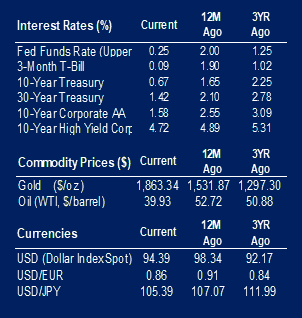

This week saw a strengthening housing market. In August, there were 1.011 million new home sales, which is 4.8% higher than in July. The expectation was for sales of 887,500 new homes. Pending home sales grew by 8.8% in August, which compares with the expected growth of 3.2% and the previous month’s growth of 5.9%. The issuance of building permits was slightly higher than expected in August with 1.476 million permits issued compared to the previous month’s and expected number of 1.47 million. The growth in housing has been attributed to the low interest rate environment. According to Freddie Mac, the 30-year fixed rate mortgage weekly average bottomed at 2.86% on September 10. Mortgage rates have not been this low in the 50 years this number has been tracked.

Durable goods orders were up 0.40% in August. This preliminary reading is lower than the expected growth of 1.5% and significantly lower than last month’s 11.7%. However, this is the fourth month of consecutive increases. The increase was led by orders for machinery, which was up 1.5% to $31.2 billion.

We continue to see indications of strength in manufacturing. The Kansas City Fed Manufacturing Index number for September is 11, which compares favorably with the expected 8.5. The Dallas Fed Index came in at 13.6, better than the expected 8.5. Chicago PMI was at 62.4, a significant increase from the previous month’s 51.2.

Consumer confidence shot up in September, as measured by the Conference Board. The reading of 101.8 was significantly higher than the expected 88.5 and the previous month’s 86.3. The jump comes after a decline in August.

The final GDP growth number was released this week. The final revision shows GDP declined by 31.4% in the second quarter. This is better than the second revision decline of 31.7%. Year-over-year, GDP declined by 9%.

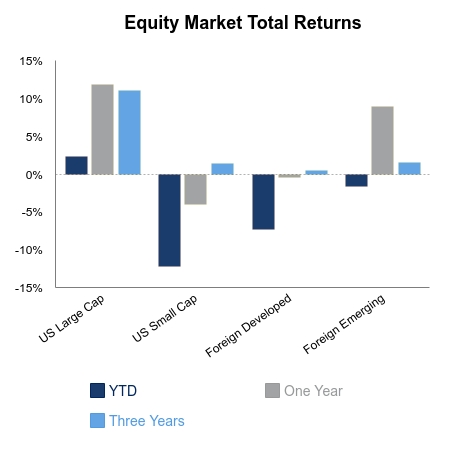

The S&P 500 ended the quarter up 8.93% over the three-month period. The one-week index performance of 3.92% significantly contributed to the strong performance for the quarter. The performance over the week was led by the Information Technology and Real Estate sectors with performance of 5.57% and 4.27% respectively. The only sector with negative performance over the week was Energy, down 0.67%.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.