Equities Surge Amid Two-Day Buying Frenzy

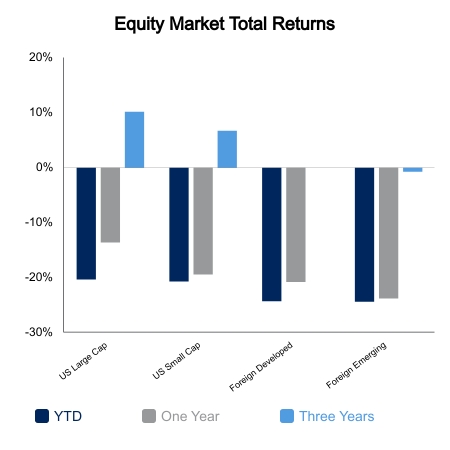

Equities traded lower to end last week but staged a rare 5.7% surge over two days. The spark was ignited by extremely oversold conditions and the Reserve Bank of Australia increasing rates by only 25 basis points. This pivot, combined with the Bank of England last week, got markets to jump to conclusions the Fed may not be far behind. It was the largest two-day rally since April 2020. The NASDAQ 100 had every component up on a single day for the first time in about 10 years. The S&P 500 finished the week up 1.7%, but foreign equities fared better with the dollar coming off its highs. Emerging markets were up 3.9% and foreign developed markets traded higher by 4.6%.

Potential Fed Pivot

The Reserve Bank of Australia raised rates by 25 basis points, surprising markets which were forecasting at least 50. Their entire yield curve dropped 30 basis points on the day and sparked lower rates across the U.S. bond market as well. This in turn propelled equities to a huge two-day move. This kind of narrative shift can be powerful when markets are extremely oversold and bearish sentiment is high. But it also turns good economic news into bad news for the equity market and vice versa.

- The ISM missed expectations on Monday with the new orders component dropping sharply from 51.3 to 47.1

- This pushed equities higher as it supported the Fed pivot narrative

- Job openings on Tuesday showed a 10% monthly decline, one of the largest on record

- This pushed equities higher as this also supported the Fed pivot narrative

- Wednesday saw ISM Services come in better than expected at 56.7

- The S&P 500 would knee jerk lower by more than 1.5% given this contradiction to the pivot narrative.

Equities would recover most of the losses by the close following the ISM Services release, but the reaction function was clearly visible. We end the week with key employment data. Jobless claims have fallen back to very low levels and an uptick might initially be received favorably by equity markets. The employment report on Friday may be a market moving event that aligns or contradicts the potential Fed pivot narrative.

Early in Earnings Season

Earnings season is just getting started, but it is expected to be a key catalyst for equity returns in the coming months. The estimated growth rate for domestic large cap equities is 2.9% in the third quarter. There have been four S&P 100 companies that have reported so far and three of the four saw their stock prices gap lower after results.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.