equal, if they return to the mean, then it would add 1.25% to the 10-year Treasury yield.

Economic Data Remains Robust

The economic data continues to surprise to the upside. The Federal Reserve has increased rates at the fastest pace in four decades. The yield curve has been inverted for a significant length of time. Those calling for a recession have doubled down. Given this setup, it seems market participants continue to expect immediate weakening in economic data. When it doesn’t transpire, then yields move higher. The dollar continues to be strong and when you have both yields and the dollar up, it tends to push equities down.

This week saw retail sales come in better than expected. Economists were looking for a month-over-month increase of 0.1% in the core group and instead we got a 0.6% increase. Add this to the big employment report beat to start the month and rising PMI new orders. Next week brings the first look at third-quarter GDP. Economists expected 0% growth in June, but they have moved it all the way up to 3.5%. Meanwhile, the Atlanta Fed GDPNOW forecast is over 5%. Jobless claims today were reported at 198,000, the lowest reading since January of this year.

Will Earning Growth Return?

Earnings season is underway, and the expectation is that S&P 500 earnings growth will be roughly flat versus the prior year. As a reminder, earnings growth has been negative for three consecutive quarters. This was an inflationary environment, so real earnings have been very weak. Still, the S&P 500 has moved higher because the price-to-earnings ratio has expanded by 20% over the last year. Logically, these conditions don’t appear to be sustainable. This is especially true when factoring in a much lower equity risk premium versus government or corporate bonds. Resumption of earnings growth will likely be a necessary step to sustained equity gains.

|

|

Source: BTC Capital Management, FactSet Financial Data and Analytics

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.