Employment will be a major theme influencing investment markets in 2022. Tighter job markets have the potential to influence companies’ earnings negatively. The impact could range from increased product costs associated with lack of labor supply to increased labor costs from companies paying higher wages to attract employees. Tightness in job markets may not be all negative. Increased wages could lead to more purchases on goods and services. We may also see faster than expected implementation of technologies that reduce reliance on repetitive labor.

Full Employment

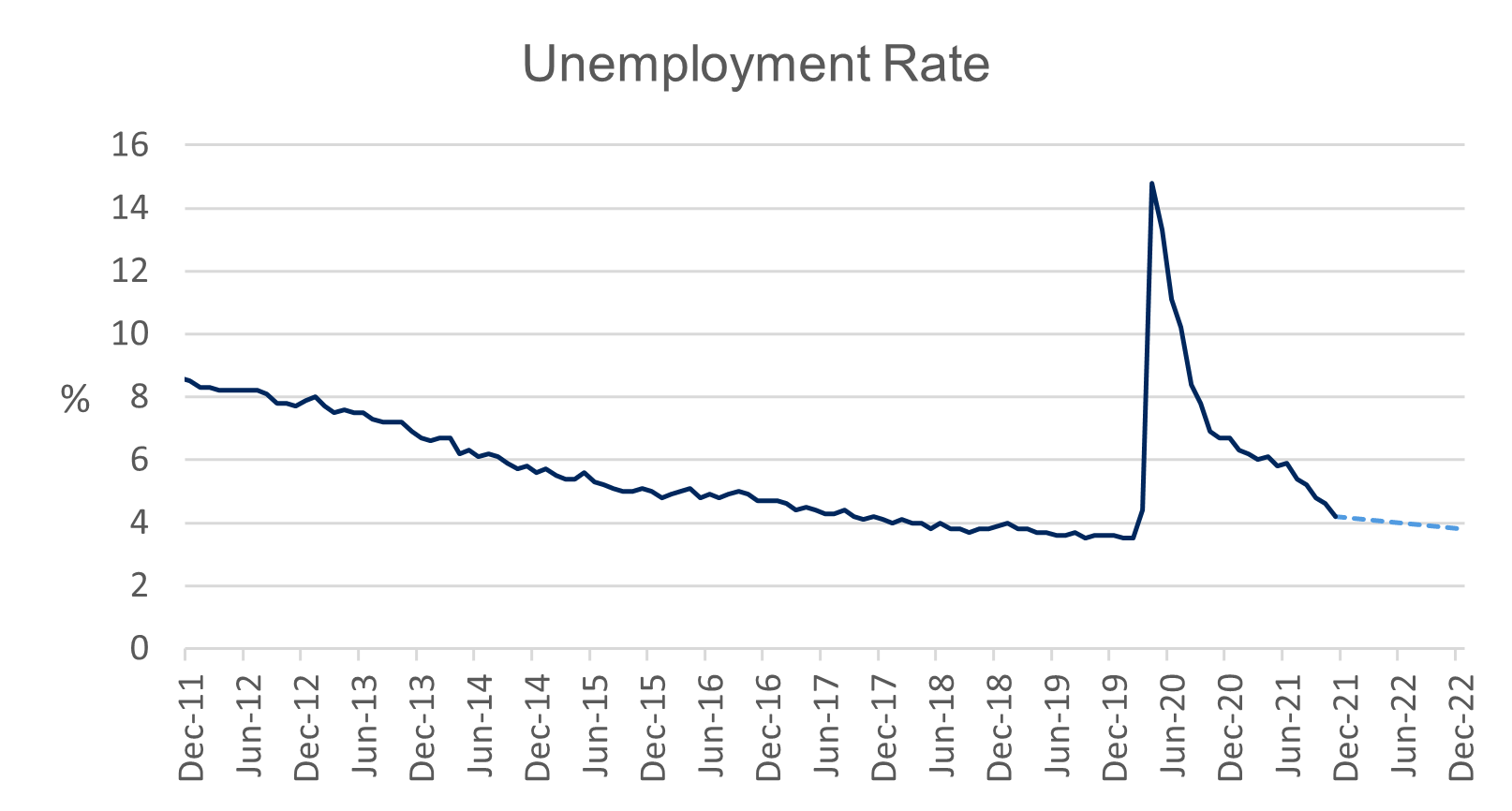

We have come a long way since the unemployment rate peaked at 14.8% (see graph below) in April of 2020. November 2021’s reading of 4.2% puts us in the “full employment” range.

The unemployment rate is expected to continue to improve through 2022. Current projections have unemployment at 3.8% by the end of 2022. The unemployment rate is calculated by dividing the number of unemployed people by the total labor force.

We saw the number of unemployed people drop from 23 million at the beginning of the pandemic to seven million in November of 2021. The drop came as the economy reopened and people started to go back to work. Therefore, the economic situation has been improving through 2021. The expectation is for improvement to continue and contribute to a tighter job market.

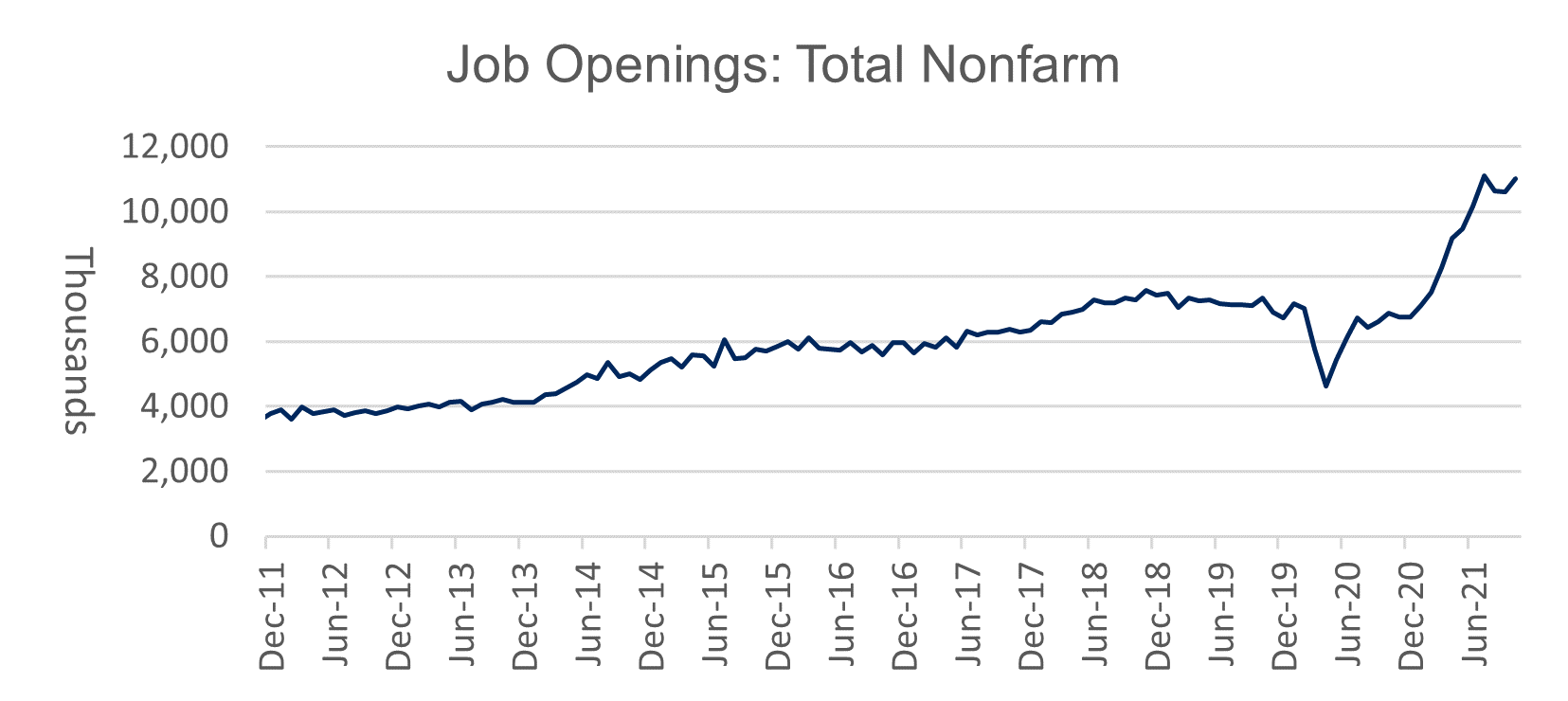

Additionally, there are a lot more work options available than before the pandemic. There are over 11 million open jobs (see graph below). This is the highest number of open jobs since the Bureau of Labor Statistics began tracking open jobs data. The average from the beginning of collection was 4.5 million before the pandemic spike. Job openings are expected to stay high. Companies will need to get creative in putting together incentives that lure people back into the workforce.

The low unemployment rate combined with the high number of open jobs will contribute to higher average wages. Wages grew in 2021 but have not been able to keep up with inflation. We will likely see wages outpace inflation for positive real earnings growth in 2022.

Labor Force Participation

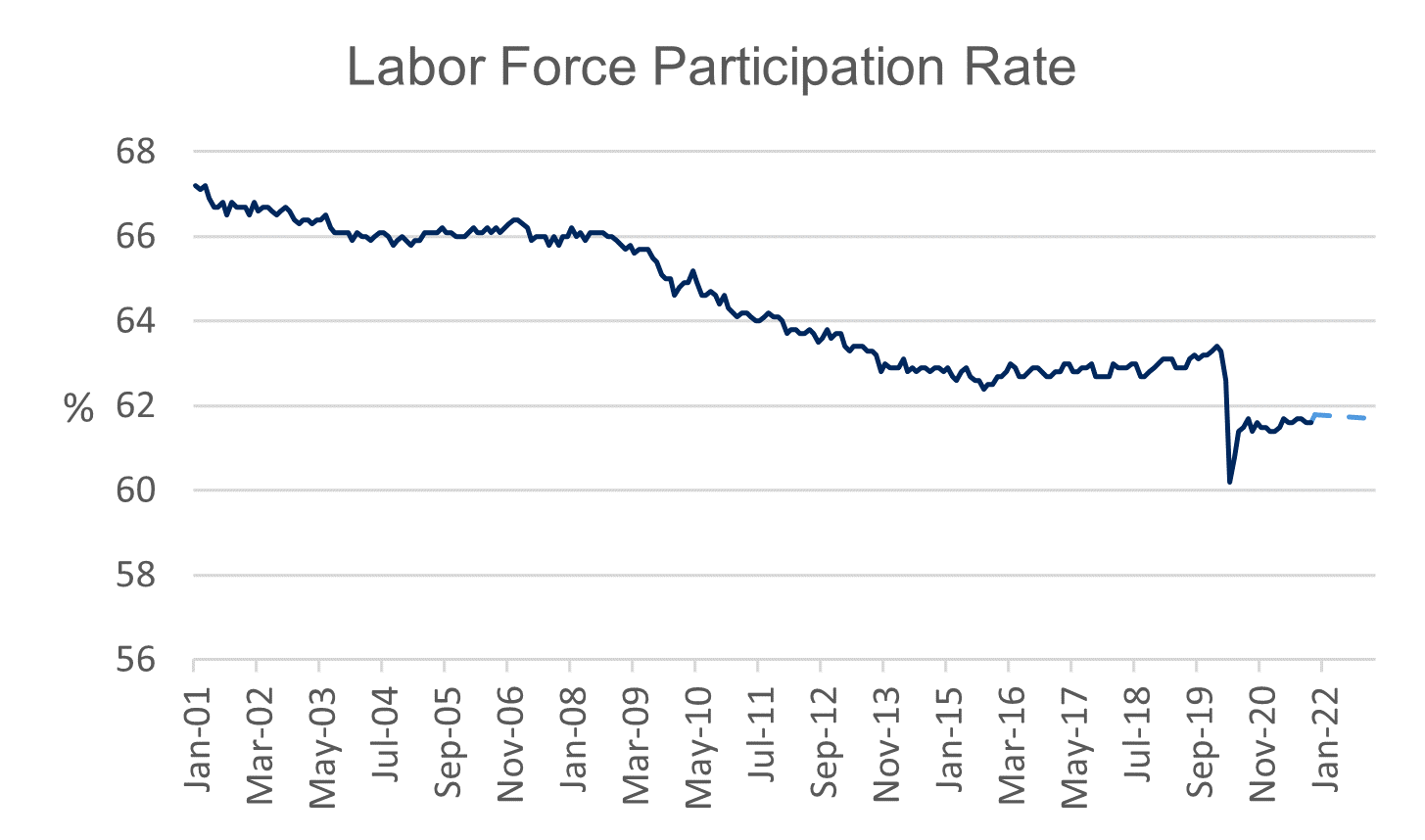

The number of working-aged people both working and actively looking for jobs is down 1.6% from January 2020 to November 2021. The pandemic drop is the fastest decrease in labor force participation ever. The trend for labor force participation had been negative prior to the pandemic. The decline had been gradual, moving from 67.2% in 2001 to 63.3% in February 2020.

The declining trend reflects an aging working population and the impact of baby boomers on employment. An increase in the percent of the population over 65 negatively impacts the rate and will continue to impact the rate. This trend is expected to continue through 2030. The labor force participation rate will hover around 61.7% through 2022.

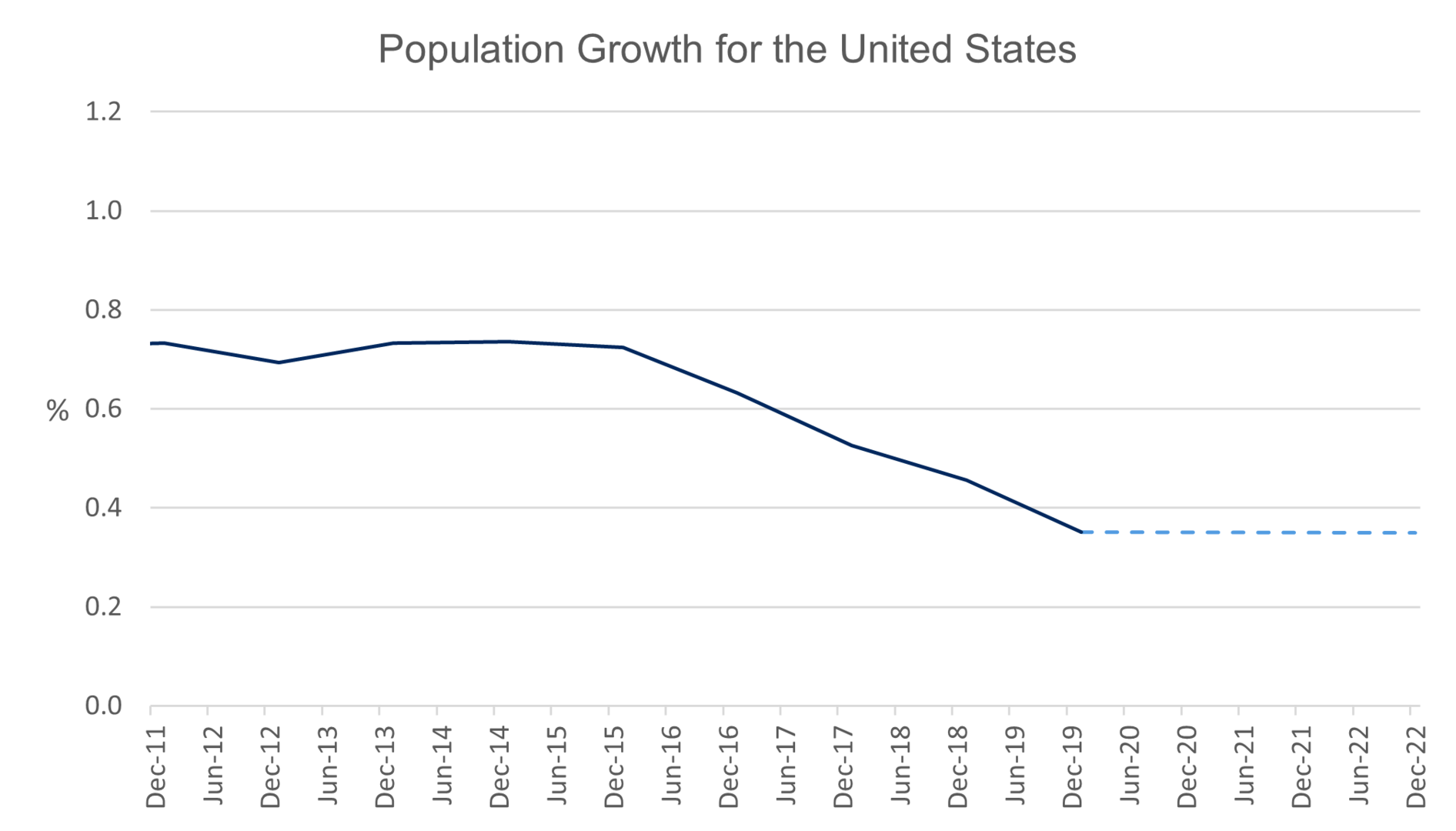

The population is expected to grow less than 0.5% in 2022. This anemic growth is not helping the employment situation. As we can see in the graph below, the growth in population has been decreasing sharply from the 1980’s. The decline in the growth rate is expected to flatten and stay around 0.35% to 2030. There is a direct relationship between population growth and economic growth. To offset the losses from a population that is not growing, heavy investments will have to be made in technology.

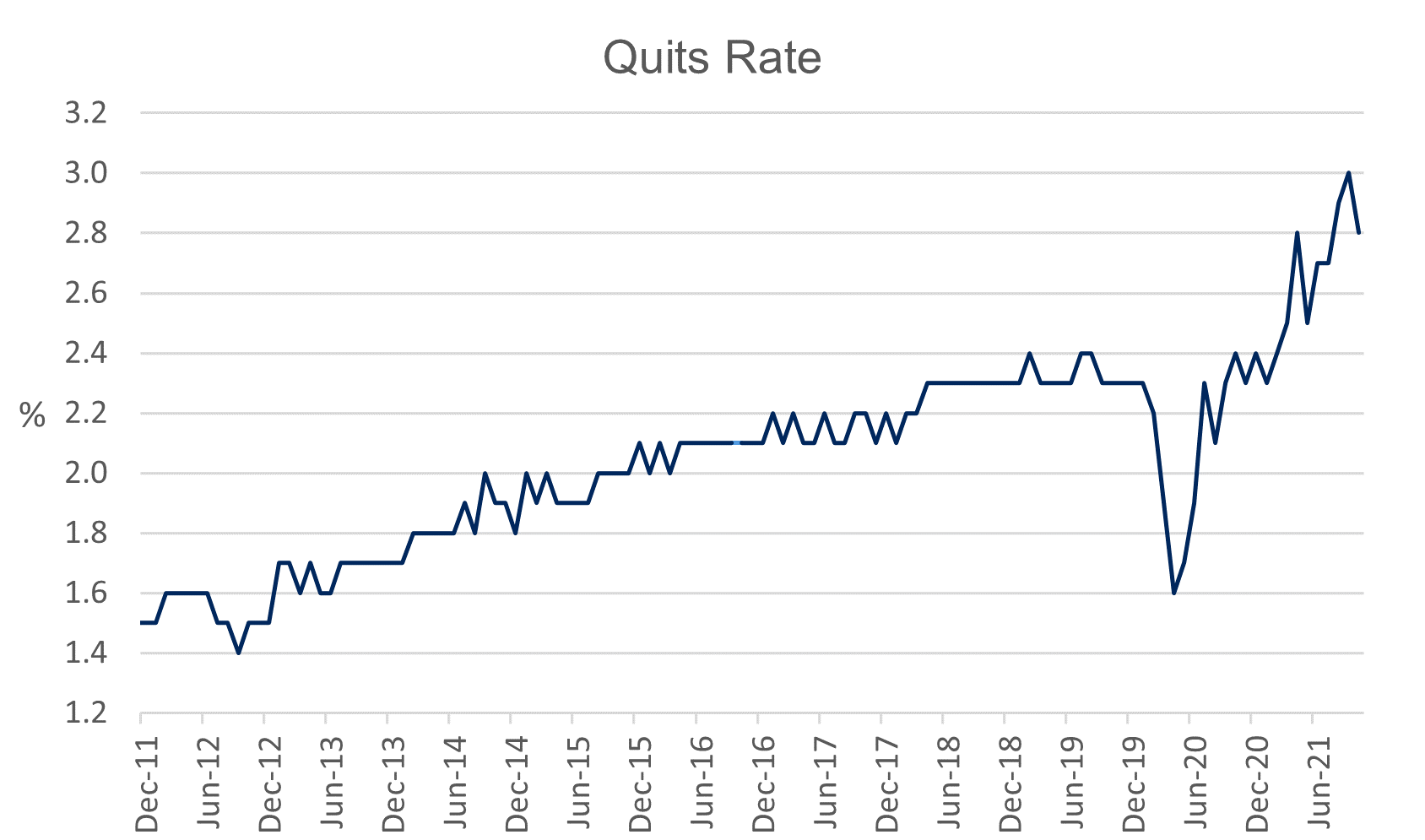

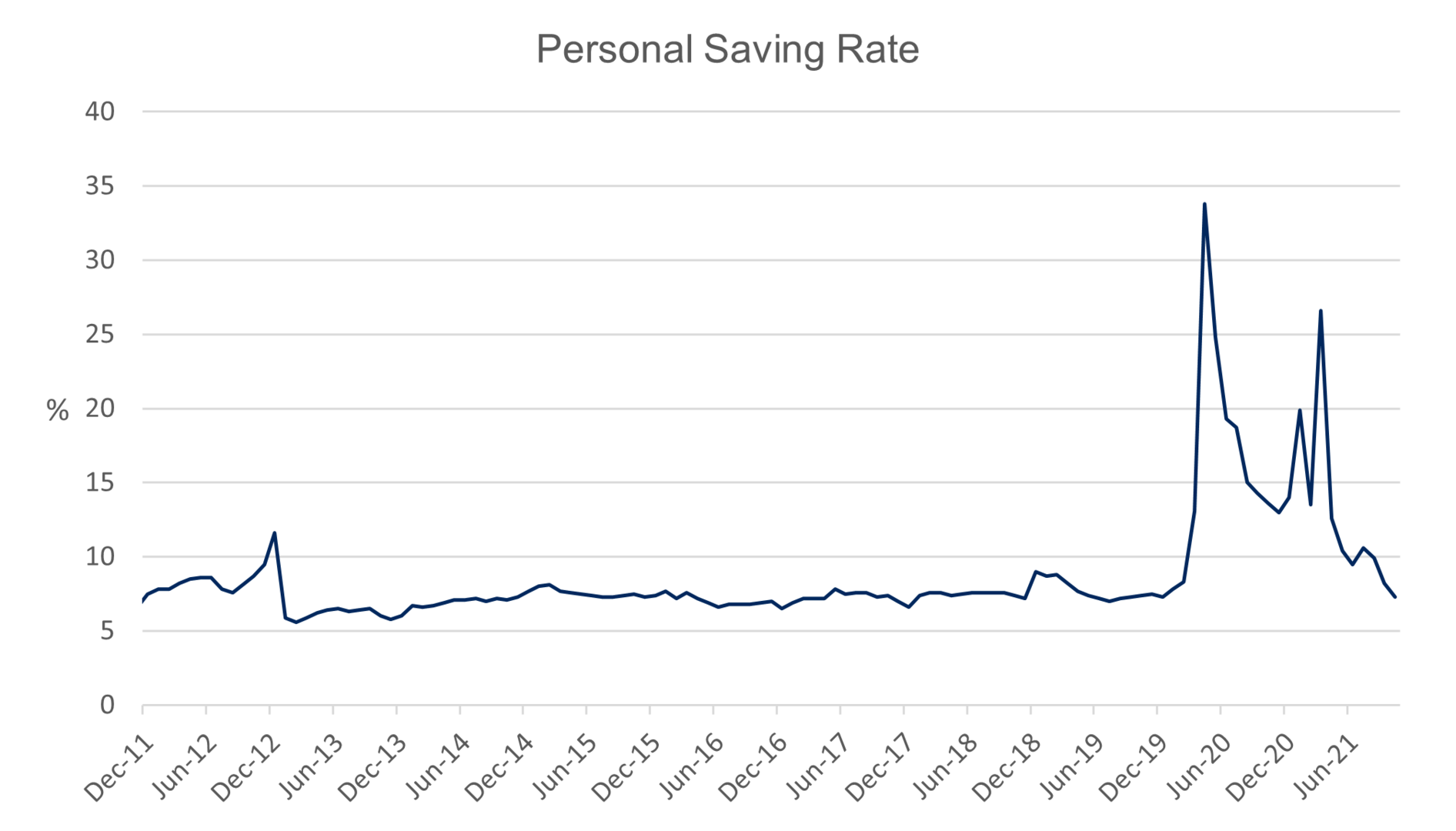

Another trend to watch out for is a potential reversal in the direction of the quits rate. The quits rate looks at the number of people who voluntarily leave their jobs. Through the pandemic, we saw the quits rate increase significantly. Larger bank accounts, which were positively impacted by stimulus checks, contributed to more people feeling comfortable leaving their jobs.

The quits rate is expected to decrease through 2022 as people deplete their savings and reenter the workforce. The savings rate is within pre-pandemic levels as we can see below. Smaller bank accounts will likely be a disincentive for people to leave their jobs. This will impact labor force participation positively, but not enough to significantly impact the trend of decreasing labor force participation.

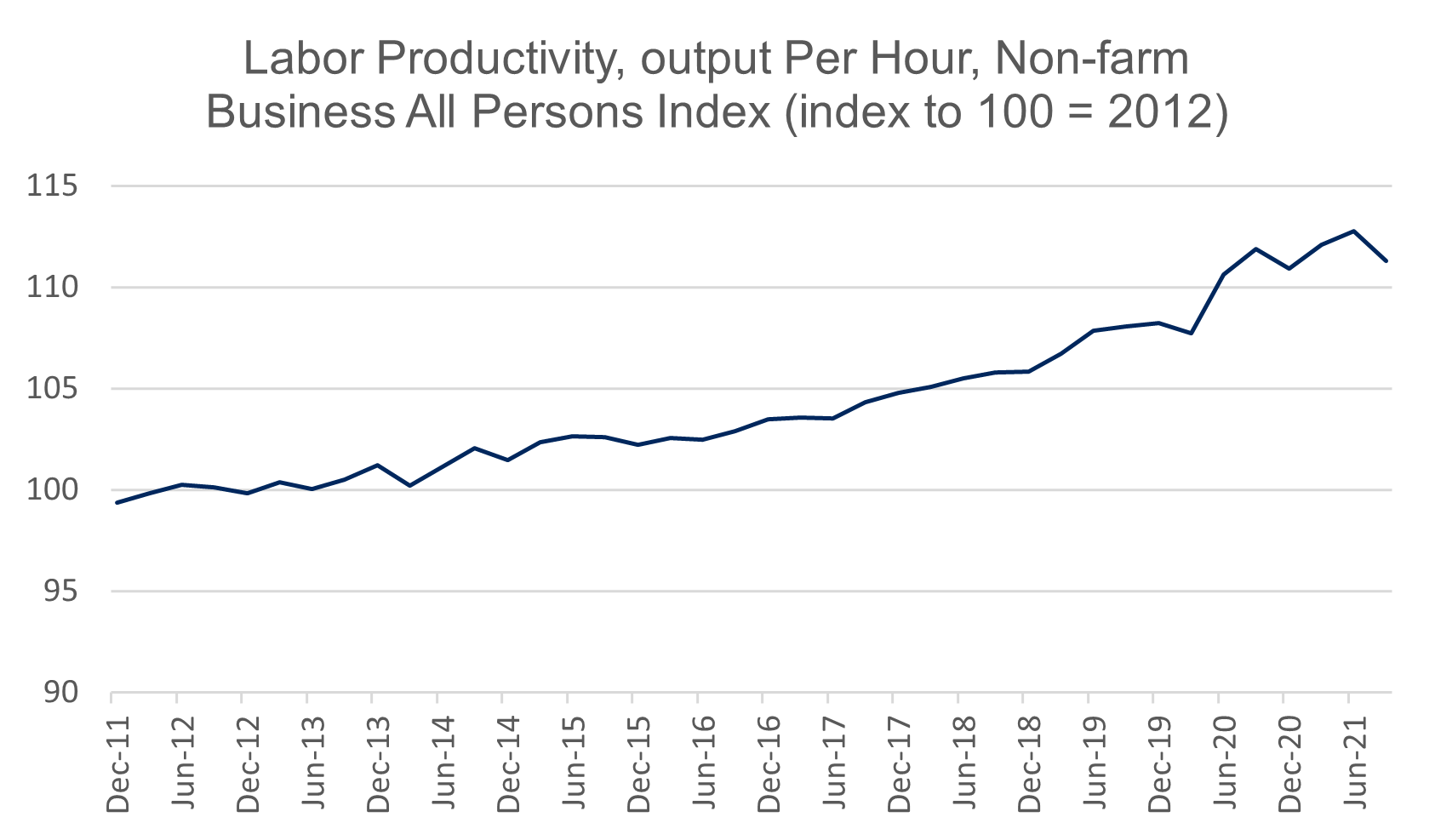

Productivity

There has been a steady increase in labor productivity since the 1940’s. Labor productivity measures the relationship between the amount of goods and services produced (output) to the number of hours worked. There has been a steady output that has grown faster than hours worked. However, that does not mean people are working less hours, instead the opposite is the case. The number of hours we are working has increased over the last 10 years. The November report of average weekly hours worked showed people working 34.8 hours a week.

Labor productivity is expected to continue to grow in 2022. Companies are expected to operate more efficiently by utilizing higher levels of technology to offset the labor force losses and control wage spending.

The employment situation is expected to impact economic growth negatively in 2022. Slowing population growth and decreasing labor force participation will be key factors that influence the rate of U.S. economic growth through the decade. Growth in company earnings will be negatively impacted by increased labor costs. Higher wages will contribute to increased spending through the year. Increased wages have the potential to be inflationary.

Additionally, employers will be figuring out how to operate with fewer workers through the year. This will likely contribute to increased investment in technology.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.