The S&P 500 ended the week up 0.3% as earnings season comes into focus. Heavy-weight names are starting to report first quarter earnings and there have been some big moves for well-known mega-cap stocks. Netflix fell 35% after reporting results, which dragged some other heavy-weight names lower and resulted in the NASDAQ falling 1.4% on the week. Netflix is down almost 70% in the last five months. On the opposite side, Tesla was up 10% at one point this morning after their earnings were released. Real Estate Investment Trusts were among the sectors exhibiting upside with a gain of 3% on the week. Low volatility stocks have outpaced high beta stocks by more than 10% over the last 15 days.

The Market is Out of Gear

The market is said to be out of gear when there is a high number of new 52-week highs accompanied by a high number of new 52-week lows. We are at levels that are associated with subpar forward equity returns. For instance, Monday saw both 100 new 52-week highs and 100 52-week lows on the New York Stock Exchange. This occurred in March of this year and November of last year and preceded 4% drops in the S&P 500 before resolving itself higher. You must go all the way back to 2014 to find the next occurrence, which also led to some near-term volatility.

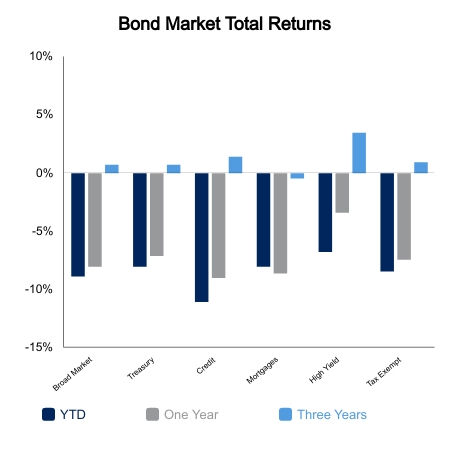

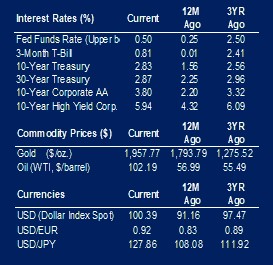

Bond Yields Surge Again

- Fixed income indices down 1% on the week.

- 7-year Treasury hit 3% today.

- Market pricing more than four hikes over next two Fed meetings.

Economic Red Flag?

Core retail sales for March came in below expectations. Core retail sales adjusted for inflation are now down 3.8% over the previous year. Since 1994, this has only occurred on two months that were not associated with recessions and never to this magnitude. Inflationary impacts are constricting volumes rather than consumers rushing to buy ahead of further price hikes. This has made its way into trucking rates and their associated equity prices have come under heavy pressure this month. On the plus side, jobless claims remain extraordinarily low. Housing data came in better than feared amid surging mortgage rates. And lastly, business Purchasing Managers’ Index data continues to hold up.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.