Earnings season has begun with strong expectations for the first quarter. Stimulus payments in March are expected to positively impact company earnings. The current forecast is for earnings per share to grow by 29.25%. Sales are expected to grow by 6.79%. Reports from financial companies are coming in strong as banks reduce their loss reserves.

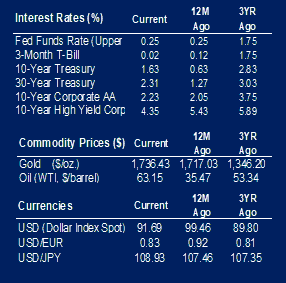

Prices jumped in March as measured by the Consumer Price Index (CPI). The month-over-month increase of 0.6% is the highest single month increase since August of 2012. The expectation was for an increase of 0.5%. The increase was led by gasoline prices, up 9.1%, and this commodity accounted for half the growth in the index. CPI excluding energy and food (core CPI) was up 0.3%. Year-over-year, headline CPI is up 2.6% and core CPI is under 2% at 1.6%. Prices of energy products and used cars have contributed the most to price appreciation over the year. Prices are up 13.2% and 9.4% respectively.

Average hourly earnings in March were down 0.1% from the previous month. After accounting for the 0.6% increase in CPI, real average hourly earnings were down 0.8%. The decrease was led by a 0.6% real average hourly earnings dip for production and nonsupervisory employees.

Small businesses seem to think the economy is moving in the right direction as indicated by the NFIB Small Business Index. The reading of 98.2 is the peak for the year after significant drops from October 2020 to January 2021. The survey results come as small businesses brace for increased revenues as local economies continue to open.

Wholesale inventories increased by 0.6% in February. An increase of 0.5% was expected. The increase in inventories are likely in anticipation of increased demand for goods. Sales for the same period were down 0.8% from January. Over the year, sales were up 6.4%.

Oil prices were up 6.37% this week as measured by the per barrel price of WTI Crude Oil. Prices in the last few weeks have stayed between $60 and $65 per barrel. Pricing for the commodity is expected to be stable as demand picks up and production increases.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.