2022 has been a year of transition away from unprecedented quantitative easing where central bankers flooded markets and government coffers with money, to the start of the tightening of the monetary policy belt. This follows the U.S. Federal Reserve’s (Fed) admission that inflation was not transitory, and that all the money pumped into the economy was chasing too few supply chain-limited goods. Focused on taming inflation the Fed turned to an old monetary playbook of the late 70’s from the last time inflation was this high. The monetary policy called for rapid rate increases that pushed the Federal Funds Rate from 0.25% to 4.5%, with guidance to expect additional increases to 5.25% in 2023. The strategy is that these actions raise the cost of credit so that consumption slows, and prices stabilize.

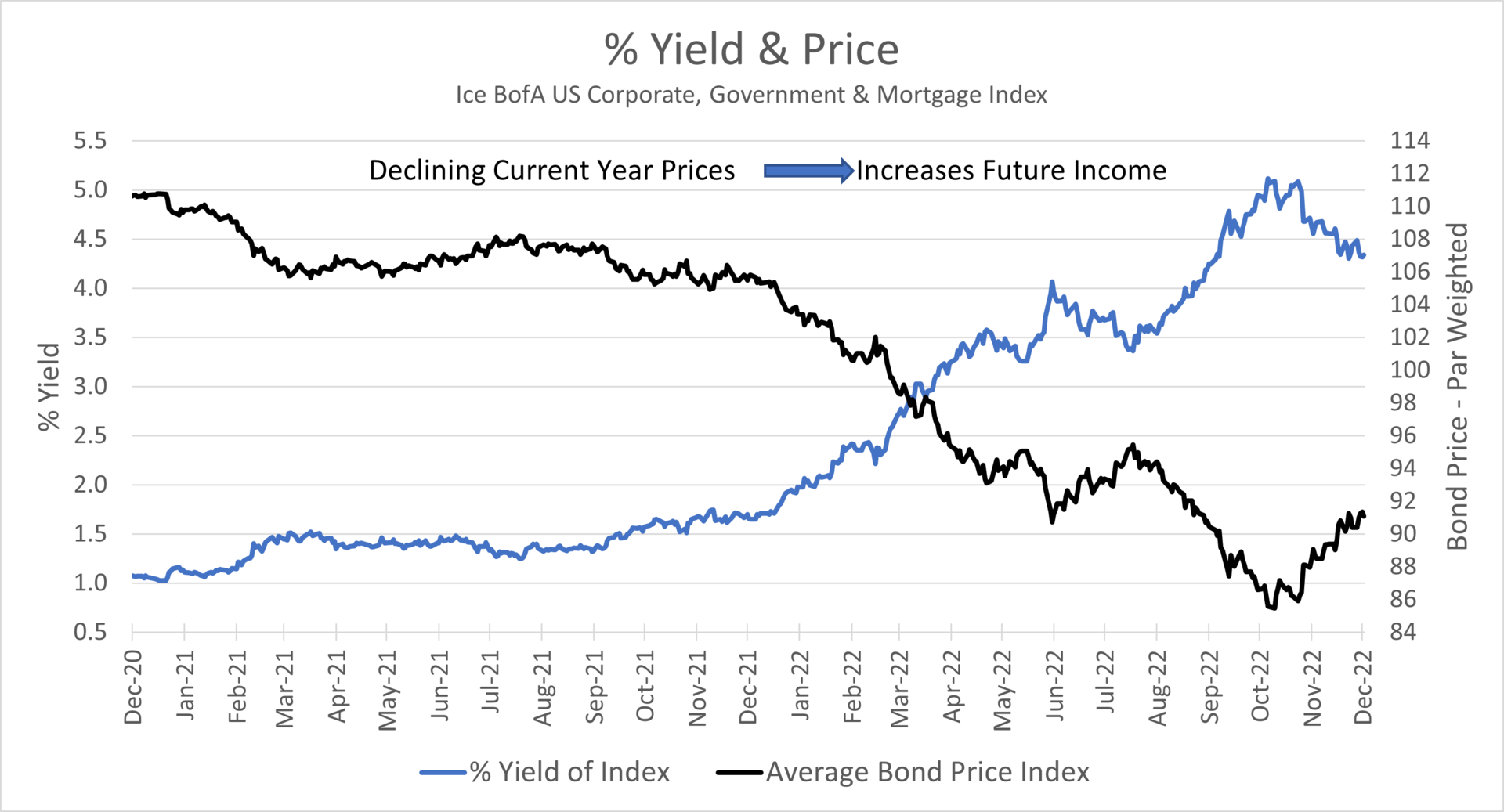

The result of these actions has been a U.S. Treasury two-year bond rising four percentage points from 0.7% to 4.7% at its high, while the 10-year bond yield climbed from 1.5% to 4.2%. Rising rates meant declining prices as bond markets have posted a decline of 11.1% year-to-date. This is the largest drop in bond prices over the last century. The rapid price decline outstripped the add-back that coupon income provides to investors, that in most years is the stable source of positive returns from bonds. The two-year chart below shows that as bond prices declined this year as yields climbed. These rising yields represent the improved future income that bonds will provide investors.

With the policy groundwork already showing signs of slowing inflation and cutting the excess money supply, in 2023 markets will focus on a downshift to slower growth and the prospect of avoiding a recession. The consensus outlook is that the Fed stops raising rates next year after March and goes on hold for the remainder of 2023. Over the last four rate cycles intermediate bond yields have tended to trade sideways in the three-months leading up to the last hike, then decline once they go on hold. Since October bond markets have front run this pattern by shifting the middle and long part of the curve lower, confident monetary policy will be successful at taming inflation. Since October, bonds have returned 4.8% as measured by the ICE BofA US Domestic Master Index.

Bonds Yields Attractive

Our outlook for 2023 is that investors will find bonds are once again a stable source of positive return. Broad market bond indices now provide yields of 4.4% from the income component and we expect a slow but moderate price gain over the next year. This higher income will over time rebuild portfolio value to offset the price declines of 2022. For example, an investment in a broad market bond index over the last five years has generated a 2.1% return, which includes a +13.6% income return fully offsetting the negative price return during this period.

Rising costs to refinance added to corporate balance sheets in recent years will create headwinds, but our view is that credit spreads already reflect this risk having tripled from the start of the year. Our view is strong technical factors will support positive returns from this sector. Lower issuance than in the past year, demand for higher grade credit and conservative balance sheet management will make this a favored sector for 2023.

If our call for lower mid-to-long dated U.S. Treasury rates plays out in 2023, tax-exempt municipal bonds will again see inflows moving prices higher. Municipal government balance sheets remain strong leading banks and insurers to return to the market buying longer maturities after a year of lower spending on the sector. After showing strong relative value at the start of 2022, we view tax-exempt municipal bonds under seven years in maturity to be overpriced relative to U.S. Treasury bonds. Until a Fed pivot to start lowering short term rates or higher municipal supply lifts yields for short-to-intermediate tax-exempt municipal bonds, we favor taxable bonds for shorter investment inquiries. The perfect alternative and one of our favored sectors are taxable municipal bonds. Combining yields comparable to investment grade corporate bond and higher credit quality this sector shows strong demand from crossover corporate credit buyers.

Mortgage-backed securities (MBS) will continue to face many of the same challenges in 2023 as they experienced this year. Efforts by the Fed to reduce its balance sheet continue to remove demand for these bonds from the market. Our view is that this market will face increased delinquency and loan workouts as high rates make it difficult to restructure loan terms and where loan-to-value could flip on borrowers in 2023 to where they owe more than the value of their home. All this points toward prepayment rates remaining slow, but stable, in 2023. We favor slightly below par very accurately defined maturity (VADM) structures with limited extension risk and relative strong value. We look to limit buying MBS holdings that add duration exposure to portfolios in favor of using more precise corporate credit, taxable municipals, and treasury bonds for managing duration risk.

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.