The Worst Is Behind Us

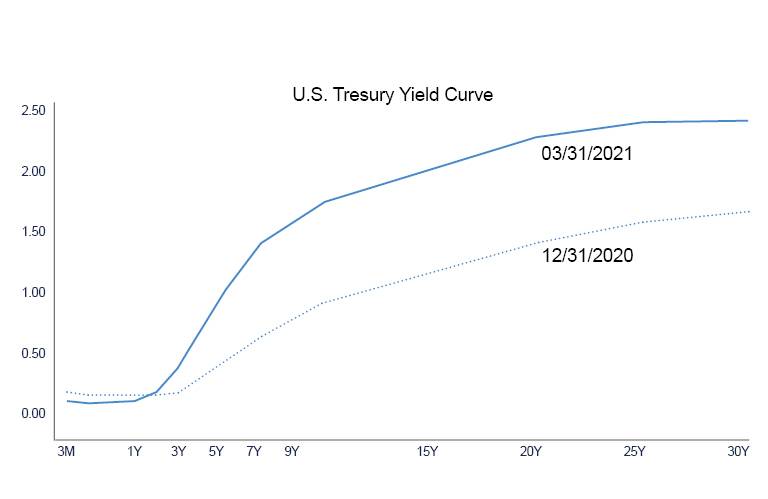

Bond markets posted a decline of 3.4% this quarter – their worst return since 1981, as the 10-year U.S. Treasury climbed to a 1.7% yield from 0.9% at year-end. Higher yields have been driven by concerns for rising inflation and an expansion of newly minted Treasury debt that has to offer higher yields to attract new buyers.

Rates climbed as the U.S. 10-year yield jumped 0.83% in what Chair Powell noted on March 4 reflects the strengthening economic recovery. It is the second consecutive month where the 10-year Treasury moved up more than 25 basis points or greater, an event that in the past has led the Federal Reserve (Fed) to announce an end of its easing cycle or where investors have reacted to a major political shift, as in the fall of 2016. Responding to this concern, the Fed may need to change course to start raising rates in 2022. Chair Powell emphasized the majority of the board of governors see no increase in the Fed Funds Overnight Borrowing Rate until after 2023. Further, his comments relate inflation risk to being driven by pent-up demand, and that after a short-burst recovery in 2021, inflation will align back with the 2.0% level. The consensus forming is that a further rise in yields will be contained, but that mixed signals from the economy will create higher volatility in bond markets.

Market participants anchored by the thought that the Fed can control short-term yields through its policies on bank reserves sent short yields toward the zero-lower bound even as yields for long-maturity bonds climbed. Rebalancing actions by large pension funds from stocks to bonds drove short-term yields lower as investors sought to avoid exposure to declining prices of longer maturity bonds.

Corporate bond returns were -4.7%, as this sector has a mix of longer maturity bonds that are more greatly impacted by rising yields. On a relative basis, corporate credit conditions improved as a broadening recovery now shows manufacturers with rising order backlogs. Municipals, by contrast, have been one of the best performing sectors with the broad market index -0.4% for the quarter. Strong inflows and tight supply during part of the quarter have been contributing factors. Despite concerns that repeal of the state and local taxes deduction limits will soften the heavy demand for municipals in high tax states, those concerns are offset by the prospect of rising tax rates across the board.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.